China and Big Tech: Xi’s blueprint for a digital dictatorship

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This is the second in a two-part series on Xi Jinping’s assertion of greater control in China. The first part is here.

When Elon Musk insisted in March that Tesla cars were not being used to spy on China, it was reported as a one-off interaction between the head of the world’s most valuable car company and the custodians of its fastest-growing market.

“If Tesla used cars to spy in China or anywhere, we will get shut down,” Musk told a high-level conference in China via video link. Responding to the Chinese government’s ban on Tesla cars from entering military compounds, Musk insisted that the data collected by sensors fitted to Teslas was always handled confidentially.

Now, however, Tesla’s travails stand as the early sounding of a geopolitical sea change. In recent weeks, Beijing has pushed through reams of regulations and policies designed to shore up China’s data security, reinforcing the control it exercises over huge volumes of data used in governing the country, boosting the economy and ordering people’s lives.

Such moves comprise a crucial part of the vision of Xi Jinping, China’s leader, to build what some analysts call a “techno-authoritarian superpower” in which people are monitored and directed to an unprecedented degree through the agency of government-controlled cyber networks, surveillance systems and algorithms.

“With better control over data, we cannot only build a more productive economy, but also a more efficient government that makes decisions based on hard science rather than intuition,” said He Aoxuan, a researcher at Beihang University, a leading technological university in Beijing.

“The embrace of digital sovereignty plays a key role in protecting our national interest against enemy forces at home and abroad.”

Xi’s data vision has always stressed control. In 2013, he said that “whoever controls data has the upper hand”. A year later he said that control of information has become an important aspect of a country’s “soft power and competitiveness”. The official classification of data in 2020 as a “fifth factor of production”, alongside labour, land, capital and technology, further revealed its importance to Beijing.

Personal data is collected not only through online interactions but also through a whole panoply of technologies designed to order a society of 1.4bn people. Digital social security cards, digital money, smart cities, surveillance cameras, social credit systems and other technologies are being rolled out across the country, creating a grand experiment for 21st century authoritarian governance.

All this forms a contrast with the Maoist echoes in Xi’s current political rhetoric. The strongman leader exhorts the country to prize “common prosperity”, while a prominent leftist commentator has been lauded for denouncing “big capitalists” and the entertainment industry’s “sissy-boy stars”. But when it comes to data and technology, Xi appears to be unveiling the blueprint for a modern, high-tech dictatorship.

Beijing aims to have it both ways. It believes that technologies will shore up social control and suppress political dissent without damping the entrepreneurial vigour or the innovation that animate the world’s fastest-growing large economy.

“Fostering innovation is still a top-line priority for Beijing,” says Kendra Schaefer, head of tech policy research at Trivium China, a consultancy in Beijing.

“It has no intention of pouring water on the flames of innovation,” she adds. “Rather, Beijing sees these rules (on data) as a trellis that guides development direction and determines the final shape of China’s digital economy.”

Hit on corporates

In order to bend such troves of data to its will, Beijing has adopted a multipronged strategy. It is publishing laws to govern data’s use. It is increasing the state’s access to the data of private companies and collecting vast data inventories itself.

The main purpose behind such efforts is captured by last month’s release of draft regulations on algorithms — or mathematical instructions that govern much online behaviour. These should, the draft law says, “orient towards mainstream values” and “actively transmit positive energy”. In other words, they should support — and certainly not oppose — the messaging of the Chinese Communist party.

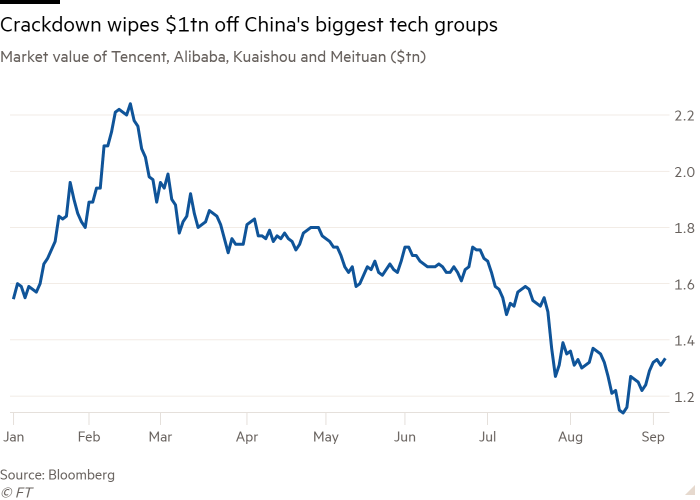

But some are feeling the chill. The hardening of China’s legal regime around data usage is causing severe disruptions for multinationals operating in China, large Chinese corporations and the financial markets.

