Measuring what matters: the scramble to set standards for sustainable business

Simply sign up to the ESG investing myFT Digest -- delivered directly to your inbox.

In a 2018 speech about the future of corporate reporting, Erkki Liikanen, a former Bank of Finland governor, recalled Europe’s debates over adopting the International Financial Reporting Standards almost two decades earlier. “It was becoming increasingly clear that different accounting requirements of differing quality were adding cost, complexity and risk to companies and investors,” he told delegates at a European Commission conference.

Liikanen, who chairs the trustees of the IFRS Foundation overseeing international accounting standards, could just as easily have been describing what has become known as the “alphabet soup” of acronym-heavy measurement and reporting standards surrounding ESG (environmental, social and governance) approaches to business and investment.

Yet, after years of complaining about the proliferation of competing metrics, companies and investors are beginning to hope that more consistency in measurement and disclosure is in sight. “This is emerging as we speak,” says Kirsty Jenkinson, head of sustainable investment and stewardship strategies at Calstrs, the Californian teachers’ pension fund. “It feels like there’s a better direction of travel, but it will be interesting to see how this next phase is going to play out.”

Quick Read

• Two decades after financial reporting went through a seismic shift with the agreement of international accounting standards, a similar effort is under way to agree global standards for measuring sustainability.

• Companies and investors frustrated with the “alphabet soup” of rival ESG measurement initiatives are pressing for simplification.

• Questions remain over how the proposed framework will fit with others, how many countries will adopt it and whether one standard can apply to all industries.

• Current ESG rankings vary so widely in their methodology that companies have been able to “cherry pick” the most flattering providers.

• The new focus is on “double materiality”, or what matters most to companies’ financial performance, as well as to society and the environment.

• The pandemic has added urgency and a sense of optimism to the search for common standards, with a new mood of collaboration among the largest standard setters and support from leading policymakers.

That phase is unfolding rapidly. Last September, five leading independent standard setters announced that they would work together towards a comprehensive corporate ESG reporting system. Earlier this year, rules came into effect in Europe to make financial firms and investors disclose “double materiality”, which covers the risk that their operations pose to society and the environment as well as to their profitability.

And while it will add another acronym to the mix, all eyes are on the IFRS Foundation, which is on track to launch a global Sustainability Standards Board at the UN’s COP26 climate summit in November with the backing of the International Organization of Securities Commissions (Iosco), the umbrella group for global markets watchdogs.

“What you have is a massive acceleration in a very short period of time — pretty much 12 months of a real willingness and ambition to sort all these problems out,” says Ashley Alder, the chair of Iosco and chief executive of the Hong Kong Securities and Futures Commission.

Even so, the idea of standardised ESG reporting remains highly contested. Companies argue that the unique nature of their operations will make comparisons difficult — just as they did at the launch of the IFRS and the generally accepted accounting principles, or GAAP. “Nobody is ever happy with a standard. It’s a giant compromise,” says Bob Eccles, a professor at Oxford university’s Saïd Business School and an expert on sustainability. “What you have with accounting is a social construct and an agreed-upon definition of reality that we all start from — that’s where we’re at with ESG.”

Some crucial questions still have to be settled. Can sustainability measurement and reporting standards serve not only companies and investors but also people and the planet? Can a framework for reporting on climate change — the SSB’s first priority — be applied to complex social issues while enabling comparisons across different sectors and jurisdictions? Can a global standard operate alongside the many existing ratings systems? And how many national governments will adopt it?

Yet the fact that these questions are being raised at all is a sign of progress. And as chief executives and investors set increasingly ambitious social and environmental goals, measuring what matters is something they can no longer afford to ignore.

“Sustainability disclosure is now at the top of the agenda for the world’s largest investors, the world’s largest companies and regulators in almost every major market,” says Janine Guillot, chief executive of the Sustainability Accounting Standards Board (SASB). “That’s a sea change from where this conversation was even five years ago.”

How did we get here?

