Is value investing back from the dead?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The tale of Tony Dye has become folklore in some corners of markets. Two decades ago, the once-lauded money manager quit his job as Phillips & Drew’s investment chief and jetted off to the Bahamas to fish for bonefish rather than the undervalued stocks that had made his name.

The fund manager had by then become infamous as the biggest bear in the City of London, insisting that the stock market was in a once-in-a-century mania. His performance withered, clients left in droves, and eventually Dye and Phillips & Drew decided a divorce was the best outcome — just weeks before the bubble burst.

Dye quickly became an emblematic casualty of the dotcom bubble, and his defenestration signalled a renaissance for his “value” school of investing, focused on finding unfairly cheap and unloved stocks.

Whisper it quietly, but perhaps Ted Aronson will prove to be this cycle’s Tony Dye?

Mr Aronson is another celebrated value investor, whose hedge fund AJO Partners threw in the towel last October. By then, its assets under management had deflated from more than $30bn in 2007 to about $10bn, as value stocks by one measure suffered their worst run of underperformance in two centuries.

“The drought in value — the longest on record — is at the heart of our challenge,” Mr Aronson wrote in his farewell letter to investors. “We still believe there is a future for value investing; sadly, the future is unlikely to arrive fast enough — for us.”

However, as Dye showed 20 years ago, the enforced retirement of once-lauded money managers whose touch seems to have deserted them is often a contrarian indicator. Since Mr Aronson shuffled off the stage, MSCI’s index of value stocks globally has climbed almost 16 per cent, compared with the growth stock benchmark’s 11 per cent gain. Indeed, value stocks have since mid-October even beaten the technology-heavy Nasdaq index.

Of course, this comes after a remarkably long and painful stretch of lagging behind. Value stocks have enjoyed brief comebacks before, only to see them fizzle out. Many investors thought the once-hallowed value strategy would bounce back in 2020, only to see it beaten up by the pandemic.

A similar theme has played out in smaller stocks. These have historically outperformed larger stocks but have also spent much of the past decade in the doghouse. The pain in small-caps has not been nearly as severe, extensive and long as that suffered by value stocks, but has been notable nonetheless.

When BlackRock last autumn launched a small-caps value ETF, it therefore naturally elicited some mirth in the investment community. It was hard to think of anything more against the market zeitgeist. Underlining the scepticism, the iShares Factors US Small Cap Value ETF — with the ticker SVAL — has only gathered a measly $45m of assets.

There is a long and ignoble history of fund launches marking the top of a market cycle. But BlackRock’s decision to launch one that sat squarely at the intersection of the stock market’s two most hated areas looks like it may have been the rare case of one being timed at the bottom.

Since its launch at the end of October, SVAL has climbed 38 per cent, almost double the gains of the New York Stock Exchange’s Fang+ index, which includes stock market darlings such as Tesla, Netflix and Amazon, or China’s equivalents, Baidu and Alibaba. US small-caps more broadly are up more than 8 per cent already in 2021.

The question is whether this is the start of a durable, powerful renaissance — as happened after Dye’s departure for Phillips & Drew — or another frustrating head fake?

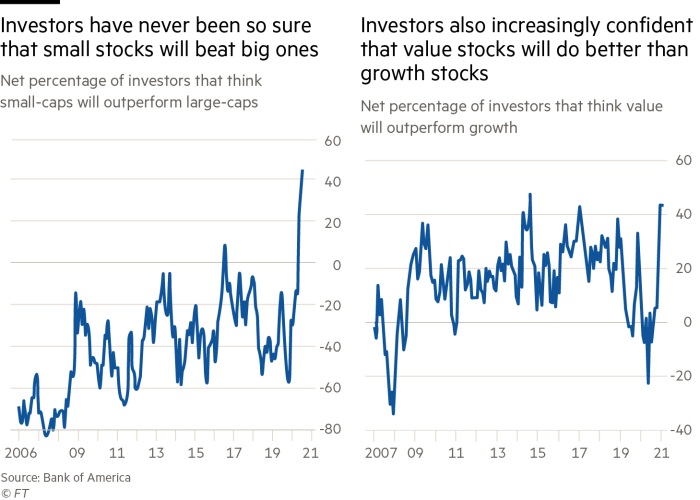

Judging by reams of investment research, it seems Wall Street thinks it is the former. Bank of America’s latest fund manager survey reveals that investors agree, and have never been so sure the two out-of-style investment approaches will come back in vogue. The unanimity is enough to make even an optimist pause.

Much rests on expectations for a massive US fiscal splurge coming true, the global economy regaining its vim in 2021 and climbing bond yields denting the lustre of rate-sensitive growth stocks. There are also genuine, secular trends challenging many industries currently classified as value, and for many smaller companies squeezed by giant rivals.

But after the nightmare of the past decade, who would begrudge the adherents of value and small-cap investing some justified optimism?

robin.wigglesworth@ft.com

Twitter: @robinwigg

Comments