Have we reached peak steel watch?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

“If you look at the Nautilus, it’s a very, very soft bracelet, a soft case. It is discreet, a discreet, sport-elegant watch. What is not discreet is the amount of people willing to own one. That’s a different matter.”

As problems go, this is about as high-class as it gets: Thierry Stern, president of Patek Philippe, finds himself in the position of making the world’s most desirable sports watch. The Nautilus is the integrated case and bracelet watch designed by Gérald Genta and introduced by Thierry’s father Philippe in 1976. For most of its life, it has fulfilled its function as the watch for the Patek Philippe customer who did not want to wear his grande complication perpetual calendar, chronograph or his minute repeater while swimming.

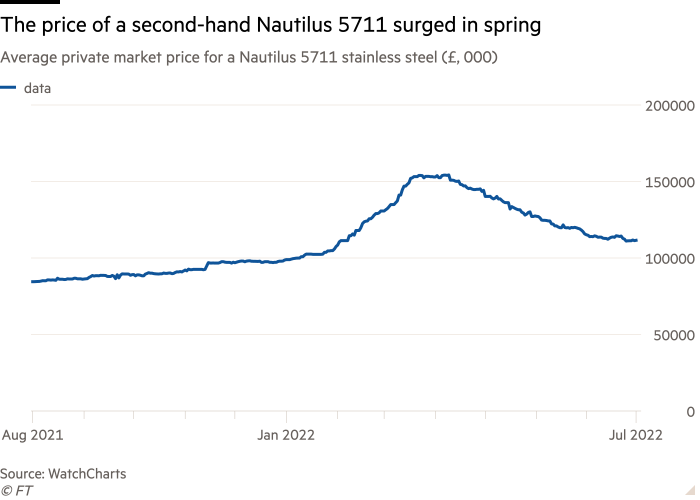

But by the time that this idiosyncratic-looking watch reached its 40th birthday it was becoming a hot watch. That was in 2016, and since then the temperature just kept rising, until last year when Thierry Stern decided to retire the steel Ref 5711. A final series with a subtle green dial was announced, and at the end of the year a run of 5711s with a Tiffany-blue dial was made for the eponymous retailer.

The 5711 was in danger of becoming the tail that wagged the dog. Patek Philippe is a watchmaker active in all sectors, from the highest complications to the simplest dress watches, yet the mania for the Nautilus, with waiting lists stretching years into the future, was becoming a distraction.

The announcement, however, sent prices rocketing on the secondary market. As recently as June, Phillips sold a regular production 5711 for $170,000 (about five times what the official retail had been).

Audemars Piguet Royal Oak

Rolex Oystersteel Daytona

The situation is far from unique to Patek. Secondary market prices of the Genta-designed Audemars Piguet Royal Oak, 50 years old this year (Christie’s sold a 15202ST for just over HK$1mn — about £114,000 — in April), and almost any steel Rolexes, have risen sharply in the past couple of years. Instead of selling, retail staff now find themselves in the business of managing expectations. “We have had to invest significant time in training our store teams to manage frustrated consumers,” says Brian Duffy, CEO of Watches of Switzerland. Meanwhile, conspiracy theories became so lurid that Rolex issued a public statement about the shortage. “The scarcity of our products is not a strategy on our part. Our current production cannot meet the existing demand in an exhaustive way, at least not without reducing the quality of our watches — something we refuse to do as the quality of our products must never be compromised.”

