Biden wins election, SoftBank earnings, US inflation data

Simply sign up to the Global Economy myFT Digest -- delivered directly to your inbox.

Much this week will centre on Joe Biden’s plans now that he has won the race for the White House.

The president-elect spoke of his intent to “restore the soul of America” during a victory speech in which he urged the country to come together after one of the most divisive periods in US history.

Focus will largely be on how Mr Biden’s approach to the coronavirus pandemic, alongside domestic and foreign policy, will play out on the global markets.

Turkey’s economy will be back in the spotlight after President Recep Tayyip Erdogan fired the country’s central bank governor for the second time in little more than a year, raising the stakes for the lira, which has slid to new depths in recent weeks.

For the central banks, the ECB holds its annual forum online owing to coronavirus, where a host of big names are scheduled to speak.

McDonald’s and Walt Disney are two of the big names US investors will be watching, while in the UK commercial broadcaster ITV, retailer WHSmith and pub chain JD Wetherspoon will draw attention.

Inflation will be the data point to watch this week in the US. China also has economic indicators out that are set to show its post-Covid-19 recovery continues, while the pandemic is likely to make its presence felt when the UK’s growth and labour figures are released.

If this email was forwarded to you, and you’d like to receive the Week Ahead in your inbox on Sundays, click here to sign up.

Elsewhere . . .

EU foreign affairs ministers will meet virtually on Monday to discuss the future trade relationship with the US after last week’s presidential election. On the agenda there will also be the World Trade Organization reform, the bloc’s approach towards China and Brexit

The US Supreme Court is on Tuesday expected to hear from a case that is challenging the lawfulness of the Obamacare law

The Manhattan federal court is hosting a status conference for the US government’s criminal case against Steve Bannon and three other co-defendants on Monday

French president Emmanuel Macron will attend the opening ceremony of the Paris Peace Forum on Thursday

Companies news and earnings

Tech

Chinese gaming giant Tencent is reporting its third-quarter results in Hong Kong on Thursday. The Trump administration has previously targeted Tencent’s WeChat messaging app with restrictions in a push to review national security risks.

Chipmaker SMIC, which is also among China’s leading technology groups that have fallen under Mr Trump’s chokehold, updates investors in Hong Kong on Thursday.

Analysts will also look out for Palantir’s results issued on Thursday as the US tech group has been recently in talks with the UK government to implement the track-and-trace programme. The move, however, was deemed contentious and privacy campaigners voiced criticisms for the lack of transparency concerning the contracting process.

Cisco, the biggest maker of routers, German group Siemens and Japanese online retailer Rakuten report on the same day.

American fantasy sports outfit DraftKings, which was recently in the news when Michael Jordan bought an 8 per cent equity stake, is expected to publish its third-quarter earnings on Friday.

Financial

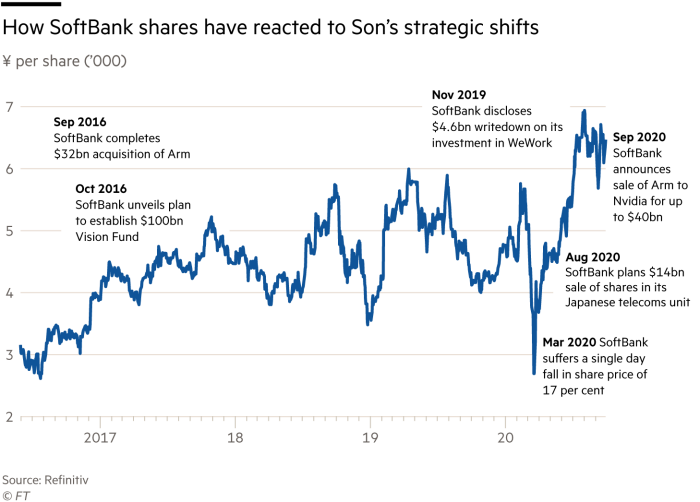

SoftBank, the Japanese group founded and led by Masayoshi Son, which has been pursuing an asset sale programme since March and exploring the option of potentially delisting its own shares, is due to report on Monday.

Brookfield Asset Management and Italian insurer Assicurazioni Generali report on Thursday followed by Mitsubishi UFJ on Friday.

Food and beverage

Investors will track Beyond Meat’s earnings progress on Monday after the US meat-substitute producer announced a further expansion in the global market, opening production facilities in China.

