What is a buffered ETF?

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Buffered, or defined outcome, ETFs, which aim to protect investors from the worst stock market ravages, do not own any underlying shares.

Instead they build a package of derivatives of “flexible exchange”, or flex, options.

These are customisable, non-standard options that allow the writer and purchaser to negotiate the terms, such as the strike price and expiration date. The options were created by the Chicago Board Options Exchange in 1993, although they now trade on other US exchanges as well.

These options give the buyer the right, but not the obligation, to buy or sell the underlying index, say the S&P 500, at a set price at a future point in time.

How does the ETF use flex options?

A buffered S&P 500 ETF will first buy a call option on the index, typically for 12 months hence, allowing it to buy the index at today’s price. To provide protection, it will also buy a put option, giving it the right to sell the index in a year’s time, again at current price levels.

Given that the downside protection is not 100 per cent, the ETF is able to recoup a little of this outlay by selling some put options. For example, if an ETF protects investors against the first 15 per cent of any loss, it could buy puts with a strike price of $100, and sell puts at a strike price of $85.

To balance the books, the ETF will then sell call options set at whatever level is necessary for the premium income to balance the cost of buying the protection.

The cap and buffer rates change over time

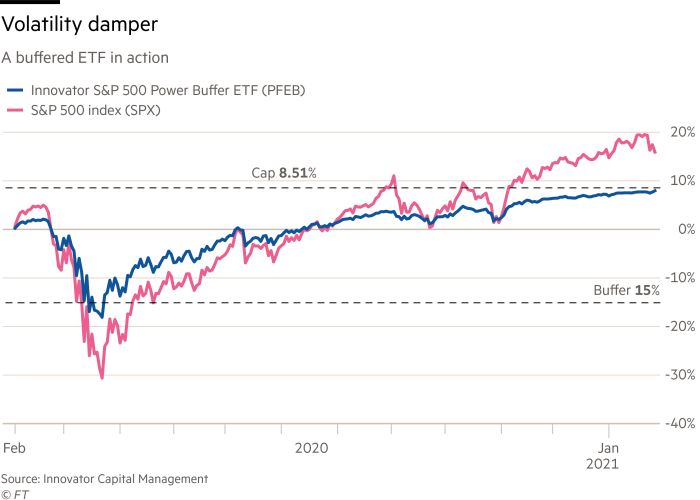

The January 2021 issue of the Innovator S&P 500 Power Buffer ETF (PJAN), for example, protected investors against the first 15 per cent of any loss over the subsequent 12 months, in return for any gains being capped at 9.75 per cent.

The December 2020 version of the same product only had a cap of 9.68 per cent at launch, though, while November’s was a far more generous 12.68 per cent, and in April 2020, at the height of the market volatility, it was a more attractive still 15.4 per cent.

The reason is that during a period of higher volatility, a call option set at, say, 12 per cent above the prevailing market level, is judged to be more likely to be called by the buyer, so it attracts more premium income than it would during a period of low volatility.

How often do they reset?

Some buffered ETF providers, such as Innovator, run a series of 12 monthly ETFs based on each index they track. In contrast, Allianz Investment Management has opted for four quarterly issues.

Whichever the case, at the maturity date the cap and buffer reset. An investor does not need to sell, the product will simply rollover.

The ETFs do trade throughout the 12-month period, though, so anyone buying in part way through needs to understand what potential upside and downside protection they have left.

For the November Innovator ETF mentioned above, for instance, because the S&P 500 had risen since its launch, the remaining cap on January 27 was only 7.1 per cent, but the buffer was 20.9 per cent — ie there was more downside protection but smaller potential gains. The price had risen 4.4 per cent as the S&P has returned 14.7 per cent.

How does performance compare?

John Southard, co-founder and chief investment officer of Innovator Capital Management, said the performance of the ETFs “is quite boring. It basically provides muted exposure to the market [either up or down]. The buffer mutes the volatility.”

Johan Grahn, vice-president, portfolio management at Allianz IM, agreed, saying: “At the very beginning of the outcome period the ETF is going to move with the S&P, but it won’t move as much. As it moves towards the end of [the period], it will move more in line with it.”

Other pros and cons

There are a few other things to consider. Buffered ETFs do not receive dividend payments so investors miss out on the market yield, currently 1.55 per cent on the S&P 500.

Fees are also higher than for plain vanilla passive exposure, typically at around 0.8 per cent.

On the plus side, the options are centrally cleared. That means there is no counterparty risk, unlike for the structured notes that are an alternative way of buying downside protection. The ability to trade buffered ETFs at any point in their life will also be welcomed by some investors.

It does pay to read the terms closely, though, as some buffered ETFs have their own peculiarities. Innovator’s belt-and-braces Ultra Buffer series, for example, promoted as a bond alternative, protects against losses of 5-35 per cent, so investors are still on the hook for the first slice of losses.

Click here to visit the ETF Hub

Comments