Banking M&A: the quest to create a European champion

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

On the computer in his spartan corner office overlooking London’s Canary Wharf, John McFarlane keeps a live spreadsheet that charts the market values of the world’s biggest banks. At a glance, the Barclays chairman can quickly check the relative size of potential merger candidates.

Known as “Mack the Knife” for his habit of firing chief executives, Mr McFarlane and other Barclays senior directors have recently been plotting a different type of upheaval at the bank — running the rule over a potential merger with Standard Chartered, its emerging markets-focused rival.

“I do think deals will happen, particularly in the European continent,” Mr McFarlane says. “Politicians in Europe want it to happen. Bankers are generally less keen. A lot of European banks look vulnerable. I think it’s possible that US banks will look to do deals in Europe.”

The Barclays chairman is not alone. The idea of megamergers between banks is back, a decade after the last round of grand-scale dealmaking left shareholders nursing painful losses, as epitomised by Royal Bank of Scotland’s crippling takeover of ABN Amro on the eve of the financial crisis in 2008.

Jean-Pierre Mustier, chief executive of Italy’s UniCredit, summed up the sector’s growing obsession with scale, or lack of it, when he pointed out recently that the $350bn market value of JPMorgan Chase in the US was four times that of Spain’s Banco Santander, the eurozone’s biggest lender.

“There are only two pan-European banks in Europe: BNP Paribas, present in France, Italy and Benelux; and UniCredit, present in Italy, Germany and Austria . . . So we have a problem,” says Mr Mustier. “We don’t have the right banks. So we need to have more pan-European banks, bigger banks . . . to support the economy.”

The Financial Times has spoken to dozens of senior bankers, regulators, investors and advisers to find out why the sector is so excited about the prospect of a big deal in European banking.

Possible deal Barclays/Standard Chartered

Total employees 165,900

2017 net loss $1.3bn

Assets $2.16tn

Pros Complementary geographic fit

Cons Lack of cost savings

Based on the combined totals for the two banks. All figures are to the end of 2017

Few believe any deal is imminent, given the distractions of Brexit, unfinished restructuring efforts at a large number of the region’s biggest lenders and the eurozone’s continued failure to create a single market for banking. But over the next 12-to-18 months many financiers are expecting a large-scale deal.

Not everything under discussion is realistic. Some of the slick investment banking presentations being delivered to the boards of the biggest European lenders about the benefits of consolidation have been so brazen that even some veteran dealmakers are themselves rolling their eyes.

“The talk has stepped up. But I don’t feel particularly sensible going into most bank boardrooms pitching some of the cross-border mergers that are being bandied around,” says a senior London-based investment banker. He cites the idea of an Anglo-Spanish merger between Barclays and Santander as one of the “craziest” ideas pitched so far.

Possible deal Société Générale/UniCredit

Total employees 238,900

2017 net profit $9.7bn

Assets $2.47tn

Pros Synergies in corporate and investment banking

Cons Political resistance

Based on the combined totals for the two banks. All figures are to the end of 2017

The idea of a major European banking merger first surfaced after Sweden’s Nordea had an offer to buy rival ABN Amro rejected by the Dutch government, the bank’s majority shareholder, two years ago. Some financiers now view UniCredit as one of the favourites to do a deal, with Mr Mustier plotting how to revive the idea of merging the Italian lender with its French rival Société Générale.

Investment bankers also think a tie-up between Deutsche Bank and Commerzbank is likely in the next couple of years in a bid to create a German champion, while other takeover targets include the part-nationalised banks: Bankia in Spain, and ABN Amro. BNP Paribas and Santander — the eurozone’s two biggest lenders — are widely seen as probable consolidators.

“In the mass-market business, size really matters and they are looking for more scale on their platforms, that is why discussions are becoming more intense,” says Bernhard Hodler, the chief executive of Swiss private bank Julius Baer. “Consolidation will continue.”

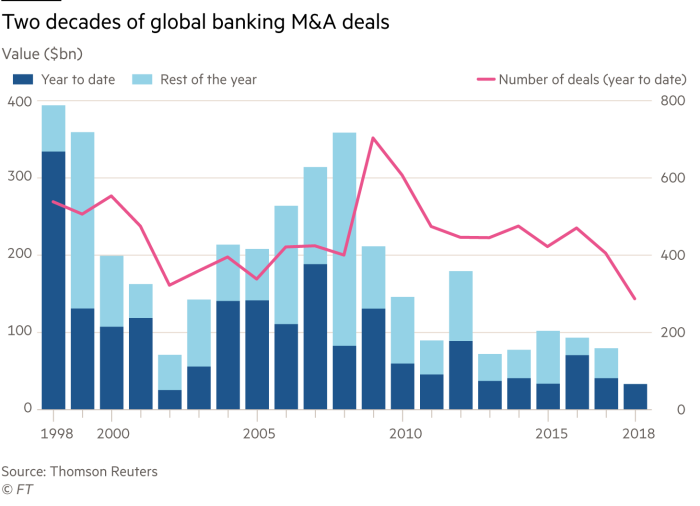

For years, M&A activity has been buoyant in pharmaceutical, technology and consumer industries. But the banking sector has been devoid of large takeovers since the 2008 crisis. Last year there were $79.6bn of mergers between banks worldwide, a fraction of the $359bn of such deals in 2008, according to Thomson Reuters.

