Fears of a disputed US election fuel market volatility bets

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors are growing more jumpy about the risk of a disputed US presidential election, stepping up preparations for a potential period of market volatility as the costs of insuring against turbulence rise.

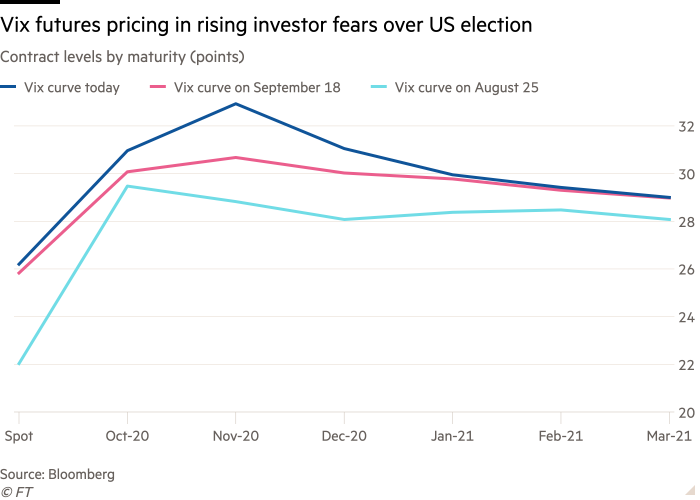

Futures tied to the Vix volatility index, a measure of the expected choppiness of the US stock market based on derivatives prices, have long reflected investor concerns that the result could become contentious. This has led to what some traders term a “volatility kink” around the November vote.

But that kink has grown more pronounced since President Donald Trump indicated he might not concede if he were defeated in the November 3 election. Futures markets suggest that investors now fret that any turmoil could last for several months.

Analysts say this represents an extraordinary level of nervousness given that previous votes have rarely caused market upsets.

“It is getting more and more expensive to hedge the election results,” said Jordi Visser, the chief investment officer of Weiss Multi-Strategy Advisers, a hedge fund. With insurance against turbulence costly, this may instead spur some investors to simply slash back positions, he said.

The level of Vix futures contracts maturing in October and November — which investors can use to hedge against turmoil or profit from it — have climbed from about 30 points just 10 days ago to 31 and 33 points respectively at the end of Monday. Those levels are already a significant premium over the current level of 26 points for the “spot” level of Vix.

Similarly, the price of the December Vix contract has climbed from 30 points 10 days ago to 31 points as of Monday evening. Six months ago, it was at about 26 points. The January Vix futures contract is also pricing in the danger that the post-election political ructions might last into 2021.

Rocky Fishman, a derivatives analyst at Goldman Sachs, noted that Vix futures volumes were subdued, indicating a reluctance among banks to sell protection against stock market turbulence, which may be exacerbating this pattern.

Investors are also beginning to bet that election-related turmoil in US markets could spill over elsewhere. October and November futures contracts on the equivalent implied-volatility indices in Europe and Japan — the Vstoxx and the Nikkei Stock Average Volatility index — have also climbed noticeably over the past month.

Polls suggest Democratic candidate Joe Biden is the favourite to win the vote. Investors also broadly expect that outcome, a survey by Survation showed last week, and they expect it to be somewhat negative for US stocks, depending on the result of simultaneous congressional elections. That means a Trump victory, particularly combined with Republican wins in Congress, could give stocks an unanticipated jolt higher.

A disputed result, however, is potentially the biggest risk to market stability.

“Unless there is a blowout win by one side or the other, we are almost certain to get litigation and an unresolved election, like in 2000,” said Brad McMillan, chief investment officer of the Commonwealth Financial Network. “A substantial market reaction would be quite possible.”

Mr Trump has provided further fuel for the nerves around the vote by refusing last week to commit to a peaceful transition if he lost. He argued — without evidence — that postal voting was an “out of control” disaster that could rob him of the win.

“US politics is becoming increasingly surreal even by the standards of the past four years, following President Trump’s intimation this week that he might not leave office peacefully,” John Normand, a senior JPMorgan strategist, wrote in a note to clients.

Watch the Trump-Biden debate live with the FT

Want to watch the debates alongside your favourite FT columnists? On Tuesday evening, join Swamp Notes columnists Ed Luce and Rana Foroohar, along with Peter Spiegel, for real-time context and shrewd analysis. On the FT.com homepage from 7pm ET.

Comments