‘A self-inflicted lockdown’: the cost of living crisis puts lives on hold

Simply sign up to the Cost of living crisis myFT Digest -- delivered directly to your inbox.

When Sarah, a 29-year-old North American, quit her job in the film industry and came to study law in London, she hoped to put her life on a firmer financial footing. Two years on, that goal seems further away than ever.

Interest payments on a bank loan have gone up; she has lost weight having cut back on groceries; and feels isolated because going out costs too much. A soaring energy bill has forced her to move out of her previous flat-share.

And with earnings as a research assistant working out at £6.65 an hour, Sarah says it is “impossible to imagine” planning for the future.

“I’m fixing the problem directly in front of me, not building a long-term game plan,” she says. “Every relationship and facet of my life has been impacted . . . It’s as if you’re climbing a staircase and you don’t know if the next step is going to be there [or] if you’re going to fall through.”

Sarah is one of countless casualties of a global cost of living crisis that is forcing people around the world to put their lives on hold — forgoing social lives, scrapping house moves and weddings, hesitating to start a family or delaying retirement because of the financial pressures caused by high inflation.

From South Africa to Singapore, Kenya to New Zealand, and across Europe, the US and UK, a global Financial Times’ survey that ran for a week in July drew hundreds of responses from readers of all ages grappling with similar problems: surging food and fuel prices, big swings in exchange rates, rising borrowing costs, and falls in asset prices eroding the value of savings.

And while the economic hardship is painfully acute for people on lower wages, even those who consider themselves financially comfortable are finding carefully laid plans are being upended.

