The challenges that remain for Philip Green at Arcadia

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

“Can firmly kicked,” was the succinct assessment from one commercial real estate agent after a restructuring of Philip Green’s Arcadia group was approved this week.

At a tense meeting, the Topshop owner secured creditor support for a complex three-year overhaul that will involve deep rent reductions at almost 200 stores and a halving of its pension deficit reduction payments.

Sir Philip is adamant the ailing fashion business can be fixed. But its list of problems remains long. Many in the industry think reviving Arcadia will take far more time and money than the controversial tycoon has set aside.

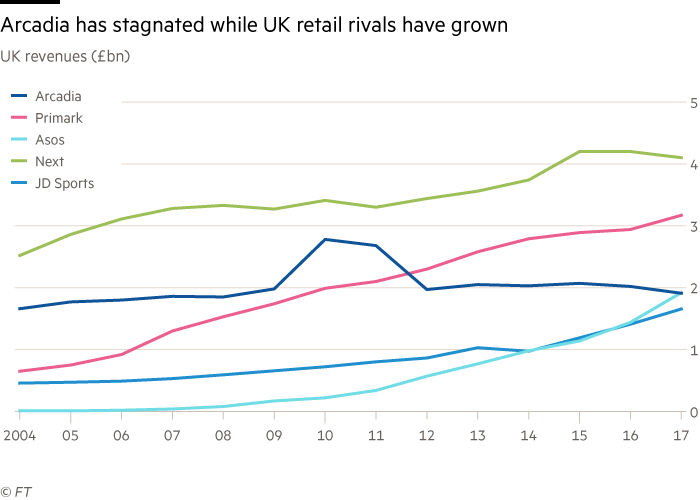

They pointed out that the £135m of promised investment compared poorly with annual capital spending of £150m at Next, £200m at online rival Asos and £350m at Marks and Spencer.

Others worried the plan, known as a company voluntary arrangement, was simply a step towards the sale or orderly winding down of smaller Arcadia brands.

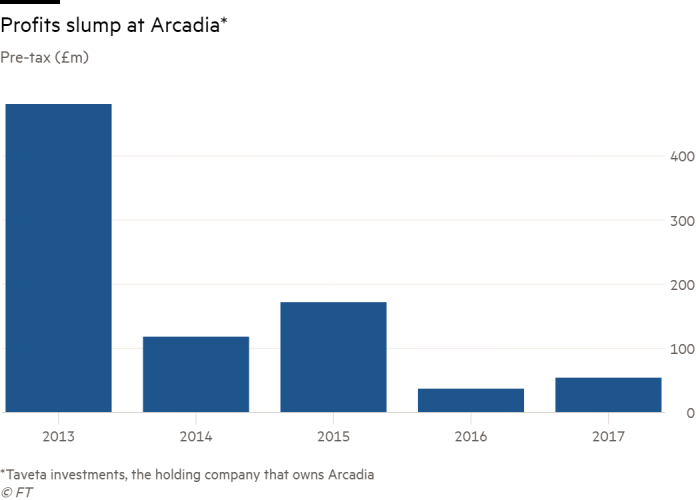

But most observers agreed that to meet the CVA plan’s target of increasing profits from a nadir of £30m this year to £117m in 2022, several issues would need to be addressed.

Stores

Arcadia is set to close 23 of its 566 stores under the CVA, and up to 25 more through a separate administration process involving some property subsidiaries. But during the second creditor meeting, its chairman said the group’s recovery plan could be implemented with as few as 300 stores.

Many expected cuts on that scale would be needed, and could be achieved within a few years using the break clauses in the CVAs and natural lease expiries. “When it comes to stores, fewer but better and bigger is the order of the day,” said John Ryan, founder of Newstores consultancy. “People will travel to go shopping provided there is a decent destination when they get there.”

An example is Spanish chain Zara, which generated £700m of sales in the UK last year from just 64 outlets.

Mr Ryan said Arcadia needed to bring many of the provincial shops up to the standard of the flagships. “Bigger branches of Topshop, like the one in Oxford Circus, are on the whole pretty good. They need to spread that investment among the smaller stores, some of which look like brightly coloured jumble sales.”

Brands

There is almost universal agreement that Topshop, which accounts for more than half of Arcadia’s revenue and is the only brand to have had an impact overseas, still has resonance. “It still has strong associations and that is something that could be revived,” said Rita Clifton, founder of BrandCap. But she and others argued that the smaller chains, such as Dorothy Perkins and Burton, had lost much of their relevance. “There is a big difference between brand recognition and brand health. You have to ask: if these brands did not exist, would you come up with them?”

Some expected the smaller Arcadia brands to gradually disappear from high streets; the company has already said that Miss Selfridge and Evans would move to a predominantly wholesale model and close most of their standalone stores.

Online capability

Place an order on Topshop.com and you have to spend £50 to qualify for free standard delivery. On Asos, the threshold is £25 — and an annual payment of £10 gets you unlimited free next-day delivery and returns. Boohoo and Next run similar schemes, helped by significant investment in IT and logistics.

Arcadia has pledged to spend tens of millions on overhauling IT and logistics. But rolling out cloud-based systems that integrate customer websites with supply chain and finance functions is expensive and disruptive.

“To do what the likes of Asos do and introduce 5,000 new products a week, your inventory management and product description has to be top-notch,” said Andrew Busby, a consultant with experience of retail IT projects.

He questioned whether Sir Philip was really committed to the investment required. “Think of a tech-savvy chairman, CEO or owner and his is not the first name that comes to mind.”

Management

New Look, Arcadia’s rival that agreed its own CVA last year, recently appointed Nigel Oddy, the former boss of The Range and House of Fraser, as chief operating officer. Last week it hired four heavy-hitting non-executive directors and said Tom Singh, its founder, would retire.

It is the sort of overhaul many think Arcadia needs. Although Sir Philip is not on the board, he is still heavily involved in the group. Many of his key lieutenants are also longtime associates. “Where are the new ideas going to come from?” said Mr Busby. “If he were really shrewd he’d step back and let someone else run it.”

Catherine Shuttleworth, founder of Get Savvy Marketing, pointed out that the board of River Island was dominated by the Lewis family, but recruited plenty of younger talent at the operating level. “The trouble is, if you’re one of the best digital marketing experts in the country, are you really going to want to join the board of Arcadia?”

Marketing

On the day that creditors approved Arcadia’s CVA, online rival Boohoo revealed that sales in the UK, a market where it has operated for more than a decade, rose 27 per cent. Ms Shuttleworth ascribed this partly to its clever marketing, which includes extensive use of social media influencers, millions of Instagram followers and sponsorship of reality TV show Love Island.

That compares with a Topshop strategy that is “still basically all about product and shops”.

She added that brands such as Topshop needed to reconnect with target customers on their terms, as M&S had started to do. “Look at what M&S has done with Holly Willoughby. The products are hardly amazing but M&S has worked out the power of her brand and her appeal.”

Comments