Why foreign banks find the US a tough market to crack

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The US has long proved irresistible to foreign banks. Credit Suisse chose New York for its first foreign representative office in 1870. Deutsche Bank arrived two years later, financing a railroad expansion from Wisconsin to the state of Washington. Scores have followed since.

Yet foreign banks have also long struggled to thrive in the US. Inconveniently for them, American banks also scent opportunity in the world’s richest country.

The grind has never looked tougher than in the years since the 2008 financial crisis. From Wall Street to Main Street, foreign banks have found it hard to make headway against their US rivals.

In retail banking, many are in the midst of a retrenchment, selling or shrinking their US operations as they cede ground to local competitors and focus instead on markets closer to home or growth opportunities in Asia.

In the past 24 months, BNP Paribas has sold Bank of the West to Bank of Montreal for $16.3bn; Spanish bank BBVA has sold its US operations to PNC for $11.6bn; Japan’s MUFG has sold its retail business to US Bancorp in an $8bn deal; and HSBC has offloaded its US retail operations to Citizens.

For these banks, the demands of competing in the rapidly consolidating US retail market meant the choice was either to bulk up or sell up.

“If we hadn’t divested, we would have had to buy an equivalent asset,” BNP chief executive Jean-Laurent Bonnafé told shareholders earlier this year regarding the Bank of the West sale.

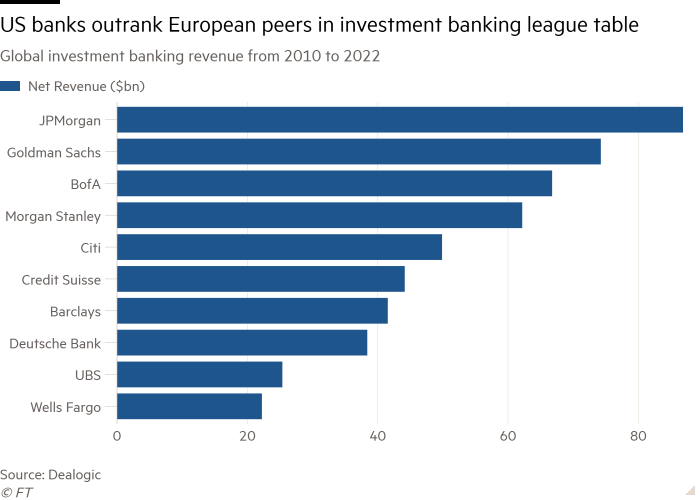

The picture is just as tough in investment banking. Few foreign lenders appear to have the resources or the appetite to go toe to toe with US banks to capture a larger share of fees in the world’s most lucrative banking market.

This has fostered a US hegemony of JPMorgan Chase, Goldman Sachs, Morgan Stanley and Citigroup, with a European investment bank failing to break into the top five fee earners since 2014, according to Dealogic data.

Although banks from Japan and China have sprouted up with operations in the US, the primary competition in recent decades has come from European lenders. Their recent struggles raise the question of what future foreign banks have in the US.

“For the European banks, it’s been a tough road, especially since the financial crisis,” says David Erickson, former co-head of global equity capital markets at Barclays and now a senior fellow at the University of Pennsylvania’s Wharton School.

Operational issues at Credit Suisse have dimmed its prospects after decades of expansionary efforts, encapsulated by the acquisitions of First Boston in 1988 and Donaldson, Lufkin & Jenrette in 2000. Deutsche Bank has cut thousands of investment banking and trading jobs to slash costs.

Meanwhile, Barclays’ acquisition of Lehman Brothers’ US operations in 2008 has yet to yield the desired investment banking success, an outcome Erickson attributes to a lack of sustained investment.

“You could compete regionally — Barclays did well in the US for a number of those years — but it never became a global player because it didn’t really have the investment commitment to do that,” he says.

Foreign banks have been hamstrung by not being as profitable as their US rivals. According to a report by Funcas, an economic think-tank set up by Spain’s savings banks, US banks consistently post better average returns on equity than their European peers.

That Europe’s economic growth has lagged behind the US’s for more than a decade has also put its banks at a disadvantage, a problem exacerbated by negative interest rates in the eurozone, Japan and Switzerland, which have squeezed out profitability from the lending business.

Despite these challenges and the consequent scaling back of banks’ ambitions, the promise of the US remains.

“Can you be global without being in China? I think yes. Can you be global without being in the US? Probably not,” says Ana Botín, executive chair of Spanish lender Santander.

Foreign bank bosses say that clients still want the distinctive, non-US perspectives that their organisations can offer, including different outlooks on countries such as China and Iran. But they are being selective about where they intend to compete.

BNP, for example, may have quit the US retail market, but it has signalled its ambitions in other areas by taking over Deutsche’s prime brokerage operations. It is also looking to recruit more investment bankers to bolster its advisory capabilities.

UBS regards the US wealth market as one its primary growth areas, highlighted by its aborted attempt to acquire digital money manager Wealthfront. Canadian lender TD Bank is also seeking to expand in the US, with two acquisitions this year.

And Santander has pared back its home mortgage lending while doubling down on car finance by purchasing the minority stake in its car loans subsidiary which it did not already own.

“What is it that you bring to the market that is unique? What is it that makes you the best owner of those assets? That is the question that we as a board ask ourselves when we define our strategy,” Botín says.

A former senior European bank executive sees specialisation as vital. “Find niches where you are competitive and focus on those,” he says. “Don’t try to take on the US guys.”

Comments