With the Speedy Tuesday, buying watches online gets sophisticated

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Omega launched its Speedy Tuesday model in January — its first watch sold directly to consumers online — the full run of 2,012 was snapped up in just over four hours.

While the name refers to Omega’s Speedmaster watch, it is also apt for the haste with which buyers pounced on the timepiece — and for a fast-growing trend in a traditionally cautious industry: selling luxury watches online.

Online luxury watch sales — estimated at just over 3 per cent of the watch market, or around €1.1bn, in 2016 — remain a small part, says John Guy, a luxury analyst and managing director at Mainfirst Bank.

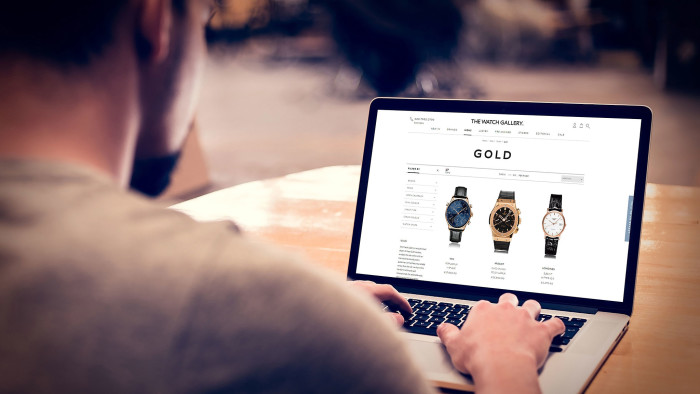

But this is double its share from three years ago, according to Mr Guy, and the past year has seen several high-end brands continue to expand digitally: Jaeger-LeCoultre and Cartier joined the UK’s The Watch Gallery online, which has 12,000 visitors a day. In its first six months on the site, Cartier sold more pieces there than on cartier.com, says The Watch Gallery chairman David Coleridge. And in May, luxury conglomerate LVMH will launch an ecommerce site for all its brands.

Direct online selling is the “new way of talking to consumers”, says Omega chief executive Raynald Aeschlimann, who adds that he felt “quite sure” about the success of the Speedy Tuesday — a watch that, pre-launch, “not even a lot of people within Omega had seen”.

Mr Aeschlimann may have had faith in this idea because a Speedmaster customer base already existed online. Robert-Jan Broer, founder of the blog Fratello Watches, created the hashtag #SpeedyTuesday in 2012 and, through posting weekly entries about the model, a community developed.

By the time Omega announced the watch (£4,100), Fratello had written almost 250 #SpeedyTuesday articles and the hashtag had been used more than 40,000 times on Instagram.

The numbers sold online are still small compared to overall sales, however, notes Mr Guy, especially for something like the Speedy Tuesday. Omega sells around 600,000 watches a year, whereas this was a line of just over 2,000. And while such “marketing ploys”, as he calls them, can help build brand awareness, he does not expect they will bring about a “huge conversion of sales” to digital.

In November 2016, Swiss watchmaker IWC made shopping site Net-a-Porter its first online-only outlet. The fine watch shop on Mr Porter (Net-a-Porter’s male equivalent) opened in 2013 with Bremont as its first brand; today it carries seven brands, with a £99,500 IWC Portugieser tourbillon its top-end piece. Asked whether IWC envisions selling directly online at some point, incoming chief executive Christoph Grainger-Herr says it is a “logical consequence . . . The question is never ‘if’ but ‘when and how’.”

Brian Duffy, chief executive of Aurum Holdings, which owns around 150 UK stores across its Goldsmiths, Mappin & Webb and Watches of Switzerland brands, says that his company’s average online selling price for luxury watches has grown 25 per cent since 2011 to £1,948 and that its sales are increasing about 50 per cent year on year, driven entirely by domestic UK buyers. Mr Coleridge says that his company’s average online transaction value is £2,500.

***

Brands are also seeing the virtue in launching watches in partnership with enthusiasts’ websites. Hodinkee, a site founded in 2008, has been behind four limited edition, co-branded watches which have been selling out faster and faster. In 2015, its first effort — the MB&F LM101, priced at $52,000 — sold all 10 pieces within five hours.

