LDI: where’s the exposure?

Simply sign up to the Capital markets myFT Digest -- delivered directly to your inbox.

We’re all now experts on liability driven investment strategies, of course, so let’s cut to the chase. Where should we be looking for wreckage?

The search so far has been focused on UK life insurers with big asset management divisions, such as Legal & General. That’s in part because figuring out direct individual exposures to gilt-mageddon will have to wait for the next round of annual reports, unless problems are big enough to force pension fund trustees into an early announcement.

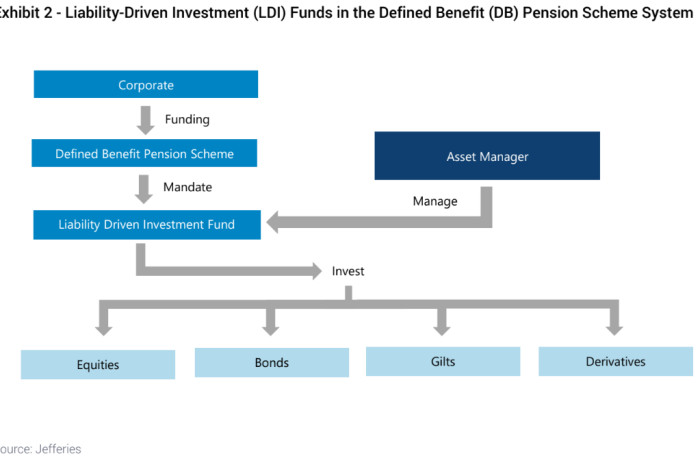

For the insurers, there’s a straightforward read-through via sharply higher bond yields on their collateral requirements for interest-rate derivatives. Jefferies illustrates:

Simple, right? Well, yes and no.

The first challenge is getting a handle on the scale of the problem. The Pension Protection Fund estimates that defined benefit pension assets account for about £1.56tn as of end August. Around three-quarters of that’s invested in bonds, according to industry analysts, so that’s £1.16tn. About half of that’s in UK linkers, with a quarter in conventional gilts and a quarter in corporate bonds. Big numbers.

But to reiterate for the umpteenth time, solvency isn’t the issue. For a well funded scheme with a gilt benchmark (which describes most of them), higher yields are good. Future liabilities are discounted at higher rates. Solvency ratios improve materially.

The issue is that the LDI strategies are (by design or accident) anti volatility, and even a well-funded scheme needs to meet its margin calls to survive. Here’s Morgan Stanley:

Pension schemes will be active in a combination of the following:

• Buying gilts on repo

• Buying gilts on TRS

• Receiving Sonia swaps

• Buying inflation swap

• Using gilts as collateral and buy other assets

The common denominator of all those activities is that they are long UK duration, long inflation risk and long leverage. The latter means implicitly that they are short volatility. And this is the main source of the problem.

This is the much-discussed doom loop, where a spike higher for yields triggers a cascade of margin calls. Older pensions schemes are the most vulnerable here, having relatively more of their assets in fixed income.

How all this carries through to the asset managers is not obvious, however. Talk to traders about the biggest LDI providers in the UK and the names mentioned most often are BlackRock, Legal & General Investment Management, Insight Investment (owned by Bank of New York Mellon) and Columbia Threadneedle Investments (which bought BMO’s asset management business in EMEA in 2021; BMO bought F&C Asset Management in 2014).

Here’s what L&G shares have done year-to-date:

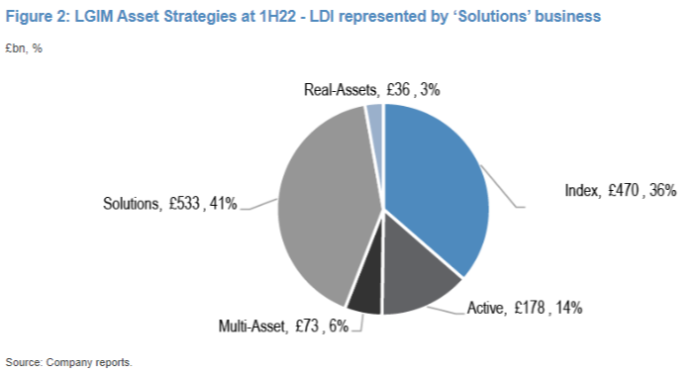

L&G’s been under the microscope because of the size of its LDI solutions business. At the 2018 LGIM Capital Markets Day, the company disclosed that in the previous year it had a 42 per cent market share in the UK. Its need to front up extra collateral in recent days would’ve been huge.

However, the cost of margin calls should be contained in third-party funds held within the asset management division, LGIM. There’s no direct impact to L&G’s capital position or balance sheet. The same ought to be true of peers, in theory.