McDonald’s will also be issuing results on the same day as it tries to recover from last quarter when it reported its lowest quarterly profit in 13 years. The burger chain has suffered the impact of the pandemic and is now dealing with a lawsuit from black ex-franchisees.

UK-listed foodmaker Premier Foods, which has experienced a jump in sales and a 20 per cent share rise after shoppers stocked up on cupboard food during the first lockdown, reports on Tuesday.

Retail

Sporting-goods maker Adidas will issue its earnings on Tuesday together with Persil-maker Henkel.

WHSmith, the high street and travel retailer, is expected to publish its fourth-quarter results on Thursday after it recorded a revenues fall of more than 90 per cent in April and May, with sales still 75 per cent down in July despite shops reopening. Nippon Paint is closing the week with its earnings call on Friday.

Energy

After the oil-price crash earlier this year, analysts said they expected a wave of after-tax impairments by oil producers reaching up to $300bn. The heavily indebted group Occidental Petroleum, which announced in June a writedown of up to $9bn, will update investors on Tuesday.

German energy company Uniper also reports on that day, followed by National Grid on Thursday.

In the manufacturing sector Japanese group Yamaha Motor, French high-speed rail maker Alstom, German car-parts maker Continental and Nissan Motor publish their results this week.

Other companies reporting include Walt Disney, fashion group Burberry, ITV, the UK’s biggest commercial free-to-air broadcaster, UK pub chain JD Wetherspoon and developer Land Securities.

Central banks

The European Central Bank annual forum kicks off on Wednesday, when policymakers will gather virtually for a two-day event.

The bank’s president Christine Lagarde will deliver a welcome address to the forum on Wednesday, and also take part in a policy panel on Thursday when she will be joined by US Federal Reserve chair Jay Powell and Bank of England governor Andrew Bailey.

The BoE expanded its bond-buying programme last week, adding a further £150bn as concerns grow over the impact of a second wave of Covid-19 and the prospect of a no-deal Brexit.

New Zealand meets on Wednesday and is expected to keep rates steady at 0.25 per cent.

Mexico is set to make no change to its overnight rate on Friday and Peru is also expected to keep its rate on hold at 0.25 per cent on the same day.

Analysts forecast Egypt will keep both its lending and deposit rate on hold on Friday.

Economic indicators

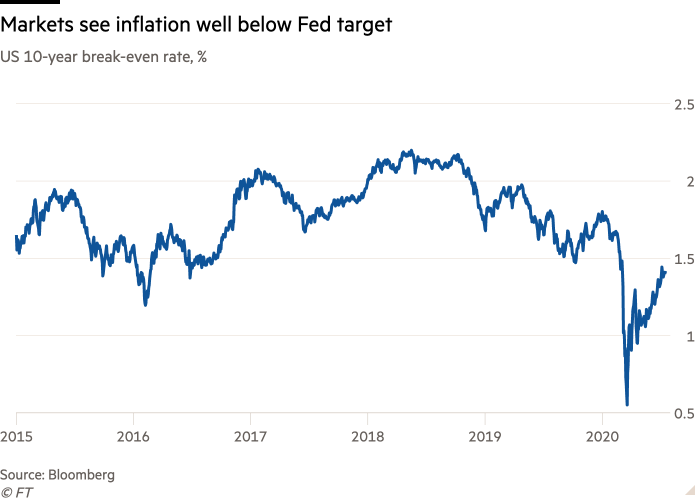

Analysts will continue to watch out for signals of a US economic recovery as consumer price figures are released on Thursday and the US consumer sentiment data on Friday.

Inflation is expected to pick up for the fifth month in a row with a 0.2 per cent increase month on month from the 0.4 per cent advance in August, but the year-on-year inflation remains below the Fed’s target of 2 per cent.

China’s consumer prices index is also out this week, but economists polled by Bloomberg forecast just a 0.8 per cent year-on-year increase for October.

Contrary to industrial activity that has been driving China’s recovery during this year, consumers have been less quick to resume their spending habits conditioned by an uncertain global outlook.

UK’s third-quarter gross domestic product preliminary figures and the jobless rate for September are due for publication. Analysts expect a GDP recovery on Thursday after the UK economy shrank by a fifth last quarter.

The Office for National Statistics publishes labour figures on Tuesday, which are likely to take a hit from the latest measures to curb coronavirus.

Further reading

Market questions: Will the US economy continue to strengthen?

Additional reporting by Julian Vickers

Comments