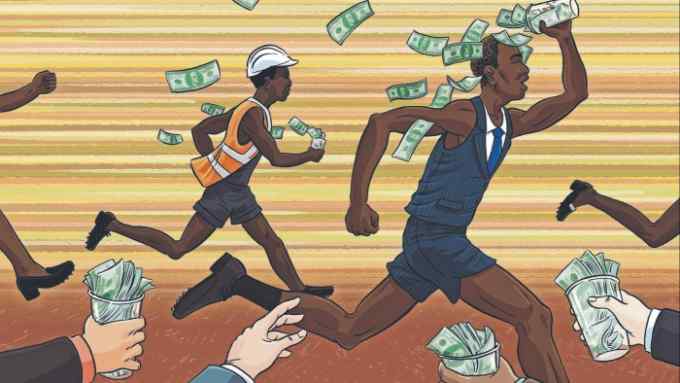

Nigerian businesses overcome woes to lead FT-Statista ranking

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

From fledgling start-ups to established powerhouses, Nigerian businesses dominate the second edition of the FT-Statista 2023 annual ranking of Africa’s fastest-growing companies. Six of the top 20 companies on the list are from Nigeria, with their operations ranging from financial services to real estate and retail.

Top of the pile is AFEX, an Abuja-based brokerage that helps farmers to sell, and large companies to buy, agricultural commodities. AFEX, which was in third place on the list in 2022, expanded its operations into Kenya and Uganda in the past year.

The healthy performance of Nigerian companies should come as no surprise, says Eloho Omame, partner at TLcom, a venture capital firm investing in tech-enabled businesses across the continent.

Omame says Nigeria’s youthful population — the median age of its 221mn people is 18 — means there is a huge cohort that is beginning to consume goods and services for the first time, and to interact with the digital products that are solving problems across a range of sectors.

“The Nigerian consumer tends to have a very strong appetite and tends to be willing to try new products and this can fuel growth for businesses, especially tech companies,” she says.

“Nigeria is a prime destination for investment capital into companies in Africa, even beyond the start-ups.”

Of the more than $3bn invested in technology companies in Africa last year, Nigerian firms attracted $976mn according to data from research firm Disrupt Africa, indicating continued interest in Nigerian businesses.

But, for all the positive performance of Nigerian companies, there remains cause for concern. The wider macroeconomic environment does not bode well. Inflation is at more than 22 per cent and interest rates of 18 per cent make commercial loans exorbitant for companies seeking capital. Under the administration of outgoing president Muhammadu Buhari, Nigeria has tipped into recession twice and economic growth now looks largely stalled.

Businesses are also grappling with a shortage of dollars that has affected companies that must spend in other currencies. Nigeria’s oil receipts — the country’s major source of foreign currency — have fallen over the past year, despite high oil prices, due to crude theft in the Niger Delta and a lack of investment in infrastructure.

The dollar shortage has made it almost impossible for international airlines to repatriate funds from ticket sales or for companies with foreign currency expenses to access the dollars that they need — an unwelcome development for an import-dependent economy.

The problem has been worsened by the multiple exchange rate “windows” for trading currencies. Through the official window with the Central Bank of Nigeria, the dollar trades against the local Naira currency at a rate almost 50 per cent lower than is obtainable on the black market, where the greenback is freely traded.

Only a few businesses have access to the central bank’s rates and analysts say the opacity around the exchange rates regime makes it difficult for businesses to plan ahead or unlock capital. “The majority of goods and raw materials used by Nigerian companies are sourced from the international market, and the inability to access foreign currency has a direct impact on their profitability,” says Ese Osawmonyi, a senior analyst at Lagos-based SBM consultancy.

Osawmonyi adds that the uncertainty has forced businesses to raise prices, further fuelling inflation, and led to companies deferring investment or exiting key markets to save capital. Unilever Nigeria announced in March it would stop manufacturing home care and skin cleansing products — a move caused by dollar shortages, according to a person familiar with the decision.

Private sector executives are hoping a new government, due to take office at the end of the month, will have more business-friendly policies than Buhari’s protectionist and interventionist approach, which has worsened the investment climate in Nigeria.

Bola Tinubu, Nigeria’s newly elected leader, will inherit an economy where foreign investment has plummeted, some of it attributed to the chronic shortages of hard currency. Foreign direct investment into Nigeria fell by a third last year, according to data from the National Bureau of Statistics. Only $468mn was invested in 2022 compared with $698mn the previous year.

Ayodeji Balogun, chief executive of AFEX, says there’s a “talent flight” companies have to contend with, as more Nigerians exit the country seeking to better themselves amid the tough economic climate and rising security problems, which make kidnappings more widespread. “It’s almost impossible to employ a brilliant person and have a view that they will be with you for three-to-five years, even at the entry level,” he says.

Comments