Value shares lag behind Big Tech in post-election rally

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

The US presidential election was expected to deliver a boost to unloved value stocks.

Instead, sectors such as banks and autos have been left behind by fashionable technology stocks yet again.

A sweeping “blue wave” in last week’s election, quickly delivering both a Democratic president and a Democratic Senate, was seen as a trigger for a swift and substantial boost to fiscal spending that would buoy stocks left behind in the rally since March.

But control of the Senate remains on a knife-edge, potentially restraining some of the ambitions of president-elect Joe Biden and pointing to a less immediate and smaller fiscal boost.

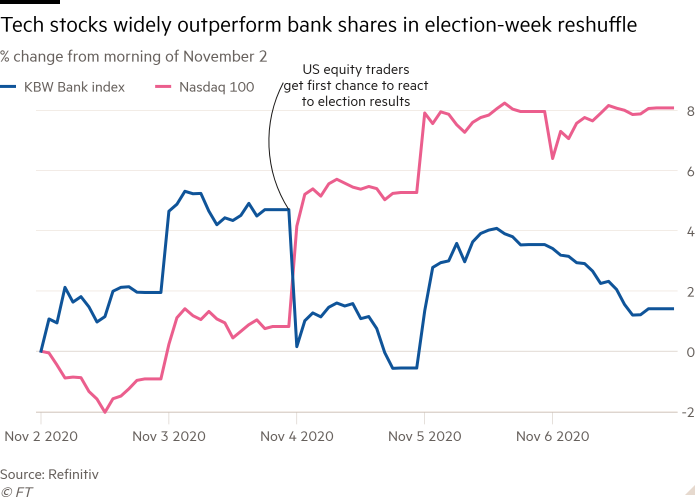

In markets, that means another big rally for Big Tech, while the more economically sensitive sectors such as banks — already among the hardest hit by the coronavirus pandemic — have slumped.

“We’ve seen a rotation back to long-duration sectors like tech at the expense of value,” said Emmanuel Cau, head of European equity strategy at Barclays.

The KBW banks index dropped by 3.8 per cent from the peak on election night to the close on Friday, leaving it roughly flat on the week, while the tech-focused Nasdaq 100 gained nearly 9.4 per cent on the week, on a par with its dramatic rally from the lows of March.

A rotation into value is “not off the table” but is likely to be delayed until there is certainty about the US election and less coronavirus disruption, said Mr Cau. If both headwinds wane, “this extreme polarisation between growth and value is going to narrow”.

Charlotte Harington, a portfolio manager at Fidelity International, said: “The quick route to a reflation trade was from a Democratic sweep, but now we’re looking at potentially a slower route.” Any such pivot to value stocks would be driven by the economic recovery from the pandemic, she said.

Comments