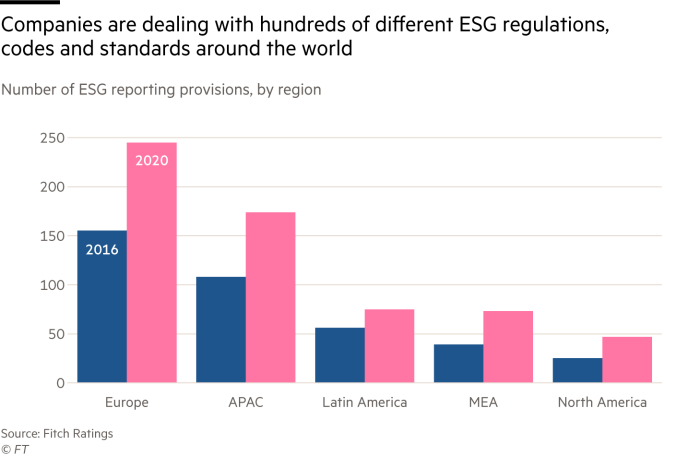

These days, some like to joke that if you want a better ESG rating all you need to do is change your rating provider. There is plenty of choice: supplying the picks and shovels of the ESG gold rush has become a lucrative business for organisations from financial advisers to sustainability consultancies and rating agencies. By 2018, more than 600 ESG ratings and rankings existed globally, according to consultancy SustainAbility.

The problem is that assessments of corporate ESG performance can vary considerably depending on the choice of ratings provider. When we asked FT Moral Money readers what their organisations struggled with most when trying to measure social and environmental impact, responses included worries that current methodologies allow companies to “cherry pick how they’re assessed” or even to “game” ESG rankings.

Researchers Feifei Li and Ari Polychronopoulos, who work for Research Affiliates, a Californian investment manager, reached a similar conclusion after looking at how two rating providers assessed Wells Fargo, the financial services group.

They found that scoring variations for social and governance ratings led to the first provider giving the bank a much better overall result than the second. In fact, the two providers gave different assessments for every single ESG dimension except the company’s environmental score.

While demand for ESG ratings products is high — SustainAbility found that 65 per cent of investors survey ESG ratings at least weekly — the same cannot always be said for their quality. “We’ve been amazed at how different the data sets are on something like GHGs [greenhouse gas emissions] and the messiness and lack of consistency across those data sets,” one executive told the consultancy.

Some investors have decided to create their own evaluation and ratings systems. For example, State Street Global Advisors has its R-Factor scoring system, while TPG and the Rise Fund developed a system called the Impact Multiple of Money, which they eventually spun off as Y Analytics.

For those without the resources to develop an in-house ratings system, the current measurement and reporting landscape can be frustrating and confusing. In fact, more than three-quarters of respondents to our FT Moral Money questionnaire thought there were too many different measurement standards.

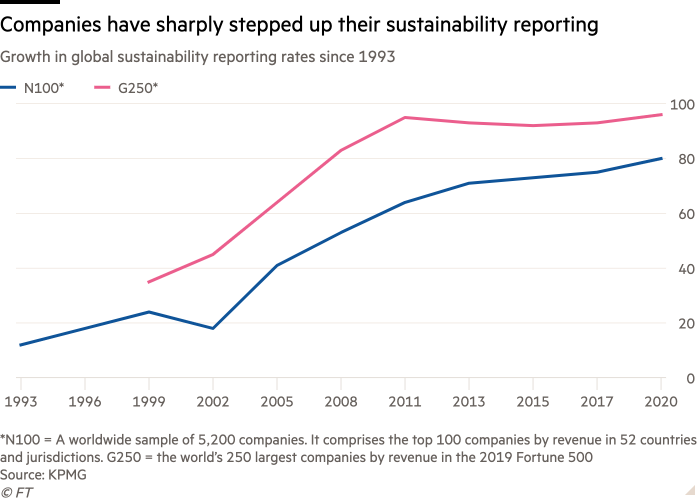

The journey towards more rigorous ESG measurement and disclosure began in the late 1990s. In 1997, the Global Reporting Initiative (GRI) launched as a non-profit organisation offering sustainability-focused reporting guidance. At the time, when a PR-heavy “corporate social responsibility” report was the principal corporate vehicle for disclosing sustainability information, few imagined how many frameworks, ratings systems and standard setting organisations would emerge from the sensible desire to find a more rigorous way of measuring companies’ social and environmental impact.

