Instagram must stop the scammers targeting Gen Z

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is the latest part of the FT’s Financial Literacy and Inclusion Campaign

I have a question for you. How do you know it’s really me writing this article? It looks genuine. There’s a picture of my face and it’s published on a media platform you trust.

What if I told you, valued reader, that I had a crypto investment opportunity that could rapidly double your money?

I would hope FT readers would immediately conclude the article must have been written by an imposter. Sadly, it’s much easier for impersonation scams to proliferate on social media platforms. Lloyds Bank recently reported a 155 per cent annual increase in scams on Instagram in the past year, focused on the under-25s.

The latest twist? Some of the UK’s most popular personal finance content creators are being deliberately targeted by fraudsters who clone their accounts and attempt to scam their followers.

“If a beauty blogger messaged you asking if you were looking for a new way to make money, you would probably be suspicious,” says Charlotte Jessop, founder of Looking After Your Pennies website, Instagram account and YouTube channel.

“But if you got a message from a personal finance expert you followed saying ‘I’ll teach you how to make an extra £500 a month’, it’s not so much of a stretch to think it could be genuine — and that is a real risk for us.”

This week, Jessop and a group of 30 financial content creators launched a campaign to raise awareness about a rash of fake accounts targeting their followers, with some losing thousands of pounds.

It’s frighteningly easy for scammers to copy the account names, profile pictures and months’ worth of content, then use these fake accounts to target young (and often financially naive) followers with scam investments.

Although this can happen on TikTok, YouTube, Twitter and other platforms, the campaigners are using the hashtag #metadobetter, as they say it’s a particular problem on Instagram.

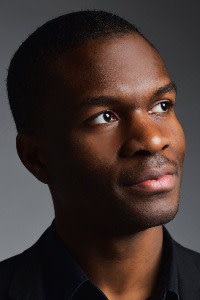

Emmanuel Asuquo — a qualified financial planner who posts financial education content on Instagram as @theemaneffectuk — posted a video this week warning about copycat accounts after two of his followers were scammed out of £4,000 in total.

“The faker copied my profile picture, my page and just put a 1 at the end of my username, then started preying on my followers, sending them DMs [direct messages] asking them to join my crypto investment club,” he says.

Two people believed it was him and transferred money, but dozens of others sent messages to his genuine account asking “Is this really you?”

Asuquo, who has 30,000 followers, has been forced to make posts pointing out he would never invest money on behalf of anyone else.

“You can get so excited that someone you admire is following and communicating with you, there’s no time to think — why would they follow me?”

Instagram eventually deleted the fake account. However, Timi Merriman-Johnson (better known on Instagram as @MrMoneyJar) says fraudsters make it harder for content creators to discover their profile has been cloned by blocking them, which also makes it trickier for them to report the fakers.

“You can’t see they exist, so the first you’ll hear about it is your followers contacting you asking why you’ve just tried selling them crypto,” he says.

He and Jessop have set up a WhatsApp group of financial experts to co-ordinate mass reporting of fake accounts.

“Literally every day someone will post about another fake account,” he says. The creators find the more fraud reports are sent, the quicker the fake account will be disabled: “But then, like a phoenix from the ashes, MrMoneyJar2 will arise and the whole process starts again.”

One of the most prolifically copied accounts is that of 21-year-old Poku Banks, whose videos about investing and personal finance have won him half a million followers on social media — many of them teenagers — which makes him a particular target.

“If you search ‘Poku Banks’ on either Instagram or TikTok, there will be at least 10 accounts that look just like mine — profile picture, posts and in some cases, followers included,” he says.

“Unfortunately one of my Instagram followers recently got in touch with me to say they had sent money to one of the fake accounts. They lost over £100 and have no way of getting the money back. It makes me wonder how many more people have fallen victim to these scams.”

Even I have had an Instagram message from a fake Poku asking me to invest in crypto — and like thousands of others, I messaged him saying “Is this really you?” His official bio bears the legend “I won’t DM you to invest”.

As influencers spend more of their time dealing with the fallout, they are rightly demanding that social media platforms do more to protect their followers and prevent this type of fraud from happening.

After I contacted Meta for comment, it replied: “We don’t allow people to impersonate others on Instagram, and people can report impersonating accounts directly to us in the app. Financial scammers use different tactics across the internet to mislead people and we pay close attention to these tactics so we can respond and protect our community.”

Even so, verifying high-profile financial commentators with a blue tick would immediately make it easier to spot fake accounts — but different platforms have different verification policies.

“Many of us are registered as limited companies and have been quoted as financial experts in the national press, yet our requests to be verified are still refused,” Jessop says.

I think if you’re well known enough for your account to be repeatedly cloned by a scammer, then you should be awarded a blue tick.

Seeing as these fraud attempts begin via DMs, why can’t platforms train their algorithms to flash up a warning such as “This account was created three days ago — could this be a scam?” or “This is the first time this person has contacted you, are you certain of their identity?”

Pinterest has a similar warning system in place — and of course, so do the banks. If you try to transfer money using your online banking app, a plethora of anti-fraud messages will flash up.

Sadly, this was not enough to deter the young investors who lost money. Their banks have said they will not be held liable for the fraud as customers transferred the money willingly.

With online fraud at record levels, retail banking executives will (privately) gnash their teeth about being fully on the hook for compensating defrauded customers when they think social media platforms could be doing much more to prevent it from happening.

The UK’s online safety bill will — eventually — impose a legal duty to improve protections for users from scams. So why wait? Like it or not, social media is where young people turn to for their financial education. It’s a shame some are learning lessons about fraud the hard way.

Claer Barrett is the FT’s consumer editor: claer.barrett@ft.com; Twitter @Claerb; Instagram @Claerb

Comments