Possible deal Deutsche Bank/Commerzbank

Total employees 146,952

2017 net loss €673m

Assets $2.15tn

Pros Cost-cutting and reduce Deutsche’s exposure to investment bank

Cons Two weak banks do not make a strong one

Based on the combined totals for the two banks. All figures are to the end of 2017

One trigger for the revived interest in dealmaking is the realisation among European bankers that they are being squeezed by more powerful rivals in their two main markets. Wall Street banks, having recovered faster from the crisis than their European counterparts, are gobbling up market share in corporate and investment banking. At the same time, the encroachment of big technology groups such as Amazon and Facebook into consumer financial services threatens to steal bank customers and squeeze profit margins.

“European banks are saying: ‘We have ceded the sunny uplands of capital markets to US banks, even in our home markets, and now we face the threat of losing the retail banking market to US big tech,’” says Ronit Ghose, global head of banks research at Citigroup. “That is a real existential threat.”

A natural defensive response, some bankers argue, is to grow bigger via acquisition, allowing lenders to spread over a larger revenue base the spiralling cost of investing in financial technology and complying with myriad regulations.

“The real disruptive threat is coming from big tech, where the really attractive profit pools like foreign exchange or payments are just a means to an end for some of the big fintech [companies],” says Francesca McDonagh, chief executive of Bank of Ireland. “There is a likelihood of more consolidation, particularly in the squeezed middle.”

Possible deal Nordea/ABN Amro

Total employees 50,353

2017 net profit $6.8bn

Assets $1.14tn

Pros Exit route for Dutch state from ABN

Cons Political sensitivity

Based on the combined totals for the two banks. All figures are to the end of 2017

Europe’s banking sector remains highly fragmented. There is one bank for about every 50,000 citizens in the eurozone, a similar level to the US, but far more diffuse than the UK’s one per 170,000 people and Japan’s almost one per 900,000 people, according to European Banking Federation figures.

“A whole set of [European] national champions is now acting and thinking about what it is like to be champions in more of a region-wide context,” says Gary Howe, head of financial institutions in North America at Lazard.

Weak profitability creates more pressure to consider radical options. The average return on equity for European banks remains below 8 per cent — lagging behind both their 10 per cent cost of capital and more profitable US rivals. “The management think [dealmaking] may enhance their position: they think they have to do something or they are going to get fired,” says Bertrand Lavayssière, a partner at consultants ZEB.

Regulators too are becoming more vocal in calling for cross-border bank mergers, which they say would boost the sector’s profitability and support the economy by providing a stronger source of funding for companies.

European Central Bank officials believe that creating a few pan-European champions would reduce the reliance on Wall Street banks, which are still perceived to have deserted Europe in the crisis — something American bankers hotly deny. Danièle Nouy, chair of the ECB’s supervisory board, said in a recent interview: “In my opinion, cross-border mergers within the euro area are the way forward.”

While the ECB would not reduce capital requirements for merged entities, officials indicate it could use its powers to help in other ways. These may include allowing banks to offset more of their biggest exposures to individual clients across borders or increasing their flexibility to move capital and liquidity between countries.

This renewed interest in mergers, however, comes more from a position of weakness than strength. Many of the banks thinking hardest about dealmaking have shares priced far below the book value of their assets. Barclays is responding to pressure from an activist investor; Deutsche Bank has made heavy losses for three years and its shares recently hit all-time lows; UniCredit suffers from hefty non-performing loans and a bloated cost base.

“I wouldn’t be sure if the [banks] are waving or drowning,” says Lindsey Naylor, a banking consultant at Oliver Wyman. “They have been trying to take costs out for 10 years without much success and there are now a growing number of players looking to move into the heart of their market.”

For all the talk about bank M&A, many believe it will not happen for several years, if at all. “You get lots of flirting, but very little sex,” says Davide Serra at the hedge fund Algebris, which has investments in several of Europe’s biggest banks. “For the next two to three years, I think each of them needs to go through their own digitisation process.”