GRI has since become part of a “big five” group of global standard setters along with CDP (formerly the Carbon Disclosure Project), the Climate Disclosure Standards Board (CDSB), the International Integrated Reporting Council (IIRC) and SASB.

Rather than develop standards, the Task Force on Climate-related Financial Disclosures (TCFD) has meanwhile provided a framework on which others can build. Created by the Financial Stability Board, the rulemaking body set up after the financial crisis, its focus is climate change.

But Mary Schapiro, head of the TCFD secretariat and former chair of the US Securities and Exchange Commission, argues that its work could be applied more broadly. “When we created the TCFD framework, we based it on a foundation that would be familiar to companies that have to report on these kinds of risks,” she says. “So we have four pillars of disclosure: governance, strategy, risk management and targets and metrics. And those four pillars work for any ESG issue.”

So far, more than 2,000 organisations have expressed their support for the TCFD’s recommendations, including companies with a collective market capitalisation of almost $20tn and financial institutions responsible for $175tn worth of assets.

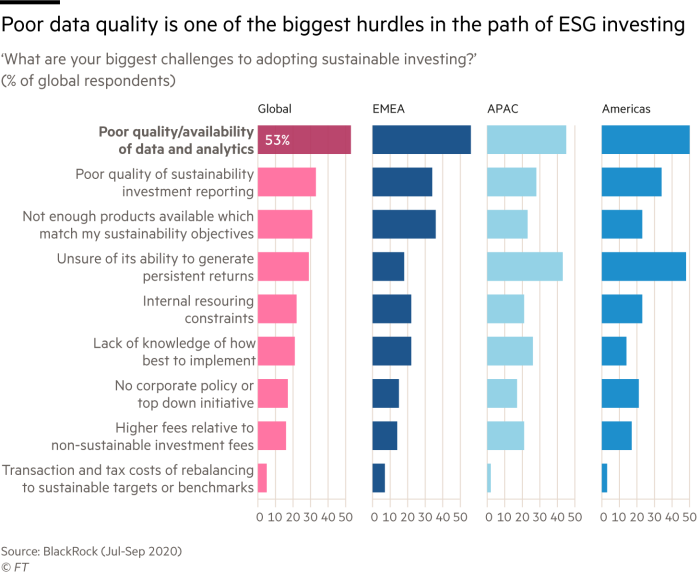

Nevertheless, companies and investors can be forgiven for still feeling confused. “There has been a lot of noise in the system,” says Alder of Iosco, “which is not surprising given that the demand from investors is high while the ability of issuers — asset managers and others — to provide the information is genuinely technically difficult.”

The R-Factor pulls together best-in-class data sources

When State Street Global Advisors surveyed the ESG measurement and reporting landscape three years ago, its dominant impression was one of confusion. “There were a number of different scoring methodologies for ESG but they had wildly different approaches and that led to wildly different results,” says Lori Heinel, SSGA’s global chief investment officer.

As a result, the company decided to develop its own scoring system, the R-Factor — R stands for responsibility. It also recognised that, given the work others had done in this field, starting from scratch made no sense. “Rather than reinvent the wheel, we decided to take best-in-class data sources and bring them together,” says Heinel.

Launched in 2019, the R-Factor draws on data from four leading providers and uses SASB’s materiality framework to generate ESG scores for more than 6,000 listed companies globally. “An R-Factor score is intended to be a compilation of best-in-class data sources to get more of a transparent, comparable, concise measure of a company’s ESG footprint,” says Heinel.