One law, the Personal Information Protection Law, which is due to take effect in November, stipulates that data being moved out of China must either pass a security assessment by the Cyberspace Administration of China, a government regulator, or obtain other forms of official approval.

Another law which came into effect this month, the Data Security Law, requires the protection of “important data” and “core data”, the latter of which is defined as information involving national and economic security, people’s welfare or important public interest. The definitions are so broad, they could cover almost anything related to private data, experts say.

“The laws mean or will mean that all data generated in China must stay in China, unless you have explicit permission to send some of it overseas on a case-by-case basis,” says a senior executive at a large Chinese tech conglomerate. “China is becoming a data empire unto itself.”

This leaves multinationals operating in China with little choice but to establish data centres to keep all their customer data. In practice, this means that if law enforcement agencies wish to check consumer data collected by a multinational in China, they will be able to do so at any time they choose, Chinese officials and executives told the FT.

Tesla, for example, was quick to see that setting up a data centre was a route to greater harmony with Chinese authorities. It did so in Shanghai in May, a couple of months after Musk offered assurance that his company’s cars were not spying on their Chinese customers. “All data generated from cars sold in mainland China will be stored within China,” the company said in a post in May on Weibo, a Chinese social media platform.

Apple is another revealing case. In response to Beijing’s stiffening data controls, Apple set up a data storage centre in the southern province of Guizhou in 2017. The following year it announced that its iCloud service in China would be managed by the state-owned data management company Guizhou-Cloud Big Data Industry Co.

Apple said in a statement that “we control the encryption keys for our users’ data” in its China data centres. However, the company also complies with Chinese law enforcement requests to hand over customer data to authorities, it added.

The foreign company held up most often by Chinese officials as a “model” of how multinationals should behave is Microsoft. The US tech giant already has four data centres in mainland China, all operated by local partner 21Vianet, and a fifth is due to go live next year, it said.

Asked if data from its platforms — such as the professional networking platform LinkedIn — can be accessed in unencrypted form by Chinese authorities, Microsoft added: “Microsoft commits to follow all laws and regulations applicable to its provision of online services.”

Listing tensions

The new data regime is tearing apart a US-China capital markets relationship under which 248 Chinese companies with a total market capitalisation of $2.1tn had listed on US exchanges as of May this year. The future for mainland Chinese company listings in Hong Kong is also clouded by the new data regulations.

The current focus of attention is Didi Chuxing, a Chinese ride-hailing company, which pushed ahead with plans for a $4.4bn share listing in New York before the Cyberspace Administration of China had completed all of its data security clearances, officials said.

In response, the CAC opened a national security review into the company and kicked Didi’s app off China’s online stores. The seriousness of the probe is signalled by the fact that it involves multiple agencies, including China’s natural resources and transport ministries, its espionage agency, the tax administration, the police and the CAC.

In New York, lawyers have filed a class-action lawsuit on behalf of Didi’s investors alleging they were misled by the company and its executives over its previous dealings with Chinese regulators. Questions over whether Didi accurately disclosed the pressure it faced from the CAC have also led to scrutiny of the banks that underwrote its listing, which included Goldman Sachs and Morgan Stanley. Didi did not respond to requests for comment.

Sheng Ronghua, vice-minister at the CAC, has said Beijing’s new rules on critical data disclosures by mainland companies that list on stock markets are the same no matter where they seek to go public, making it unlikely that Hong Kong’s exchange will enjoy more lenient treatment than that governing New York listings.

“The rules are published to protect the safety of critical information infrastructure and all companies, no matter what kind they are or where they are listed, must comply with the country’s laws and regulations,” he said.

Nevertheless, it is clear that Chinese regulators make a basic distinction between offering shares in the mainland and listing offshore in Hong Kong or overseas in New York. The CAC has proposed, for instance, that companies with more than 1m users should undergo security reviews before listing overseas.

Regulators are also considering rules that would require data-rich companies to hand over management of their data to third-party firms if they seek to stage a share offering in the US, officials told the Financial Times.

