Cryptocurrencies: how do they work and what are the risks?

Simply sign up to the Cryptocurrencies myFT Digest -- delivered directly to your inbox.

What are cryptocurrencies?

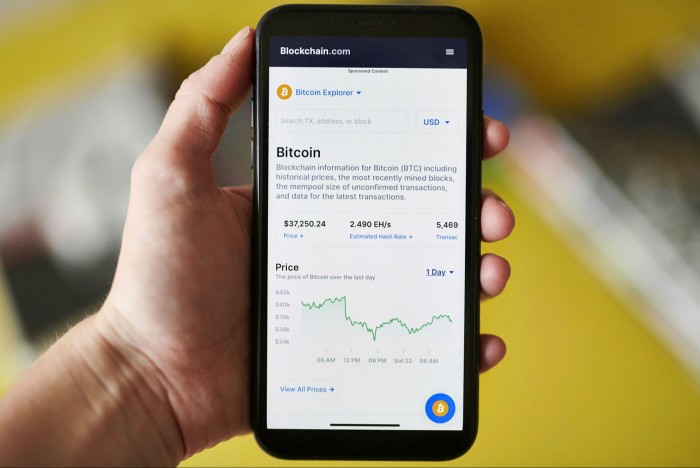

Cryptocurrencies are assets that have been created digitally by a private company to serve as a store of value, which can be used to exchange for goods and services. But, unlike the money that is widely used today, a pure cryptocurrency is not created by a central issuing authority and its value is transferred and recorded on an open public ledger known as a blockchain. Furthermore, the currency’s provenance, and transfer of ownership, is secured and verified by cryptography.

There are dozens of cryptocurrencies, the best known being bitcoin, ether, binance coin and cardano. However, there is an important distinction between a cryptocurrency, also known as a coin, and a token.

A cryptocurrency has its own blockchain; it is effectively the native currency of the blockchain on which it is issued and traded. By contrast, a token is a unit of value that represents projects that are built on top of an existing blockchain. For example, ether is the native currency of the Ethereum blockchain. But a token such as dai is built using Ethereum. Dai itself is a stablecoin — a bridge between existing financial markets and the crypto world.

Increasingly, observers are talking about crypto assets in a more encompassing way to describe all the projects under way in the industry. Other ventures include security tokens, which are a crypto-based version of an existing security and usually a regulated activity.

The Bank of England has estimated that crypto assets have grown in value by roughly 200 per cent in 2021, from just under $800bn to $2.3tn. Even so, that remains a fraction of the $250tn global financial system, notes the central bank.

How do cryptocurrencies work?

The first versions of cryptocurrencies were intended to be a form of electronic cash whose value could not be manipulated by outside actors such as central banks. But their use in everyday life — to buy consumer items such as coffees or sandwiches — has been slow. That is partly because the technology to make payments is far slower than the contactless card or chip-and-pin systems of today. But the main reason is that the value of the asset is highly volatile, making it unsuitable for everyday payments. Instead, cryptocurrencies are being seen as stores of value in their own right.

Cryptocurrencies are created in different ways. Some, like bitcoin, are created as a reward to “miners” for using computer power to verify transactions that are made on the bitcoin blockchain.

But that makes bitcoin expensive to operate — and the industry has been heavily criticised for its energy consumption. Others are trying to find alternative processes to ensure deals on blockchains can still be verified but do not require the same amounts of computing energy.

Newer projects are focused on third parties to take on the legwork of processing some payments, to make the system more efficient and scalable.

What are the investment risks with cryptocurrencies?

Prices of coins can be volatile and can move rapidly in the short term. That is why some cryptocurrency owners use the mantra “hodl” (“hold on for dear life”). With bitcoin hitting record prices in 2021, it is easy to see why they feel vindicated. Still, the coins are largely unregulated around the world so, if something goes wrong and investors lose their money, they have little protection from the authorities.

Other assets that are based on cryptocurrencies, such as futures, have more investor protections. Some exchanges that offer crypto-related trading, such as derivatives exchange CME Group, also have to meet local laws that ensure the integrity of their market.

The value of a coin can also be affected if it is discontinued, delisted or undergoes a significant technology change. Currencies can be discontinued for many reasons, from low volume and liquidity to security breaches.

Finally, developers or members of a crypto community may have differing views on the future direction of the network or want to change the rules, or protocol, that governs the blockchain. That can lead to a “hard fork” which, in effect, splits the protocol into two branches and creates a new cryptocurrency. Forks can create volatility in crypto prices and, over the longer term, the two versions of the currency may not produce the same performance.

What are the security risks with cryptocurrencies?

The owners of the assets are as responsible for safeguarding the asset, as much as they would be for protecting their cash. Digital currencies can be kept on a computer and there are several choices available to crypto owners.

One option is a virtual wallet that is kept online. It is easier to access and makes it faster for users to trade because they can quickly connect to exchanges or other services.

However, being online makes a wallet more susceptible to being hacked, so some people prefer to keep their assets in what is known as “cold storage” — on an electronic device but in a vault not connected to the internet. Cold storage wallets do not accept as many kinds of cryptocurrencies as online wallets, however, and they are more expensive storage options. Another problem is losing or forgetting the private key, which unlocks the digital wallet.

Like other financial institutions, crypto service providers also have to make sure they are not hacked. Compromising the security of a blockchain is widely seen as a remote problem — to succeed, a hacker would need more computing power than all the other independent verifiers on the network. That often means the computer code written for new projects is the most vulnerable point in the system.

Sometimes, the code is little tested before it goes live and is open for hackers to exploit and walk off with the assets. But so-called ethical white hat hackers can try to test and improve the service. In August, one hacker removed assets worth $600m from Poly Network, a decentralised trading network, when he found a flaw. He later returned them.

Comments