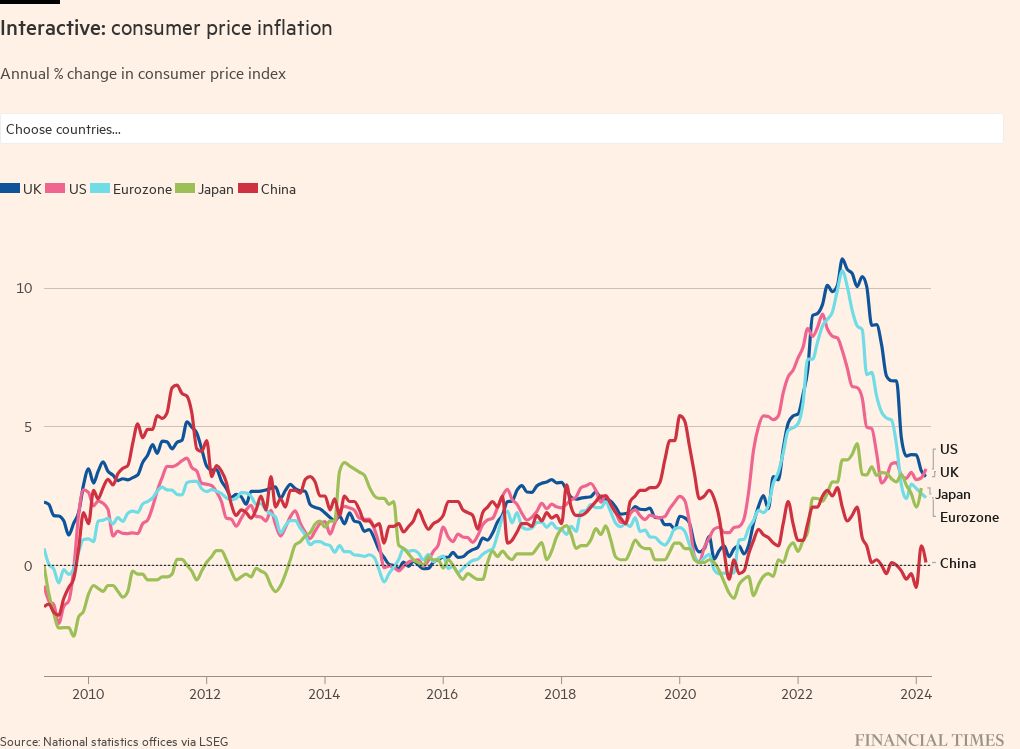

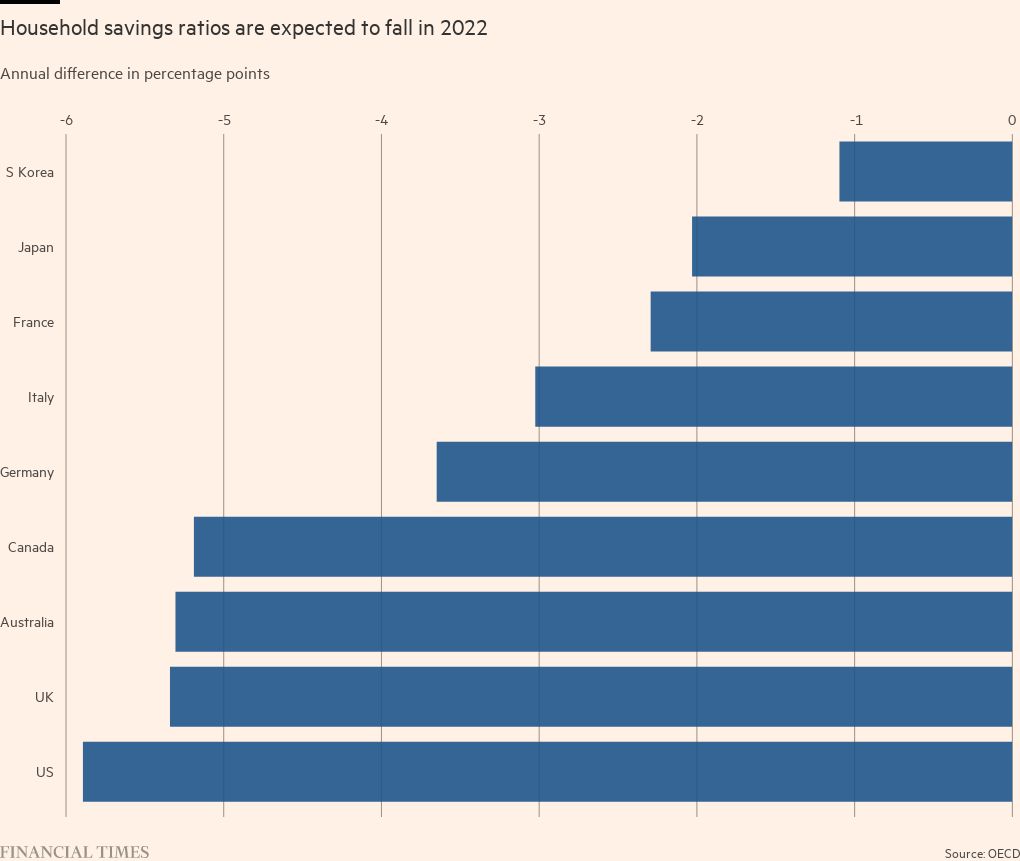

With inflation at its highest for decades in many countries, central banks around the world are responding by raising interest rates at speed. For millions of people, this means bigger mortgage payments or higher rents as landlords pass on their own increased costs. Meanwhile, average wages are falling in real terms in most countries, prompting households to run down savings or cut their spending.

A pause on luxury

Many respondents said thrift was now dictating their day-to-day habits: eating less meat; passing on small luxuries in favour of supermarket own-brand products; giving up takeaway coffees and cut flowers; minimising laundry, batch-cooking and taking the bus to avoid filling fuel tanks too often.

“We now barely use the car. Our last trip was to Aldi, which speaks volumes about our lifestyle changes,” says Rosanna, a London-based civil servant now planning to job-hunt in the private sector, as the costs of a home renovation project spiral.

But even more striking than these material changes is the extent to which the crisis is isolating people from friends and family — just as the easing of the pandemic had made socialising possible again — as spending on leisure becomes harder to justify.

