Battle intensifies to unlock value in the ‘internet of things’

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Only a few years ago the term “internet of things” (IoT) meant little to consumers. To most, the concept of a “smart” device meant almost exclusively the smartphone. Now, as people demand connectivity from other devices, companies are competing to bolster their brands by innovating with IoT.

Growth in the sector has been rapid. Ericsson, the Swedish telecoms equipment maker, estimates 1bn cellular IoT connections already exist globally, which it expects to rise to 4.1bn by the end of 2024. Included in this figure are smart consumer devices but also billions more sensors for industrial applications such as remote monitoring of equipment and factory automation.

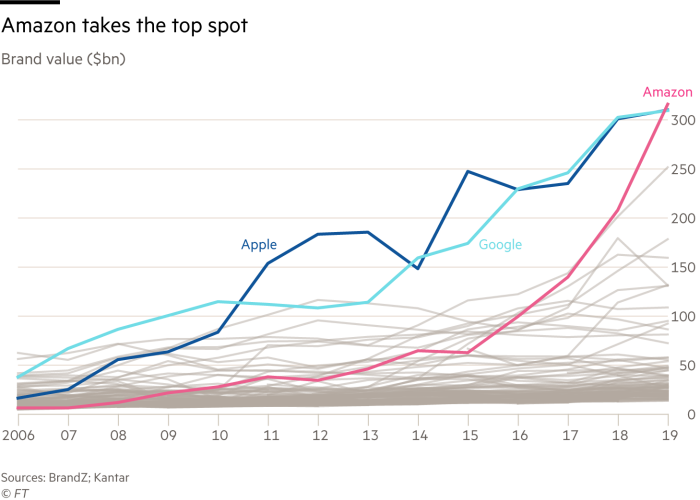

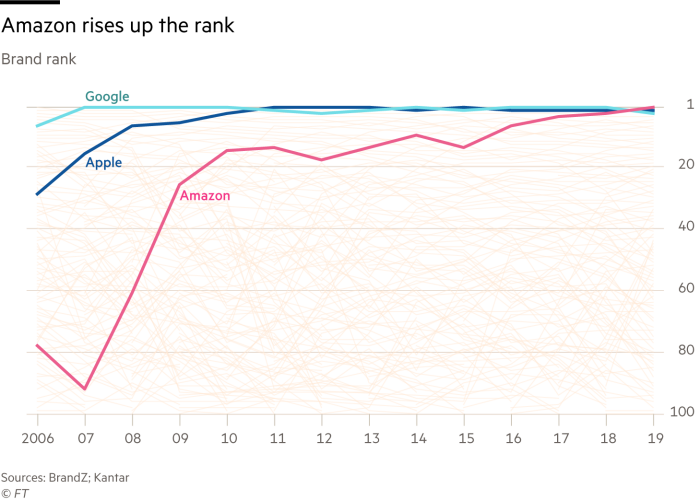

The consumer take-up of IoT has already had a profound impact on the brand value of the world’s largest companies. Amazon was the most valuable brand in the world, according to this year’s Global Brands survey, after a 52 per cent jump from the previous year.

The company has long outgrown its roots as an online bookseller, with an enormous brand value being driven by a variety of factors, including a push into video streaming with Amazon Prime, groceries after acquiring Whole Foods, and announcing plans to launch satellites. One of Amazon’s most pervasive products over the past year, however, has been the Echo range of smart speakers and its Ring connected doorbell, some of the most high-profile IoT products on the market.

Other brands that have a foot in the door of the smart home include technology companies Microsoft, Google and Xiaomi, and appliance maker Haier, which have also risen in the ranking.

Paul Lee, head of telecoms research at consultancy Deloitte, says while IoT was once a technology niche, it has grown into an essential part of the branding landscape. “The IoT-enabled badge is no longer just for tech and telecoms brands,” he says. “Connectivity enhances a whole range of devices and IoT is increasingly vital to the brand strategies for companies across all sectors.”

