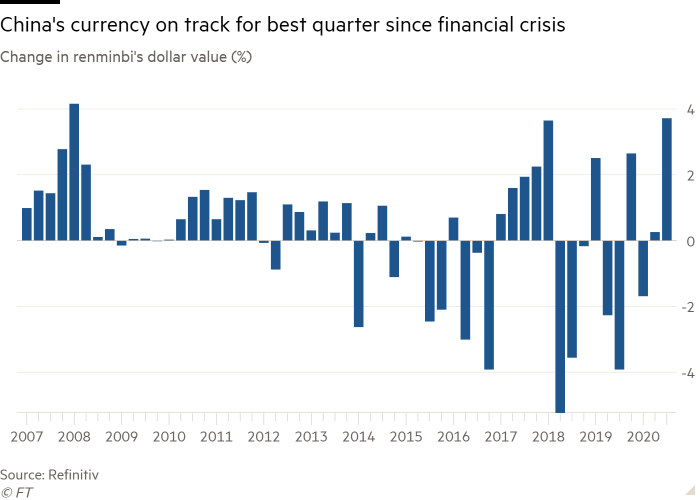

Renminbi set for best quarter since global financial crisis

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The renminbi is set to notch its best quarter since the global financial crisis, helped by a sell-off in the dollar and bets from traders that the worst of the tit-for-tat tariffs between Washington and Beijing have passed.

China’s onshore exchange rate has climbed about 3.7 per cent against the dollar in the past three months to Rmb6.81, putting it on track for the biggest quarterly rise since 2008. The gains also surpass those of early 2018, when the Trump administration began imposing tariffs on imports of Chinese goods.

Tensions between Washington and Beijing have deepened this year, with the White House putting pressure on Chinese companies operating in the US and raising the prospect of “decoupling” the US economy from China’s. But neither country has shown any sign of abandoning the “phase one” trade deal signed in January, which commits each side to hold off on imposing additional tariffs.

“The main impact on the renminbi has come from the broad-based tariff increases that we’ve had over the last couple of years,” said Mansoor Mohi-uddin, chief economist at Bank of Singapore. Currency markets were not pricing in any additional tariffs ahead of the US presidential election in November, he added.

China has also benefited from a fallback in US government bond yields after the US Federal Reserve cut interest rates to counter the economic effects of the coronavirus pandemic. That has pushed yields on 10-year Chinese government bonds to more than two percentage points above those on equivalent US Treasuries.

“It does look as if Chinese government bond yields will stay higher than developed markets’ bonds,” Mr Mohi-uddin added, citing the lower level of monetary stimulus provided by Chinese policymakers.

China posted a current account surplus of $110bn in the second quarter, according to recently released data, recovering from a deficit in the first. Portfolio inflows, meanwhile, topped $42bn between April and June as foreign investors snapped up renminbi-denominated stocks and bonds.

Inflows should be bolstered further by FTSE Russell’s decision earlier this month to include Chinese sovereign debt in its benchmark government bond index. That could trigger an estimated $140bn of investment, after the inclusion process begins next year.

JPMorgan strategists said strength in the onshore renminbi was “rooted in a fundamentally strong balance of payments outlook”, adding: “Despite sharp appreciation, the yuan’s valuation is not in froth territory.” The bank expects the currency to trade at Rmb6.85 to the dollar by the end of the year. Credit Suisse expects it to strengthen to Rmb6.7 to the dollar by the end of 2020.

The upward trajectory of the onshore rate, which can move 2 per cent in either direction of a midpoint set daily by China's central bank, has also been followed closely by its less-regulated offshore counterpart.

A lack of outbound tourism had also supported the renminbi by reducing a key source of currency outflows, said Michelle Lam, greater China economist at Société Générale, after Chinese holidaymakers opted for staycations.

But the US presidential election is a potential stumbling block. A victory for Democratic presidential nominee Joe Biden in November would solidify the renminbi’s gains, Ms Lam predicted, while a victory for President Trump would once again raise questions about the strength of the current trade agreement, “and what the next step is for a phase two deal, if any”.

Comments