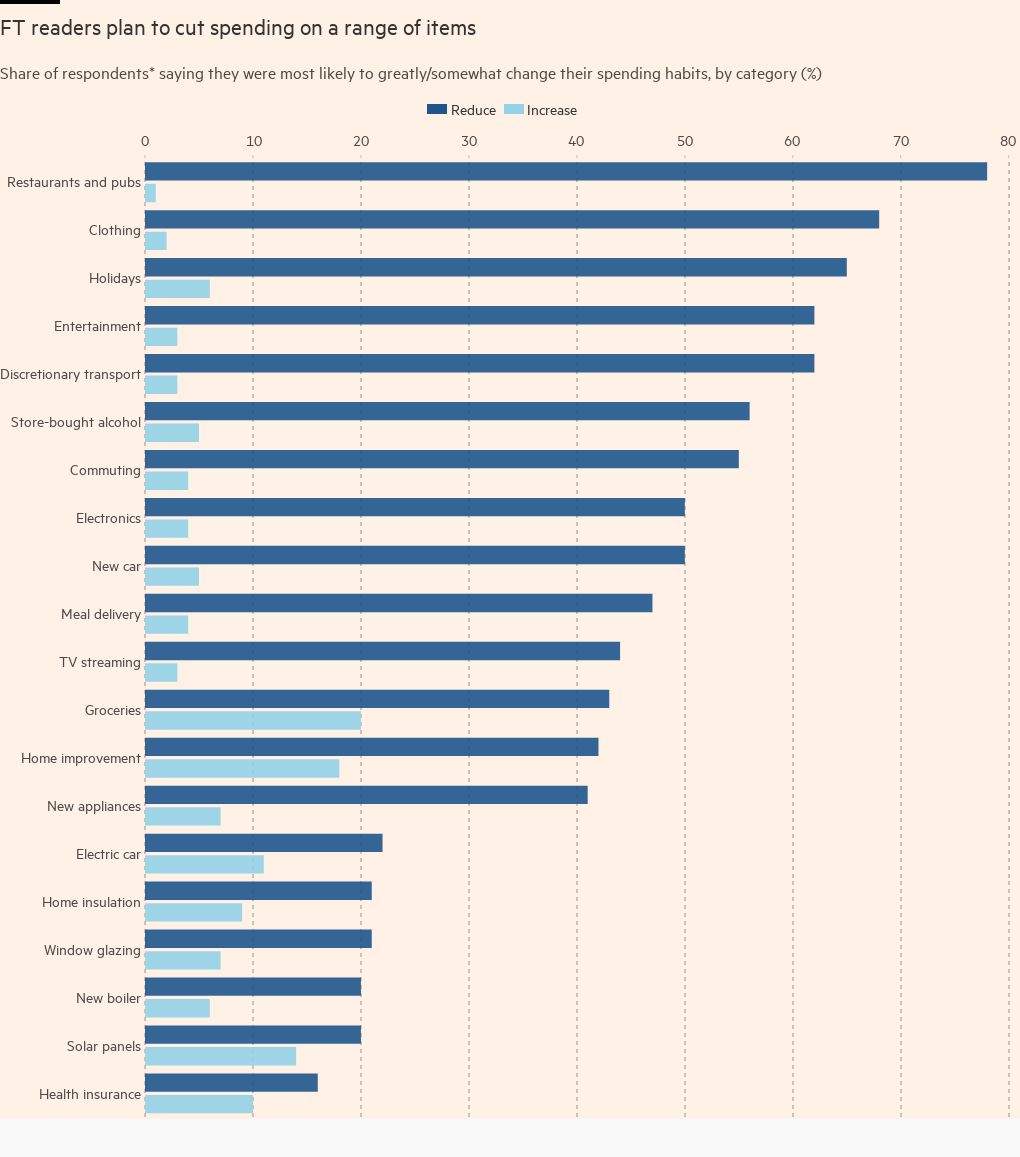

About eight in 10 of the nearly 500 respondents say they would spend less in restaurants and pubs as a result of the cost of living crisis, while two-thirds were considering scaling back on holidays and entertainment.

