Activist investors start asking for more in board battles

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Nelson Peltz launched a proxy fight against Procter & Gamble in 2017 to seek a board seat for himself, his mistake was only asking for one seat, a competitor said privately.

If he had sought two, a settlement with the company would have been straightforward — he would probably have been offered one.

Instead, the costly fight went to a close vote, and after months of recounts, the company was eventually declared victorious by a hair. After all that, Mr Peltz was offered a board seat by P&G anyway.

Whether it would have been an easier settlement had he demanded more than one seat is up for debate. But the comment by the competitor activist investor, who declined to be named — ask for twice what you really want and hope for a settlement — is becoming an increasingly used tactic.

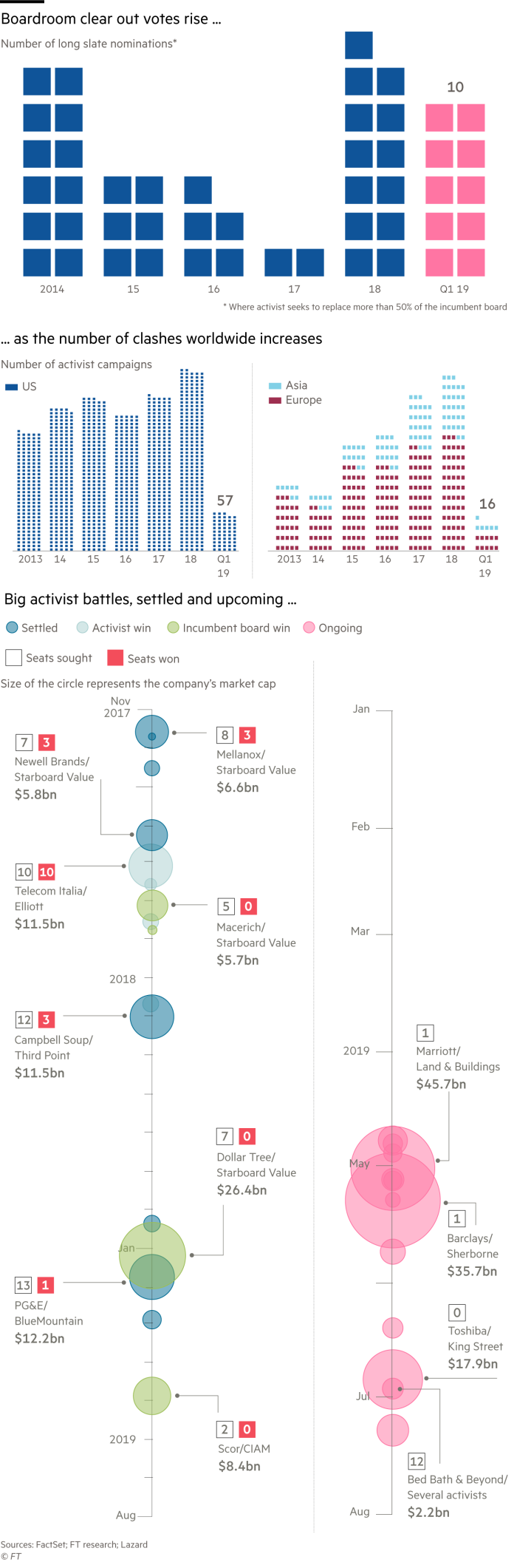

In the first quarter, there were 10 instances where shareholder activists nominated long slates — at least half of an incumbent board — compared to seven in the same period last year. There were 13 long slates sought in all of last year, and only two in 2017, according to data compiled by Lazard.

The majority of proxy fights are settled, rather than going to a vote, so the more directors who are nominated, the better the chance of being granted several seats as part of a prospective peace offering.

Part of the surge is because of Jeff Smith’s Starboard Value. After successfully ousting the entire board of directors of Darden Restaurants in 2014, Mr Smith has made it a point to put up a greater number of nominees for election.

Seeking board seats is not a tactic used by all activist investors, who build up stakes in companies and try to effect change. Last year, the most common requests in activist campaigns were related to mergers and acquisitions, whether to force a sale of a company or unit, break up a company, or to improve terms of live deals, according to Lazard.

But activists still won the largest number of board seats at public companies ever last year.

In the first quarter, three of the campaigns seeking long slates were led by Starboard. The others were smaller or first-time hedge fund activists.

In the activist fight at the US retailer Bed Bath & Beyond, three smaller funds — Ancora Advisors, Legion Partners and Macellum Capital — joined together to seek to oust the company’s entire board.

BlueMountain Capital, a credit-focused hedge fund that rarely takes activist stances, was also seeking a full-board overhaul at Pacific Gas & Electric, which ignored the fund’s pleas to avoid filing for bankruptcy in the face of mounting litigation liabilities stemming from California wildfires. That campaign settled earlier this week with an agreement to expand the board.

Comments