Josh Krichefski, chief executive of media agency MediaCom UK, says the smart speaker has been the driver for Amazon and the wider IoT market that was long scoffed at for solving problems that did not exist with products such as the connected fridge. He predicts the rise of one particular product will prompt other companies to react.

“The success of the smart speaker took everyone by surprise — it became big for Amazon surprisingly quickly and now there is a battle for supremacy in the home,” he says. “Inspired by this, everyone is trying to grab a chunk of it, and work out what works and what doesn’t.”

Mr Lee says consumer expectations and excitement around new technology have driven more companies toward IoT as some of the lustre of innovation has faded in the smartphone market.

“Consumers will no longer just accept a capsule-based coffee-maker. They want their device to be IoT-enabled so that it can replenish itself when it knows you are running low on your 12-strength espresso,” he says. “Your oven [should] not merely heat up food, but should also have a connected camera to enable chefs to see their meat roasting on their phones from the comfort of a pub. Heated car seats are no use if you can’t set them to warm before you get in the car.”

Traditional connectivity companies are also keen to get into the IoT sector to boost their flagging brand values. Nick Read, chief executive of telecoms group Vodafone, imagines a world where a customer would not just subscribe to traditional communications services like mobile, TV and broadband today, but would also have “25 IoT devices” on the account as well. Those would range from connections to smart meters to pet trackers provided by the company.

Vodafone’s brand value fell 8 per cent this year as it dropped 12 places in the ranking but IoT, alongside 5G, could be the ticket to a reversal of that trend. The UK company has grouped its IoT products under the brand “V by Vodafone” as part of the push.

Stefano Parisse, Vodafone’s group director of products and services, says IoT is now a core part of the company’s brand strategy. “It is very significant for us,” he says of the push into pet trackers, drone management and other smart services. Mr Parisse says IoT has grown to become more important for consumers. “It has gone from mystical magical jargon to something tangible,” he says. That reflects the focus more on what the customer needs, he argues, highlighting security as an area where Vodafone can increase its market share.

“A customer may say, ‘I have a car, I have a pet, I have a child, I have a precious bag, but how can I protect it?’,” says Mr Parisse.

As a mobile network provider, Vodafone has the potential to expand its product range beyond smart home devices in ways that hardware-based businesses cannot. “There is no difference, inside or out. This is a product for a family, not for a home. What we sell is peace of mind,” says Mr Parisse.

Merely adopting the IoT moniker as a point of differentiation, however, is not enough to boost brand value — the technology has to have a clear purpose and the company must be adequately positioned to fulfil that purpose.

Gabriela Styf Sjöman, head of networks at Telia, says the Swedish telecoms operator has targeted IoT as it heads into the 5G era with a dedicated unit called Division X. However, she warns that companies need to define clearly where they sit in the IoT value chain. “IoT is a very broad term,” she says. “It is not that simple to say ‘I want to be an IoT provider’ — do you really want to be the integrator? Or the connectivity provider? The value varies massively.”

Some telecoms companies see their role as just to provide the network for IoT, but others, like Vodafone and Telia, expect to play a broader role where they lead a contract, taking responsibility for hardware as well as the connections, to create value. Vodafone, for example, is not only selling pet trackers but also hopes to enter the air traffic control market for drones as part of its push beyond traditional telecom services.

The internet of things has provided a huge boost for brands that have tapped into the growing consumer trend but there are risks in the association with the technology. Mr Krichefski says many devices grouped under the banner of “smart” represent the next stage in “the rise of surveillance capitalism”.

He says data produced by devices, such as Google’s Nest smart thermometer, monitor the behaviour of consumers and are fed back via artificial intelligence to sell predictive models and advertising. This, he adds, could lead to consumer cynicism and erode brand value over time.

“If you read the terms and conditions, you are given before you are allowed to use it, you will end up going through the Ts&Cs of over a thousand connected companies Nest sells the data to,” he says.

Comments