Commodity funds stage revival as investors seek inflation hedges

Simply sign up to the Commodities myFT Digest -- delivered directly to your inbox.

Commodity funds are making a comeback after years out of favour, as institutional investors seek hedges against stubbornly high global inflation.

Investment vehicles tied to raw materials such as oil and wheat drew in net inflows of $38.7bn in the year to May 10, building on weekly inflow highs through March, according to data from Citi.

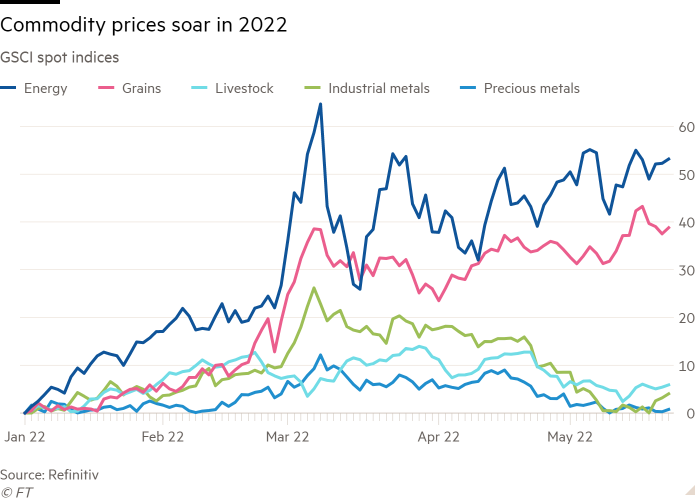

Commodity prices have soared this year as pandemic supply chain disruptions were compounded by a squeeze on oil and gas supplies over the winter, pushing the broad S&P GSCI index in March to its highest level since 2008.

Prices for grains, cooking oils, energy and fertilisers have all jumped following Russia’s invasion of Ukraine, stoking inflation even further and raising fears of widespread hunger in developing countries.

The wide-ranging S&P GSCI raw materials index has receded from its March peak, but remains up 37 per cent for the year, compared with a fall of 16 per cent for the broad MSCI World share gauge and a decline of 8 per cent for an Ice Data Services barometer tracking global high-grade bonds.

Agricultural commodity funds have received the most flows this year, according to portfolio managers at DWS. Data tracked by Morningstar show both broad-based and sector-specific commodity strategies have taken in $24.5bn in net flows this year, with more than 95 per cent going into index funds tracking these goods.

“We have a pretty diversified portfolio at all times, but we’re definitely leaning a bit more into natural resources and commodities, which is a counter to historically what we have done if we see this kind of global growth slowdown,” said Evan Rudy, liquid real assets fund manager at DWS.

In a sign of investors’ flight to safety in turbulent markets, the SPDR Gold Shares exchange traded fund was the commodity strategy to receive the most inflows, drawing in $7.2bn. Most commodity funds include gold, which is widely seen as a short-term hedge against inflation.

Commodity prices spent the first 10 years of this century riding high on the back of China’s insatiable demand for resources to fuel its economic growth spurt. After the so-called supercycle ended, commodities were unpopular for several years as investors worried about their volatile prices and often dicey sustainability credentials.

Environmental, social and governance principles were “one of the reasons institutional investors stayed away, but also the volatility is quite extreme. Institutional investors can’t stomach volatility so commodities were very out of favour,” said Amin Rajan, chief executive at think-tank Create Research. “They are a feast or famine prospect.”

Additional reporting by Neil Hume

Comments