However, she argues that ratings alone do not always provide the full picture of that footprint. “Part of the value in R-Factor is it gives us the basis for a conversation with a company about what material factors they are reporting and how timely and comprehensive that reporting is,” she says. “Because one of the reasons you might have a poor R-Factor score is because the data is just not there or is stale or incomplete.”

Given the speed at which ESG ratings developments are unfolding, she stresses that the R-Factor is a “bridge strategy” that may have a limited lifespan. “It’s our hope and expectation that 10 or 20 years from now we won’t talk about ESG as its own standalone thing. It will be like the financial accounting standards,” she says. “So we would not be disappointed if at some point in the future the R-Factor was no longer necessary.”

The materiality challenge

As Alder points out, coming up with the right ESG data is no easy task, but those working on the ESG measurement and disclosure challenge are converging on a principle they call “materiality”. For until companies have figured out which social and environmental factors really matter to their business, they cannot accurately assess their ESG or sustainability performance.

Companies also need to be able to evaluate the “circularity between impact and dependencies”, says Veronica Poole, Deloitte’s lead expert on IFRS accounting rules. This means assessing how their footprint affects not only the broader society but also the company. An example might be a drinks company whose water consumption reduces the supply for both local communities and the business itself.

“Understanding that circularity is critical, and you can’t just look at the next 12 months,” says Poole. “You need to look to the longer term and across the entirety of your value chain — that’s a different way of approaching materiality from the current financial materiality thinking when it comes to financial statements.”

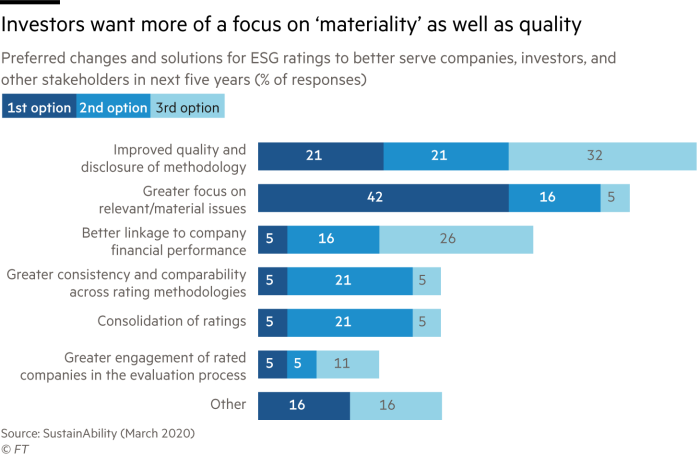

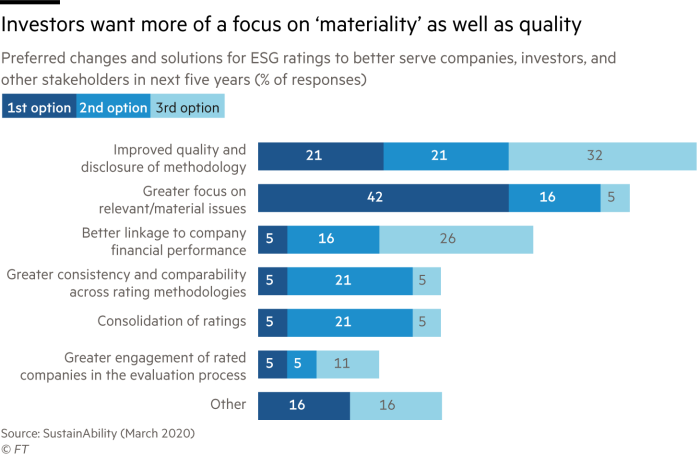

Measuring what matters is also something with which investors struggle when constructing sustainable investment portfolios. In SustainAbility’s Rate the Raters survey, greater focus on materiality ranked second — after improvements in disclosure methodologies — among the changes to ESG ratings investors said they would most like to see in the next five years.

An added complication is that what is material to one business may be less relevant to another. While fuel efficiency, for instance, is a significant factor in an airline’s financial and sustainability performance, the same would not be true for a legal services firm. And while a global clothing manufacturer’s performance on labour rights would influence its ESG rating, it would be less important for a US-based biotech firm.