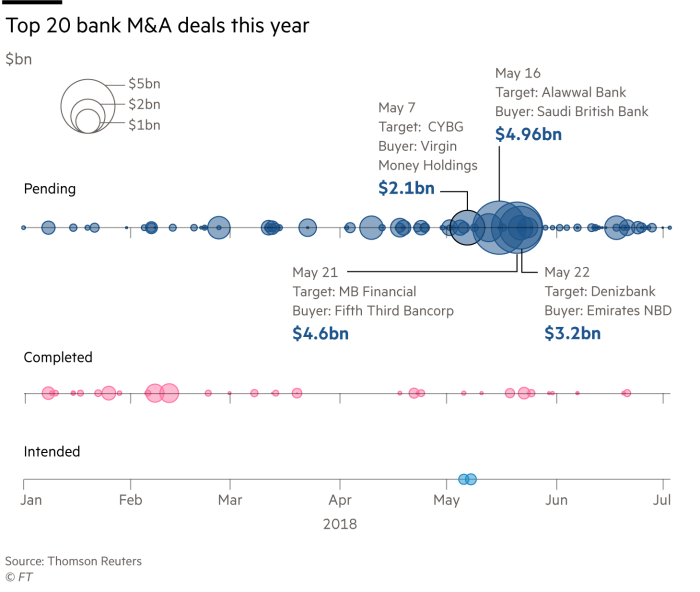

Most deals this year have been between mid-sized domestic lenders, such as the $5bn merger of Saudi British Bank and Alawwal Bank to create the kingdom’s third-largest lender, or the $4.7bn deal in the US between Fifth Third Bancorp of Cincinnati and Chicago’s MB Financial. Virgin Money last month agreed to a £1.7bn takeover by rival CYBG to create the UK’s sixth-largest bank.

The case for big cross-border banking deals is weakened by the poor results of past deals. An Oliver Wyman analysis found that fewer than half cross-border bank deals in the decade to 2016 achieved positive net synergies.

Séverin Cabannes, SocGen deputy chief executive, says: “If you have structural value destruction, it’s not stable . . . so the cross-border merger could come one day, but before [that] we should see further domestic consolidation in certain European countries.”

Another major hurdle to consolidation is the unfinished nature of eurozone banking union. The bloc has harmonised some bank rules, but many areas remain fragmented including tax, bankruptcy law and rules on treatment of collateral. Senior bankers say pan-European combinations only make sense if they can move capital and liquidity more freely across the bloc — something that is unlikely until policymakers agree a common eurozone deposit insurance scheme.

The election of a Eurosceptic government in Italy may make these negotiations harder, especially with widespread scepticism in Germany that the scheme is a thinly disguised bailout of southern Europe’s weak banking systems.

On top of this, any bank thinking about a big merger needs to weigh the cost of moving up the scale of systemic importance, which brings with it extra capital requirements from the Financial Stability Board, an arm of the G20. They also need to consider the complexity in combining two IT systems.

In spite of these hurdles, many bankers believe consolidation is inevitable.

Bill Winters, the former JPMorgan executive brought in three years ago to run Standard Chartered — a perennial subject of takeover speculation, has little doubt that there will be “many, many, many fewer banks” that can adapt to the new environment. “We will have massive consolidation along the way,” he adds. The question is who will move first and which banks will be left standing when the dust settles.

US deals Medium-sized banks see opportunities to grow

A decade ago Gary Parr was in the thick of things at Lazard in New York advising on the sale of Bear Stearns to JPMorgan Chase and Lehman’s US business to Barclays, among other crisis-era combinations.

But he, and other veteran advisers, do not envisage a return to such big-bank mergers and acquisitions in the US even as counterparts in Europe consider radical moves. For one thing, notes John Esposito, co-head of financial institutions at Morgan Stanley, some of the biggest banks already have more than 10 per cent of deposits nationwide, meaning they are prevented by a 1994 law from buying any more. Regulators remain wary of backing any deal that might make a big bank more complex and harder to manage.

However, one level down — among regional banks and the so-called super-regionals — there could be some activity.

Congress last month lifted the threshold for a bank to be considered a serious risk to the financial system, and thus subject to extra layers of regulation. That means mid-sized banks can now grow a lot bigger — amassing up to $250bn in assets — without fear of higher expenses. Eric Bischof, co-head of the global financial institutions group at Bank of America, says there have been several recent deals in the $1bn-$5bn market capitalisation range and expects more to come, perhaps worth as much as $20bn.

Foreign banks, too, could seize the opportunity to expand. Sumitomo Mitsui Banking Corporation, Japan’s number two lender by assets, has long been linked to a US deal, while MUFG wants to become a top 10 bank by deposits in America. Canadian banks also remain keen to diversify. Ben McLannahan

Letter in response to this article:

The biggest barrier to banking consolidation / From Dr Tim Oliver Brandi, Frankfurt, Germany

Comments