Techno-authoritarian state

One persistent frailty of authoritarian systems in history has been an information logjam between grassroots society and the ruling elite. The former Soviet Union foundered as much because of petty corruption and endemic shortages of basic goods as because of its expensive cold war rivalry with the US.

But China’s leaders believe they have found a way to avoid such threats to their hold on power as a result of the trove of data they now control.

Dimitar Gueorguiev, associate professor at Syracuse University, says the digital technologies deployed by Beijing have helped it keep tabs on popular sentiment and needs.

“I argue that the CCP has overcome the information acquisition problem, thanks in large part to the digital ecosystems it has established,” says Gueorguiev, author of a new book on the topic, Retrofitting Leninism.

“As a result, today’s China is more perceptive of public opinion, less prone to policy blunders and better equipped to manage its own bloated bureaucracy.”

Several countries — both democratic and authoritarian — have started using digital systems to assist in governance and to provide services. But the scale and intrusiveness of China’s deployment are on a whole different level.

“It’s been called digital Leninism or techno-authoritarianism,” says Andrew Gilholm, a director at Control Risks, a risk consultancy. “The concept certainly has that huge element of political control to it but it is not solely focused on that. The vision is also about governing more effectively using various technologies to overcome perennial governance problems.

“And it’s not only about the big brother stuff,” he adds. “The appeal for Beijing is you use e-governance instead of electoral accountability to rein in local corruption. You can use data instead of privatisation to boost competition.”

Understanding the way that China’s digital ecosystems work reveals both the programme’s ultimate aims and the shortcomings of this grand “techno-authoritarian” experiment.

Some technologies form basic building blocks. The installation of an estimated 415m surveillance cameras all over the country — with densities of over 8,000 cameras per square mile in cities such as the southern manufacturing hub of Shenzhen — makes China’s population by far the world’s most surveilled.

But the use of facial recognition technologies to identify individuals as they walk down the street does not appear to be popular; nearly 90 per cent of anonymous respondents to a survey in Beijing said they were opposed to the use of facial recognition technology in commercial areas.

Nevertheless, surveillance cameras enable another technology in which China’s deployment also leads the world: smart cities. In 2020, the country was estimated to have some 800 smart cities under construction or in planning — about half of the world’s total. The concept behind a smart city is to use networked technologies to control traffic, allocate energy usage and dispense other services as well as to fight crime.

The provision of services is also the purpose behind China’s digital social security cards, with which more than 300m people can access or apply for unemployment benefits, prescription drugs, public transportation and other services through mobile phone apps.

But in terms of their capacity for social control, such technologies pale next to the digital renminbi, which has been undergoing tests in several cities this year and may be ready for a formal launch after next year’s Winter Olympics, which are scheduled to be held in Beijing.

The currency is designed so that all transactions are traceable in real time, providing a state surveillance capability that does not exist with the current mixture of cash and digital payments operated by private platforms such as WeChat Pay and Alipay.

Mu Changchun of the Digital Currency Research Institute, an official body, has said a system of “controllable anonymity” will be rolled out, meaning that only transactions which authorities request to see will be visible. Nevertheless, this will allow Beijing to trace potential criminals, crack down on money laundering and combat official corruption.

“The digital renminbi is likely to be a boon for CCP surveillance in the economy and for government interference in the lives of Chinese citizens,” wrote Yaya Fanusie and Emily Jin in a recent report for the Centre for a New American Security, a Washington-based think-tank.

Other elements of the system, however, remain imperfect. A social credit system that blacklists defaulters and aims to prevent them from making subsequent purchases of high-end items operates only imperfectly.

The problem is that many of the high-end hotels, train stations, airlines and other service providers have not signed up, meaning that some defaulters are able to skip detection and continue on their spending sprees.

Ultimately, Xi’s new model still remains untested. It has yet to be proven that collecting large volumes of data will give the Chinese regime useful intelligence or help it to correct policies when needed. And some experts see a more sinister design.

“I think the solution that [Xi Jinping] has settled on is Orwell,” said Scott Kennedy, a China expert at Washington-based think-tank CSIS, referencing George Orwell, author of 1984, the dystopian novel in which the omnipresent eyes of the party and its ruler, Big Brother, use information superiority to keep subjects in check.

Speaking on a recent podcast on Chinese politics, Kennedy added: “That is artificial intelligence and data . . . You make sure you have asymmetrically more information than everyone else.”

Comments