Off-grid solar offers light — and some hope

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

To get to the small town of Kasongo, in Maniema province in eastern Democratic Republic of Congo, a solar panel must travel approximately 7,000 miles. From a factory in southern China or India it is shipped to the port of Mombasa, trucked 1,200 miles across Kenya, Tanzania and Rwanda and over the border to Goma in DRC. From there, it is flown to Kindu, capital of Maniema province, before making the final bumpy journey by road to Kasongo.

And the fact that a solar kit can make this journey, be sold for $63, and produce clean power for 20 years is a miracle of technology and supply chains. Increasingly, distribution networks are the key: how to get technology that mythical last mile into the hands of the customers who need it, at a price they can afford.

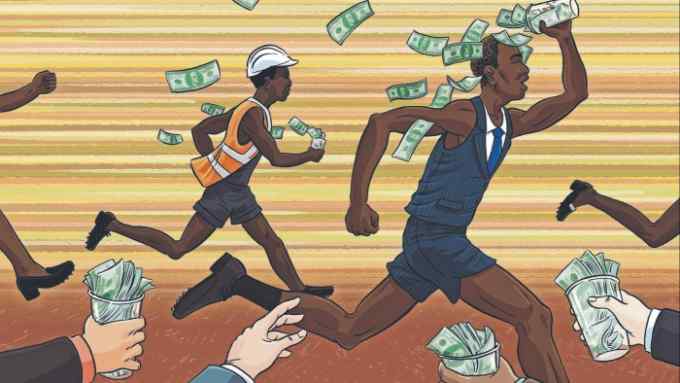

In the case of Altech, which ranks number four in the FT-Statista list of fastest-growing companies in Africa, the answer is to use a network of roughly 4,000 so-called “solar ambassadors”. They work on commission in communities across 23 of DRC’s 26 provinces, selling the product and collecting micro-repayments, sometimes daily.

“They are evangelists for our off-grid solutions,” says Iongwa Mashangao, a co-founder of Altech. “Ninety per cent of our people are living without access to electricity. This is impacting our development efforts in all aspects of life. We have this vision to eradicate energy poverty in the country.”

The story of how two exiles from the DRC brought up in a Tanzanian refugee camp hit upon the idea of bringing renewable energy to their homeland is the stuff of Hollywood movies. But the path that Mashangao and his partner, Washikala Malango, followed is, in fact, one that has been well trodden.

More than a decade ago, M-Kopa, a Kenyan company that now offers its services to countries including Uganda and Nigeria, helped pioneer the pay-as-you-go-model that has allowed off-grid solar to spread rapidly around the continent. By 2021, 53mn homes in Africa were using off-grid solar, according to the International Renewable Energy Agency. But that still leaves an estimated 600mn people without reliable power in a continent whose population is likely to double to 2.5bn by 2050.

Rossie Turman, international finance co-chair of the Africa Practice at Lowenstein Sandler, a US law firm, says that dozens of companies operating across the continent are fulfilling a similar need. “It’s viable because it is actually solving a need in homes in areas with no long-term hope that they’re actually going to get electrified,” he explains.

M-Kopa Holdings, number 50 on the FT-Statista list, was originally built on the back of the M-Pesa system of mobile money pioneered in Kenya. That allowed the company to charge customers micropayments and, using what it calls the internet of things, to deactivate equipment should customers fail to pay.

M-Kopa has extended the goods it offers to smartphones and, most recently, electric motorbikes. More important still, it has built a lending and insurance business on the back of the credit histories it is able to accrue from its customers. It describes itself as a fintech business.

“There are companies that have picked up on our initial innovation and do a lot of good business in what you might call pay-as-you-go solar financing,” says Jesse Moore, one of M-Kopa’s co-founders. “But we always believed that we were creating a set of rails for financing and have a broader set of life-enhancing assets.”

Altech — and Easy Solar, a Sierra Leone company that made the ranking’s top 50 at number 9 — are at earlier stages of development. That helps to explain their faster growth, says Turman, who notes that companies that have cracked the last-mile problem are likely to expand quickly.

Altech encourages customers to pay by mobile money services offered by telecoms companies Orange and Airtel, but its “solar ambassadors” also take cash payments. That inevitably complicates the business model and increases the overhead costs.

Life is made harder by the challenging geography of DRC, a country roughly the size of western Europe, much of it covered in primary forest, with more than 100mn people scattered in hard-to-get-to regions.

The two Congolese founders set up what became Altech (Alternative Lighting Technologies) after seeing simple solar kits in a market in Dar es Salaam a decade ago.

“We bought 50 pieces with our own savings and brought them back to Baraka,” says Mashangao, referring to the town in South Kivu on the shores of Lake Tanganyika where he is from.

In Baraka, there was a lot of work to do to persuade people that the kits were reliable and safer than the kerosene equivalent.

Originally, they distributed equipment to trusted members of the community — such as schools and medical dispensaries — and collected monthly repayments.

As volumes increased, they made several trips back to Tanzania, returning each time with bigger and bigger shipments. For the smallest units — which run a lightbulb and a mobile phone charger — customers put down a $3 deposit and pay $1 a day for 60 days. Altech offers a two-year service warranty.

Bigger units, capable of running four bulbs and an FM radio, can also be bought over longer periods. Altech’s biggest offering, paid for over 36 months, can run televisions, fans and other household appliances.

Mashangao says his company has sold 350,000 units and that it intends to increase this to 2mn by 2030.

To date, fund-raising has reached $18mn, from grants and impact funds. Further financing, including $13mn from South African investment bank Verdant Capital, still undergoing due diligence, is on the way, he adds.

These are small numbers for a vast country. They are, nonetheless, a start.

Comments