This is something SASB has recognised. In 2018 it devised a set of sustainability accounting standards for corporate disclosures covering material issues for 77 industries. The standards, says SASB, “identify the minimal set of financially material sustainability topics and their associated metrics for the typical company in an industry”.

Some groups, however, have taken a single-sector approach. One is GRESB, or the Global Real Estate Sustainability Benchmark, an investor-led organisation that evaluates the sustainability performance of property companies, real estate investment trusts, funds and developers.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here

“The universal-versus-specific debate shows how opinions are divided. Among respondents to the FT Moral Money questionnaire, a clear majority wanted to see internationally agreed ESG measurement standards, but there was equal support for sector-specific rankings over a one-size-fits-all approach.

A further complication is the pressure to report on “double materiality” — the effect sustainability issues have not only on companies’ financial performance and long-term value but also on society and the environment. Lenders and investors are interested in the former, while employees, customers, civil society organisations and a range of regulators want data on the latter. “So when you talk about sustainability disclosure, it’s important to be clear on the target audience,” says SASB’s Guillot .

Jenkinson of Calstrs sees a regional divide emerging. “You have this bifurcation where Europe, the GRI and other standard setters are pointing to the impact that business has on society, whereas in the US, where it will be really challenging to shift the emphasis, it’s going to be the risk to an investor from a company’s ESG factors,” she says. “That’s perhaps adding to the confusion on sustainability standards.”

Moreover, what matters to companies can change rapidly. Take the #MeToo movement. In 2017, with accusations of sexual assault being levelled at US film producer Harvey Weinstein, a tweet by actress Alyssa Milano calling on harassment survivors to tweet about their experiences on the #MeToo hashtag went viral.

As the movement achieved scale globally, companies started reviewing their gender equity policies while capital flows into “gender lens” investments swelled to $2.4bn in assets under management by 2018.

The #MeToo movement provides a powerful illustration of why companies and investors need to be able to measure ESG not only by looking backwards to past performance, but also by anticipating what social or environmental factors are likely to matter to their business in the future.

Flexibility and nuance are important to AB InBev investors

In large companies with complex global supply chains, the universal-versus-specific debate plays out internally. And for the world’s largest brewer, Anheuser-Busch InBev, the challenge lies in streamlining ESG reporting while retaining the nuance and details its investors are looking for, says Ezgi Barcenas, the company’s global head of sustainability.

To do this, AB InBev uses a range of standard setters and measurement frameworks. These include GRI, SASB and CDP, which Barcenas says is “one that our investors care about and a separate process and timeline entirely”. Managing the different levels of reporting and disclosure demands resources. And while AB InBev uses third parties to verify its disclosures, when it comes to internal resources, rather than creating a dedicated ESG reporting team, it relies on different business units from procurement to logistics to track the data.

This year the company issued its first ESG report. “Investors were asking for a lot more information and context to understand the mission, the lessons learned and vision forward,” says Barcenas. “So we felt we should report the non-financial material issues in our annual report but issue a separate report to provide more colour and context.”

Barcenas would like to see a balance as ESG standards evolve. “What’s needed is clear standardisation but in a way that provides flexibility and takes into account the nuances across geographies, industries and business models,” she says. “If you have really rigorous standardisation, you could lose that flexibility and miss out on the context our investors are asking for.”

Light at the end of the tunnel

If there are similarities between the development of international accounting standards and current progress on ESG measurement and disclosure, one big difference is proving an advantage: the sense of urgency.

“The pandemic has concentrated minds,” says Alder. “What were seen to be remote existential risks may not be all that remote.” This, of course, includes climate change and a growing sense that action is needed now to avert a planetary crisis. “On the climate side, we don’t have much time,” he says. “We don’t have the luxury of 10 to 15 years to produce a standard.”