“I’ve cut down on going out and have not seen friends in months. It feels like a self-inflicted lockdown again,” says Karl, a former bank employee in Rotherham, a town in northern England, now working in an Amazon warehouse on a third of his former salary. Karl, who was made redundant near the start of the pandemic, wants to return to financial services, but recently turned down a good opportunity because it would have cost too much to commute by car. “It’s a job I would like to do, but I can’t really afford it,” he says.

Linda, a public sector worker in Leicester in the UK, has turned off her heating and restricted showers and laundry. “I don’t go out in my car unless absolutely necessary, which is a blow as I live alone,” she says. She has also put off retirement despite reaching the state pension age.

“We are in our late 30s, want kids and are very frustrated,” says Jessica, a nanny in Holyoke, Massachusetts, who had been house hunting since mid-2020 with her husband. As he was a freelancer, they were struggling to secure a loan. Just when he found a better-paid job, working remotely, interest rates went up and the market turned. Now, they feel stuck in an apartment with lead and asbestos. “We are nervous to drop a 20 per cent down payment right now, when prices and the economy are so wonky, but we are at an age where putting life on hold is devastating,” Jessica adds.

A crisis of two halves

The impact of the crisis is highly unequal. Some people who answered the FT survey were already making desperate choices — cutting meals, skimping on showers and using a torch to avoid turning the lights on.

Gurpreet, in west London, says she had received threats from bailiffs and was looking for a second job at weekends as “one job is not enough” to survive. Drake Rose, a man in his 20s in San Diego, says he had stopped buying medicine until he could pay off debt that had built up while he was between jobs last year, while a man in his 70s in Brazil is limiting his diet to rice and beans.

At the other end of the scale were people feeling little pressure, either because their incomes were high enough to absorb the shock, or because they had received big pay rises that matched inflation.

“My employer has increased my salary materially, as they saw me as a flight risk,” says Chris, a man in his 50s who had just bought a new electric vehicle and family house in Devon, in the south of England, whose pay is bolstered by non-executive roles. Another man whose salary had kept pace with inflation — a thirtysomething living in Mumbai — says he had even made savings, buying a car at a discount while demand was low, and reducing his wedding budget when the pandemic was still limiting the size of gatherings.

Others with a comfortable financial cushion were becoming more cost-conscious; forgoing luxuries, rather than essentials — scrapping skiing holidays and season tickets, or the purchase of a second home. David, a New Zealander in his 70s, is selling some surplus land and using his boat less, while a respondent in Singapore had switched his holiday plans from the Maldives to Vietnam.

About two in 10 respondents to the FT survey say they were still likely to increase spending on home improvements, while 40 per cent say they would reduce it.

Higher earners were also able to invest in energy-saving equipment that would pay off over time. Nick, a Londoner on a six-figure salary, says he had “reset various settings in our high-tech home”, while Mark, a man in his 50s in the Netherlands, had installed solar panels, window blinds, low-carbon heaters — while also taking his foot off the accelerator when he drove, to save fuel. Kipruto Chirchir, in Kenya, says his family is planning to replace a gas-guzzling SUV with two saloons.

In between these extremes, many people on salaries they would usually consider comfortable were also facing difficult choices.

“I earn £70,000 thanks to RMT [the transport workers’ union], but I am still having to tighten the purse strings,” says Kim, a Londoner in her 20s, who has stopped drinking alcohol and is car-sharing with her partner, despite it being “a logistical nightmare for two shift workers”.

Kate, a woman based in London, says: “We are not living on the breadline . . . I understand that we’re very privileged.” Nonetheless, she and her partner have delayed plans to move out of a one-bedroom flat shared with their 3-year-old and have reduced their mortgage payments to cover other bills. They’re also selling on eBay for “a bit of extra money we can use to do nice things”.

Share your experience

How are you coping with the cost of living crisis? Tell us your stories and thoughts in the comment field at the bottom of this story

Energy consumer inflation is rising at an annual rate of 52 per cent in the UK and 41 per cent in the eurozone, leaving considerable less money available for other goods and services, particularly entertainment. Even in the US, where the energy crisis is less pronounced, the cost of energy for consumers rose 24 per cent in August.

