Do you pay too much for financial advice?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

You may still struggle to get a face-to-face appointment with your GP — but what about your financial adviser?

When we polled FT Money readers, more than two-fifths (41 per cent) were in favour of continuing the convenience of digital meet-ups, though 33 per cent preferred a hybrid model.

Judging by your many emails, those who had a good relationship with their adviser before the pandemic were those who felt the most connected when face-to-face advice became screen-to-screen.

FT Money reader John Foster says it all comes down to the personal touch. He was phoned directly by his adviser as soon as the pandemic hit, and continues to feel reassured and well-informed about his financial position.

“I am by no means their largest client, but I am certainly made to feel that I am,” he says. “Would I recommend them? Unequivocally, yes.”

However, those who felt neglected pre-pandemic tended to feel even more distanced from their advisers and unsatisfied with the service.

One reader wrote to say he and his wife had received “lots of emails, but just one Zoom call and some brief phone calls” from their wealth manager, who they feel is dodging their questions about the poor performance of their investments.

Six of the seven funds in the couple’s portfolios are in the bottom quartile of Trustnet’s one-year fund performance index — and one of these is the wealth manager’s own fund.

“Apparently unnoticed by him, this is a measure of the degree of interest our adviser has in our affairs,” he writes. “I am consequently wondering whether I will be wasting my time formally complaining.”

Certainly, the availability of free introductory digital meetings has made it easier than ever for clients who are unhappy to shop around.

Charlotte Ransom, founder of tech-enhanced wealth manager Netwealth, says she has inherited plenty of unsatisfied clients during the pandemic.

“Lockdowns have been a trigger for families to examine their finances, the performance and the service they’ve been getting and the fees they’ve been paying,” she says.

Often, customers migrating from more costly discretionary services have been persuaded to set up offshore bonds as a tax planning tool without the wealth to justify it.

“Apart from that, the financial advice they’ve received from their wealth managers has generally been pretty good,” Ransom says. “The problem is, they’re paying far too much for it and are usually on the hook for annual advice fees even if it’s not something they need every year.”

The advent of more digital services has led clients to expect this will reduce costs. In our poll of FT Money readers, 41 per cent said they expected the cost of purely digital advice to be lower, and 29 per cent expected it to be substantially lower.

And when FT Adviser polled its professional readership, nearly half agreed that they would be able to cut costs (in time) by reducing office space. However, around the same number feared investing in IT would prove the biggest barrier to providing better digital services.

I caution that these were fairly small sample sizes of a few hundred people, but it’s a real talking point.

Just look at the success of low-cost advice providers who have emerged on the scene during lockdown, notably Vanguard, although these are not suitable for those with more complex affairs.

When it comes to more “traditional” forms of financial advice, firms tell me they see the benefits of having a more blended model.

Colin Lawson, founder of Equilibrium Financial Planning, says his clients are happy evolving to a “phygital” relationship with Zoom for admin catch ups, and face-to-face for anything complex or critical like inheritance tax or intergenerational planning.

“We found people were not able to converse in the same way online, putting back plans and decisions until they could meet with their adviser in person, potentially increasing their tax liability,” he says.

However, one thing that seriously impedes the digitalisation of our financial lives is the poor progress the big pensions providers and life companies are making in this area.

Anne McClean, a partner and financial planner at Smith & Williamson, says the need for “wet signatures” on physical documents is still causing huge delays even as the economy reopens. “The worst example I’ve had is waiting over 100 days for an in specie transfer to go through,” she says.

Working from home has made sending documentation through the post a challenge. Plenty of advisers tell me they’ve wasted hours trying to get through by phone, and by email. “If someone ever picks up the phone, they say ‘send us an email’ and then your email goes unanswered!” one complains. As clients of advisers, we are the ones paying for this digital ineptitude.

The big providers, who conveniently have a rather indirect relationship with the people whose money they manage, seriously need to pull their socks up. The speed of innovation surrounding video wills shows what should be possible in this space — and the future of financial advice will remain decidedly analogue until they get into the 21st century.

Jokes from financial folks

Having a good sense of humour might not be a quality that would come top of your list when choosing a financial adviser, but our recent Twitter competition showed there are certainly some wags in the profession.

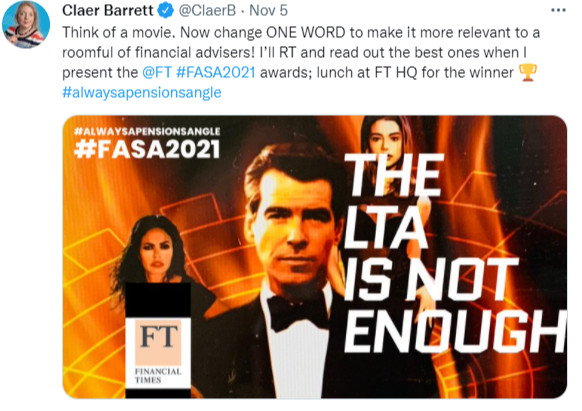

The annual awards ceremony organised by our sister publication, FT Adviser, is usually a lavish in-person dinner. This year, to liven up the Zoom presentation, I challenged my followers to replace one word of a film title to make it more suitable for an audience of financial advisers (follow me on Twitter or look up the hashtag #alwaysapensionsangle if you want to read them all).

My own starter for 10 was “The LTA is not enough” (the limits of the pensions lifetime allowance are a dramatic topic for our readers and their advisers).

Of the 150 entries we received, I was particularly tickled by “One flew over the cuckoo’s nest egg” (thanks to leasehold specialist Graham Pack), “Good Will Drafting” (hat tip to Craig Rickman from the Lang Cat consultancy) and “Four Weddings and a Funeral Plan” from Anne McClean.

Unsurprisingly, the cost of advice was a popular theme. Paul Lewis of BBC Moneybox offered “Licence to Bill”, financial planner David Hearne came up with “Crouching Tiger, Hidden Charges”, and the FT’s Naomi Rovnick suggested “Despicable Fees”.

Other entries from FT journalists including “Saving Private Pensions” from our very own Josephine Cumbo (she got a lot of ‘likes’) and “Triple Lock, Stock and Two Smoking Barrels” from FT Adviser’s Amy Austin.

As pension promises go up in smoke, financial planner Dan Gaylor suggested “Enemy of the State Pension”. I can think of a few ministers who deserve a cameo role in that one.

Former pensions minister Sir Steve Webb came up with “Love Actuary”, and even the Pension Protection Fund joined in, offering “It’s a Wonderful Lifeboat”. I was very impressed by “Accrual Intentions” from financial planner Charlene Young.

However, financial planner Steve Buttercase was crowned the winner with his entry “Commission Impossible”. Mashing up a Tom Cruise action thriller with the ramifications of the Retail Distribution Review would make a compelling movie for financial advice professionals — and Steve’s prize is coming in for a canteen lunch with FT pensions writers at Bracken House.

Claer Barrett is the FT’s consumer editor: claer.barrett@ft.com; Twitter @Claerb; Instagram @Claerb

Comments