The Zenith El Primero Original ($7,900) followed in October 2016 — all 25 sold in just over an hour. And in February 2017, Hodkinee partnered with Vacheron Constantin to offer the Historiques Cornes de Vache 1955, priced at $45,000; all 36 went in 30 minutes after interested parties had filled out online reservation request forms.

MB&F, which does not sell online directly, had a mixed online experience previously. In 2010, it had partnered with watch blog PuristSPro and sold all the examples of a $79,000 watch.

But in 2015, a collaboration with Cool Hunting, a more general online design publication that at the time had more users than PuristSPro and Hodinkee, resulted in only three of the 10 pieces selling on Cool Hunting, despite a lower price of $34,000.

A trusted community and a well-aimed product underpin Hodinkee’s sales, just as #SpeedyTuesday developed within Fratello’s community. Hodinkee has around 1m active users per month, says managing editor Stephen Pulvirent, with visitors ranging from those “that buy $200 Seiko watches on Amazon to collectors who spend millions of dollars on watches a year”. Indeed, the buyers of its co-branded watches reflected that mix, being both existing collectors and newcomers.

In 2015, Hodinkee merged with another watch site and raised $3.6m from investors including Google Ventures and Twitter’s Evan Williams, and a year later it launched an online vintage shop. All commercial content is unique to Hodinkee, such as photographs of real watches (as opposed to digital renderings) often placed in glossy lifestyle settings.

Mr Pulvirent says the editorial site provides the everyday expertise of a salesperson. “Our users trust and hear from us daily.” Equally, when asked whether Hodinkee is risking its reputation for impartiality by working with brands, Mr Pulvirent contends the site is “aware of not wanting to disrupt that credibility at all” as its role expands into selling watches.

The Hodinkee shop uploads details of new watches on the same day every week, with no promotion or images beforehand to keep the element of surprise. With a 90 per cent sell-through rate, there is often a race to buy.

“We like this idea that out of nowhere we create this flash,” says Mr Pulvirent. The bulk of its vintage watches are priced between $2,000 and $10,000, with a $175,000 Rolex Paul Newman Daytona its most expensive to date.

The piece was bought using Apple Pay: “Someone purchased it at 10.30pm on their iPad — using their thumb, which is wild,” says Mr Pulvirent. (You unlock the payment on your device with your thumb.) Apple Pay was also the method by which Hodinkee’s first co-branded watch was sold: the $52,000 MB&F watch was then the largest Apple Pay purchase.

In the same way that Hodinkee uses luxurious photography to sell its watches, retailers are also focusing on attractive online experiences. Aurum Holdings has been deliberately growing its online presence, says Mr Duffy.

Last year it “significantly upgraded” its online customer experience, from improving navigation to adding video and text concierge services. During the SIHH watch fair in Geneva in January, it broadcast live web discussions for the first time — an initiative it is bringing to the Baselworld fair, which opens today in Switzerland.

***

Online marketing is a “very new and fascinating” space, says Mr Duffy, hinting that what works and what does not remain to be seen. “You do tend to spread your appeal widely but hope to capture anybody out there who’s looking for a luxury watch.”

The Watch Gallery’s Mr Coleridge echoes this sentiment. He argues that large generalist retailers such as Selfridges, whose online store has 100m visitors per year and whose watch department is operated by The Watch Gallery, will be “a critical part of the future of online trading generally, particular for watches”.

The plans of LVMH, the world’s largest luxury goods company by revenue, to launch an ecommerce site for all its brands in May under its department store marque, Le Bon Marché, reflect this impetus.

Ultimately, the divide between online and offline might become less important, says Mr Coleridge: “Customers are not the slightest bit interested in whether they’re buying online or in a shop. For them it’s a process.”

Purchasing a luxury watch will usually be completed within two to three months, he adds, during which there will be a mixture of visiting shops, reading articles, searching primarily via Google and talking to friends: “We try to be reactive to that process,” says Mr Coleridge. The Watch Gallery lets customers chat about a watch online with a specialist, who can then offer to meet them in store.

Still, while these online exclusives continue, watch fans will pursue them. George Bamford, founder of the Bamford Watch Department which personalises watches, including Rolexes, believes that limited editions like Hodinkee’s are the new game.

He admits to buying into the Speedy Tuesday “hype”, and says he would like to own one. “Even I couldn’t get one — and normally I can get most watches.”

Comments