“I think we class ourselves as pretty firmly middle class and didn’t think we would be worrying about money as much as we are,” says Chris Cathcart, who lives in Hampshire in the UK. Having already delayed his wedding once, because of Covid, he has now had to defer it again.

He and his girlfriend — who are in their forties, with two children — had found a venue only slightly beyond their budget, but an overnight rise in their monthly energy bill from £90 to £270 made them put both wedding and holiday plans on hold.

“We really want to get married but we see it as a luxury rather than a necessity,” Chris says. “If you’d asked me two years ago if we’d be having conversations about how to make ends meet at the end of the month then I wouldn’t have believed you but it’s what we’re doing and what lots of our friends are talking about.”

‘Retirement is delayed’

Big swings in exchange rates have made some people’s finances even more of a lottery. “We earn in Polish zloty, but pay our mortgage in euros, so we need to pay more now,” says Ewa, in Poland, who was cutting back on “daily small pleasures” and had put on hold her plans to buy a bigger house and car.

The dollar index, which tracks the US currency against six others, is up by a double-digit rate since the start of the year, adding pressures on many other currencies both in advanced and developing economies.

For others — especially those relying on pension savings — falls in asset prices are the biggest issue, causing them to delay retirement or even rejoin the workforce.

“At age 75, I have returned to full-time employment,” says Peter, a federal employee in Vienna, Virginia. Steve, in Wellington, New Zealand, had planned to retire this month, but now felt “like I would be locking in the losses”.

“I really don’t want to be the old fool pretending to be capable of things I am no longer capable of, but perhaps I may need to,” says Patricia, a 69-year-old American considering a return to part-time work. Others in a similar situation were taking on consulting work, teaching English, or — in the case of one man in his 50s in the UK — switching from freelancing to full-time employment in order to have a steady income.

“Retirement is delayed. I’m driving a vehicle with 255,000 miles on it that I’ve owned for 11 years,” says Michele, an American in her 60s who has cut spending on flights, holidays and organic food. “We have modest means. We did not expect this kind of inflation,” adds her husband Joseph, who fears they could not afford both to retire.

Meanwhile, younger people are in despair of establishing themselves, with several saying they would now wait to buy a property — and delay having children as a result.

“I have moved back in with my parents because I can’t afford to start my finance career in London . . . I don’t think I will ever be able to afford to have children or own my own home in the UK,” says one student, who hopes to save enough to rent in the capital after graduating — but plans to seek work abroad if not.

Just about managing

One positive legacy of the pandemic — a greater acceptance of remote working — has given some people flexibility that allows them to keep costs down, whether by cutting out commuting, or by going to the office more often in order to save on their heating bill.

“Working from home saved the day on commuting costs for me and my family — we now spend less on gasoline per month than in 2018,” says a man in Boulder, Colorado. In contrast, one man in his 20s, in Germany, was contemplating not only using the office to enjoy its warmth, but also to shower.

Most people say their debts were manageable, for now — although this survey was conducted in July before the latest turbulence in UK markets drove up mortgage rates.

However, many were worried about rising borrowing costs. In the US, the average 30-year mortgage rate is not far short of 7 per cent, more than double the rate last year and the highest since the 2008 crisis. Rates are the highest since 2016 in the eurozone and lenders are offering mortgage rates of about 6 per cent in the UK, up from an average rate of 2.55 per cent in August.

A minority of respondents say they plan to fill the holes in their budget by working more — whether by lengthening their hours, taking a second job or finding a side hustle. Gemma, an NHS worker in her 40s with a 70-mile daily car commute, says she was “putting pressure on my teens to get jobs” so they could cover some of their own costs.

But the more common response was that people were resigned to using their savings or spending less — including on essentials.

“I am too tired to work extra . . . I am just cutting out, no holidays, not going out,” says Anita Henderson, another NHS worker, who now expects to retire at 65, five years later than planned, because she could no longer pay off her mortgage as fast.

“I have no savings,” says one woman in her 60s working on the UK minimum wage, who has turned off her boiler and is eating one meal a day. “When my money runs out, I just go without.”

Comments