Globe-trotting Vijay Mallya denies fleeing debts in India

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

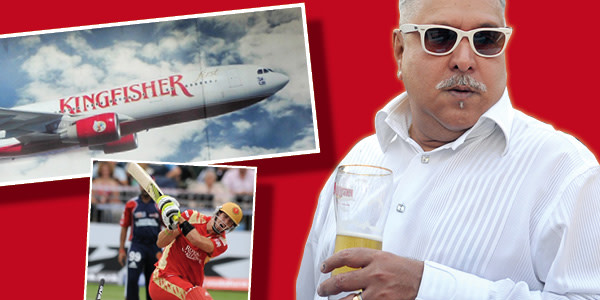

Drinks baron Vijay Mallya, the hard-partying businessman once known as the “King of Good Times”, has been flitting in and out of India for years, gallivanting around the globe in pursuit of his cricket and Formula One teams, and to visit his scattered luxury properties.

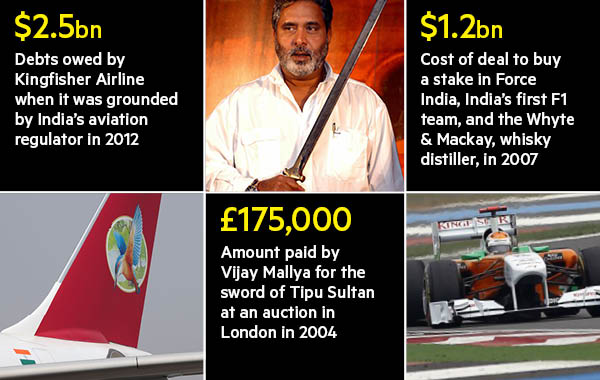

But his most recent flight from India, possibly to the English countryside, has ignited a national furore. It came just as 17 frustrated Indian banks were seeking a court order to prevent the tycoon from travelling overseas until he settled more than $1.3bn of unpaid debts left by the 2012 collapse of his Kingfisher Airlines.

The departure has embarrassed Prime Minister Narendra Modi’s administration, which is under pressure from the central bank to get tough with entrepreneurs responsible for a mounting debt problem in India’s banking system.

Mr Mallya, who sold his lucrative spirits business to British drinks group Diageo in 2012, has been vilified in India’s national media as the embodiment of the feckless businessman who lives in extreme luxury, even as his companies fail to repay taxpayer funded state banks.

Amid the outcry over how he was able to fly to the UK, Mr Mallya told his nearly 5m Twitter followers on Friday. “I am an international businessman. I travel to and from India frequently. I did not flee from India and neither am I an absconder. Rubbish.”

“As an Indian MP, I fully respect and will comply with the law of the land. Our judicial system is sound and respected. But no trial by media.”

Mr Mallya complained last week that India’s media had turned him into the “poster boy” for all stressed assets in India’s banking system, which are estimated to be at least $117bn, though some believe the figure could be higher.

The furore has reverberated in India’s parliament. Opposition lawmakers have accused Mr Modi’s government of a “criminal conspiracy” to help the brash businessman, known for his diamond ear studs, to flee “first class”.

Arun Jaitley, the finance minister, responded that the loans to Kingfisher Airlines that went sour were all extended during the previous Congress government.”

A decade ago, Mr Mallya seemed to be flying high. His United Spirits, a liquor company, and United Breweries, a beer company, were the undisputed heavyweights of India’s growing market for alcoholic drinks.

While conservative Indian business-owners typically maintain a low profile, Mr Mallya was known for his unapologetically, jet-setting lifestyle. He hosted glamorous parties with Bollywood stars and sports legends at his Goa mansion, on his yacht, or at other luxury properties around the globe.

But his 2005 foray into India’s turbulent airline business brought a brutal descent. Though popular among travellers, his Kingfisher Airlines, squeezed by high fuel prices and bitter competition, never turned a profit. It finally collapsed in 2012, leaving nearly $2bn in debts, including about $1.3bn to state-owned banks.

Since then, Kingfisher’s creditors have struggled to recover the money from Mr Mallya, or to foreclose on physical assets, and personal guarantees, pledged as security on the loans. They have proved largely unsuccessful, as many of Mr Mallya’s trophy assets were not, in fact, his property.

The famous beachside Goa mansion — and 12 other luxury homes in India and abroad — were in fact owned by United Spirits, a listed company, rather than Mr Mallya. Kingfisher’s aircraft were owned by leasing companies rather than the airline. Banks have issued a notice saying they are seizing the trademarks of the now defunct carrier as collateral, though experts say they have little real value now.

“Clearly, they haven’t done their homework or their due diligence when they were lending the money,” says Amit Tandon, founder and managing director of Institutional Investor Advisory Services. “You need to be sure the person who offers security actually owns it.”

“I wouldn’t go so far to say as it shows complicity but it shows incompetence,” he says.

Amid the deadlock, banks were reinvigorated by last month’s news that Diageo, which had already paid £1.8bn to take control of United Spirits, was giving him a $75m “golden handshake” to ease him out of the chairmanship, a post he had retained after the sale.

Banks mobilised their lawyers to try to lay their hands on some of that cash, and a debt recovery tribunal last week ordered Diageo not to make the payout. But by the time the order was issued, the first $40m had been paid out already.

The woes of Kingfisher’s creditors are undoubtedly symptomatic of wider systemic problems in India’s banking system, and the inability of its sluggish judicial process to enforce resolutions of contentious cases in a timely manner, which has allowed bad debts to simply pile up. But Mr Tandon says Mr Mallya’s defiant stance and his flaunting of his wealth has made him a target for public wrath.

“There are others who have defaulted to the banks for far larger sums, and we don’t see banks or the system trying to recover the money with the same ferociousness as in the case of Mallya,” he says.

“But unlike others who defaulted and are reasonably servile when going to see their bankers, Mallya’s attitude was ‘you can’t touch me’,” says Mr Tandon. “He continued to say, ‘I’m going to party in this room, and you’re going to sit here.’ And now you are seeing this playing out.”

Comments