What the IFRS Foundation and Iosco do have, however, is infrastructure — something developed two decades ago for the international accounting standards. “We have IFRS, we have the governance model,” says Erik Thedéen, director-general of Finansinspektionen, Sweden’s financial regulator, and chair of Iosco’s sustainable finance task force. “So what we’re doing is building a parallel governance structure inspired by the financial part of it — that, of course, makes it easier.”

A new spirit of collaboration among standards setters will help. While the big five are already planning to streamline their reporting standards, two other standards-based organisations, B Lab and the Global Impact Investing Network (GIIN), are also working to align their impact measurement tools. And in March, the World Economic Forum’s International Business Council, which had its own ESG reporting framework in the works with the Big Four accounting firms, announced that it would back the SSB.

And while the plethora of standards has been a source of frustration, it has allowed the IFRS Foundation and Iosco to move faster than they might otherwise have done. “We already have the basis for standards with TCFD and with the other private standard setters merging and working together now,” says Thedéen. “So we don’t need to find a new system — it’s more like refining the metrics and the definitions we already have.”

Technology could also play a role, with machine learning and artificial intelligence able to tap into everything from traditional corporate reporting to alternative data ranging from satellite imagery, social media, news and analysis to remote sensing. “It enables the democratisation of ESG data and more tailored solutions,” says Georg Kell, chair of Arabesque, a quantitative asset manager which uses AI and big data to assess the ESG performance of globally listed companies. “The costs of doing so have come down and the ability to create bespoke solutions is improving enormously — that’s the next wave on the investment side.”

Noises from governments also favour the streamlining of ESG measurement and reporting. In the US, Joe Biden’s administration has put the task of combating climate change back on the agenda, adding fresh impetus to ESG disclosure efforts.

John Coates, acting director of the SEC’s division of corporation finance, said in March that the agency should “help lead the creation of an effective ESG disclosure system so companies can provide investors with information they need in a cost effective manner.”

Policymakers elsewhere are also becoming more active, with Jacinda Ardern’s government announcing that New Zealand plans to become the world’s first country to make climate risk reporting mandatory, using the TCFD framework.

Guillot sounds a note of caution, however. “A topic like greenhouse gas emissions, where there’s been a global greenhouse gas protocol to develop global consensus around measurement, is significantly more advanced than, let’s say, a topic like diversity,” she says. “Even with the concept of standards, there’s still significant complexity in measurement because of the nature of the issues.”

Conclusion

Given the forces lining up in support of sustainability accounting standards, levels of optimism are high. “Two years ago, when Iosco started looking into this and sending questionnaires to stakeholders, it was very premature to talk about where we are right now,” says Thedéen. “So we are all positively surprised.”

And because the SSB is focused on reporting, Alder believes governments will be open to adopting its set of standards. “We’re not taking a policy stance,” he says. “This is more to do with the standards around which reporting should happen so that asset owners and asset managers can make better capital-allocation decisions. From that perspective it’s eminently adoptable.”

This does not mean the work on ESG measurement and disclosure is over — far from it. While respondents to the FT Moral Money questionnaire were unanimous in agreeing that companies should measure their social and environmental effect, a large majority said that neither companies nor investors were sufficiently focused on this. Only last month, for example, it emerged that fewer than 50 UK public companies were reporting on climate risks comprehensively and setting targets in line with TCFD recommendations.

However, ESG measurement and reporting are increasingly recognised as being essential for shifting capital in the right direction. “Markets are very powerful forces, and if they are equipped with the information and transparency they need about risk, they can price that risk more effectively — and that will smooth the transition to a low-carbon economy,” says Schapiro. “So embracing disclosure is going to lead to more durable change than anything decreed by policy.”

As this idea gains momentum, what was once part of an arcane, jargon-heavy debate confined to small groups of passionate experts is now seen as a necessary tool in shifting capitalism towards a more sustainable model. As Eccles puts it, “if you put ESG information on par with financial information — with the same quality of control systems, the same quality of assurance, the same rigour and enforcement — that’s a game changer.”

Please share your thoughts on how best to measure what matters in the comments below.

Comments