So for the listed insurers it’s more about reputational risk and mood music, per Morgan Stanley:

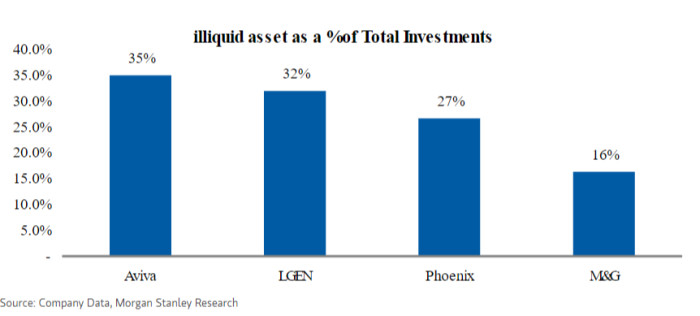

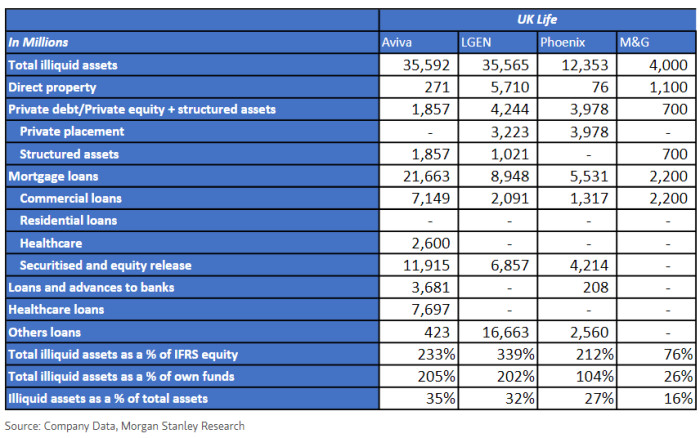

Asset risk at UK life insurers has risen mainly due to the strategy of growing bulk annuities under which insurers take large exposures to credit and illiquid asset risk to back annuities liabilities. It seems fair to say that the annuities liabilities are illiquid in nature as customers have no lapse option, so insurers can hold these assets to maturity without crystallising any losses as there is no specific rush to liquidate assets backing these liabilities. However, given there are no mark-to-market prices for illiquid assets and they are typically rated internally, we believe that the market will remain cautious, given recessionary risk at the moment.

And, specific to L&G’s pension risk transfer business, here’s JPMorgan:

This bring us to the question of whether these collateral risks pose any risk to L&G’s own on-balance sheet annuity and PRT liabilities. While L&G does use some hedging in these portfolios, it is not a large user of interest rate derivatives, since it matches PRT liabilities closely with its investment portfolio. A large part of this is provided by its illiquid, or ‘Direct Investment’ portfolio, where L&G has originated long-dated securities that are a good match for its PRT and annuity liabilities.

Where L&G does use derivatives in its PRT portfolio (eg to manage interest rate risk), it is able to post collateral using gilts, of which it is a large holder. It also benefits from a strong inflow of cash each year from its annuity and PRT premiums, which provide a strong regular source of cash.

Solvency II has strict requirements to manage and hold capital requirements against liquidity risk to prevent a 1-in-200 year negative liquidity scenario. To manage this risk, L&G places very close attention to its collateral and hold sufficient liquidity or collateral to meet these calls. These includes collateral for FX hedging, given that approximately half of its annuity portfolio is matched by ‘international’ assets outside of the UK.

Therefore, we do not believe the on-balance sheet pensions, annuity or PRT business of L&G faces any particularly liquidity crunch or capital issue — and it is not a forced seller of assets in these businesses. Importantly, higher bond yields are very positive for Solvency II capital suggesting a strong strengthening of balance sheets, and a better ability to withstand market dislocations. Higher bond yields are also supportive for the PRT market . . . Hence we do not view the sharp rise in bond yields as a risk for the annuity and PRT business, in contrast it further strengthens the outlook for this business.

(LGIM declined to comment.)

There is one big complication to all this, and it relates to regulation. The Financial Conduct Authority will presumably have picked up on the rising threat of credit defaults, and might have spotted that UK life insurers used the free money era to gorge on stuff that’s difficult to sell in a hurry.

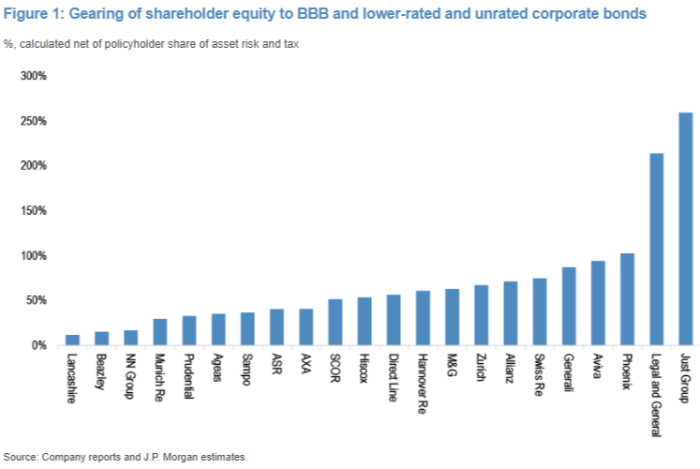

Some UK insurers also wallowing knee-deep in corporate junk, around which default risk has heightened.

So quite a lot now depends on whether the regulatory response to a barrage of LDI criticism is knee-jerk or considered — and older readers may now be suffering from a sense of déjà vu.

Comments