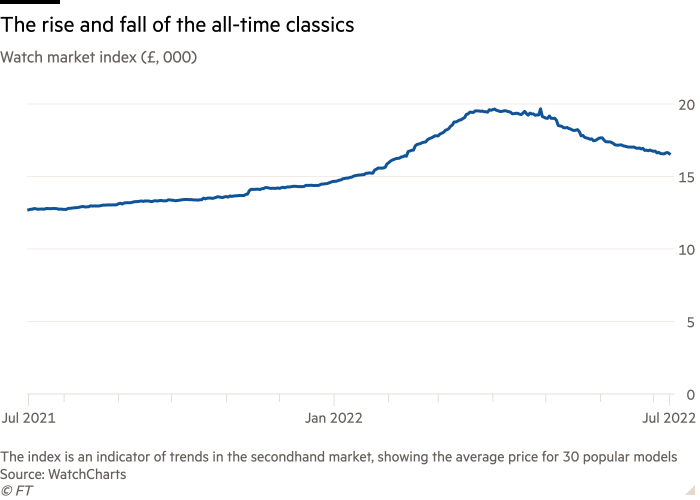

But in recent months prices have cooled in the secondary market, as Danny Pizzigoni, founder of The Watch Club, observes. “I believe steel sports watches are still the cornerstone of any collection, but we’ve had unprecedented growth, especially in the past two to three years, that has pushed ‘steel sports’ to a different category, which made us a little uneasy. There has been a much-needed correction, and sales are not what they were six to 12 months ago.” He uses the example of a Rolex chronograph: “In the spring a brand new ‘Panda’ 116500 steel Cosmograph Daytona hit £45,000 when it was put up on the secondary market; some vloggers speculated it could reach £100,000. But today it sells for £35k to 37k — that’s 20 per cent down, but still 200 per cent above RRP, and still over 20 per cent above what we were asking for the same watch two years ago. These über-collectable steel watches have had a blip, because they went up too fast, and it wasn’t sustainable.”

Steel the scene

This price correction has shone light on the emergence of the contemporary and modern steel sports watch as a discrete sector of watch collecting, one with particular appeal for younger collectors. “For young collectors the initial attraction of steel sports watches is to be able to purchase them at relatively low retail prices,” says collector Shary Rahman. “Provided, of course, they can be found at retail, which has become increasingly difficult if not impossible.” Wearability, especially as dressing becomes increasingly casual, and durability in terms of robustness and water resistance further add to the appeal, while their online recognisability has enhanced their powers of status-conferral. “Today’s generation thrives on instant gratification, in many ways fuelled by the unprecedented influence of social media,” says Rahman. “Collecting in general is no longer limited to being a hobby but a means of being able to establish oneself as an authority on all things collectable and enhancing one’s credibility in the social media-filled metaverse!”

“The demographic is different, it’s a younger, social media-aspirational market influenced by seeing Ed Sheeran wearing a Nautilus, or Jay-Z front row in his skeleton Royal Oak,” concurs Pizzigoni.

Among less experienced collectors, the ability to identify a watch from a social media post is often confused with real knowledge and understanding. “There is little need for expertise or research — unlike vintage watches, which require patience and research to find the right examples,” says Silas Walton, founder of specialist watch sales platform A Collected Man. “From an investment perspective, ‘blue-chip’ vintage Patek Philippe doesn’t offer the same perceived financial return, in the short term. Steel sports watches could be compared to bullish technology stocks, while ‘blue-chip’ vintage Patek Philippe could represent more mature, longer-term, sound investments.”

There was certainly speculation and risk-taking. Anecdotally I have heard from one auction house specialist that he had been receiving calls from groups of three or four people wanting to buy a Nautilus using credit cards, purely for investment; given that credit-card interest runs at around 20 per cent APR, that would mean expectations were running extraordinarily high.

Of course, this is not genuine watch-collecting. But while rash speculators who entered the commoditised steel sports market might take some losses, scarcer pieces, whether a vintage complication, green-dial Nautilus or Paul Newman Daytona, are less volatile. “We’re not witnessing the same correction with the rarest pieces,” said one dealer.

Meanwhile, Brian Duffy actively welcomes a cooling of the secondary market. “Irrational price premiums are unhealthy and unhelpful for the genuine watch-lover and authorised retailer. Our waiting lists are expanding. We are adding ROIs [registrations of interest] faster than we are supplying watches and there is a greater spread of sales across many brands.”

He is seeing that customers deterred by secondary-market premiums and long waiting lists are finding that there is an increasing choice of interesting steel sports models from other brands: Chopard has experienced a hit with its Alpine Eagle; Vacheron Constantin’s Overseas has been rediscovered; and Bulgari’s Octo Finissimo is a contemporary classic. If those don’t appeal, how about the Odysseus from A Lange & Söhne or Zenith’s Defy Skyline? The horizon is expanding.

Comments