Up to a quarter of US equity ETF revenues derived from China

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Up to a quarter of the revenues generated by the constituent companies of exchange traded funds focused on US stocks are derived from sales to China, according to research by Bank of America.

The analysis demonstrates how difficult it is for investors to avoid the fallout from Beijing’s crackdown on a swath of private sector activities.

“What happens in China doesn’t stay in China,” BofA said, with the correlation between earnings per share growth in the US S&P 500 and Chinese economic growth surging from zero in 2010 to 90 per cent, exceeding the importance of US gross domestic product growth for US-listed stocks.

About 30 per cent of global GDP growth over the past two decades has come from China, greater than the 21 per cent from the US, while almost 80 per cent of the S&P 500’s margin expansion since 1990 has been driven by globalisation, the bank added.

BofA found that 79 S&P 500 companies generate at least 5 per cent of their revenues from China, a figure rising to 63 per cent for casino operator Las Vegas Sands and 70 per cent for rival Wynn Resorts, both heavily focused on the Macau gaming market.

Next highest were chipmakers Qualcomm, at 60 per cent, and Texas Instruments (55 per cent), followed by laser developer IPG Photonics (42 per cent).

Globally, it identified 303 listed companies, with total market capitalisation in excess of $19tn, that generate at least 5 per cent of their revenue from China.

Separate analysis by Jared Woodard, head of the research investment committee at BofA, found that — based on their holdings of these 303 companies — 138 of the 251 ETFs the bank covers generated at least 3 per cent of their underlying revenue from China.

Apart from China-focused funds, emerging market ETFs were the most exposed, with their constituents typically deriving between 25 and 45 per cent of their revenues from the country.

However, even some ETFs focused purely on US-listed stocks were found to have high exposures, led by the iShares Semiconductor ETF (SOXX), whose constituents generate 27.9 per cent of their revenues from China, according to BofA’s numbers.

The VanEck Semiconductor ETF (SMH) is not far behind, at 25.8 per cent, with VanEck Low Carbon Energy ETF (SMOG), which tracks a global index, at 19.1 per cent, and the First Trust Nasdaq 100 Technology Sector Index fund (QTEC), at 16.6 per cent.

“A lot of US companies have built up quite a lot of dependence on revenues from China,” Woodard said. “Investors may not be aware. People know the mandates of the funds they buy usually, but what they might not know is that companies around the world have become increasingly dependent on China.”

The figures might even understate ETFs’ exposure to China. Some funds will hold companies that derive some revenue from China, but less than the 5 per cent threshold used in BofA’s analysis, meaning their contribution is missed. In addition, not all companies disclose the full geographic breakdown of their sales, Woodard said.

The research also only covered revenues emanating from China, not other potential vulnerabilities such as supply chains.

“Revenue exposure is something we can measure [but] that is just one reflection of their relationship. [Via] broader trade, labour pools, there are a host of ways that means economies around the world are more connected than before,” Woodard added.

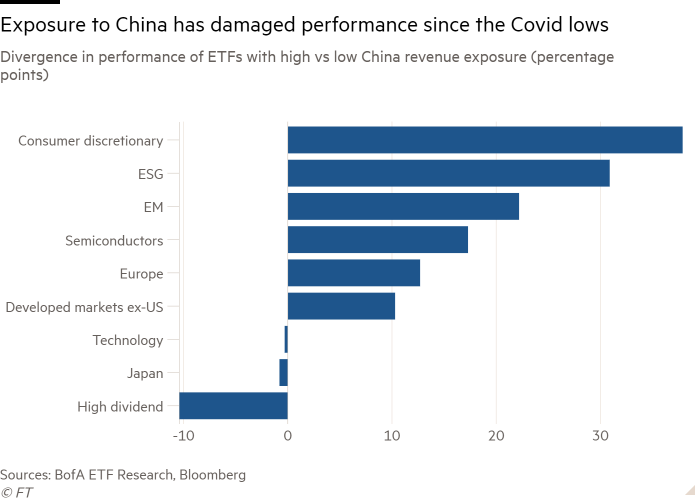

His analysis found that some of the ETFs with little exposure to China have outperformed comparable China-centric funds by as much as 37 percentage points since the onset of the pandemic in March 2020.

The gaps are particularly large for consumer discretionary funds, where some ETFs hold China-dependent casino, education and luxury stocks, while others do not.

The gaps are also notable for funds following an environmental, social and governance mantra and those focused on emerging markets.

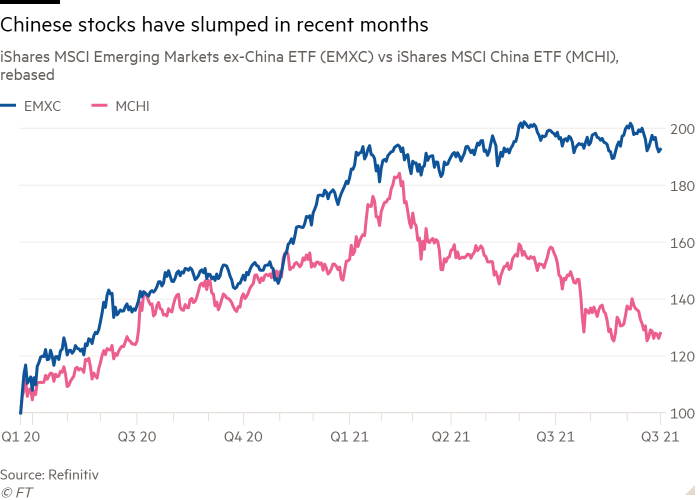

While every stock market has its ups and downs, Woodard argued that China’s current combination of long-term concerns around issues such as demographics and potential growth, cyclical headwinds such as tight monetary policy, and “political interventions in the name of common prosperity” means “the risk may be greater than the rewards”.

Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, said the analysis underscored the need for investors to be aware of what is in the funds they hold.

“The geographical location of a company is somewhat arbitrary. It’s not necessarily linked with where it makes its money. Shell and BP are listed in the UK but that’s not where the bulk of their revenues are coming from,” Lamont said.

“American companies tend to have a fairly large domestic footprint because they have a large internal market, but in a globalised world we are all dependent to some degree on how well China is doing.”

BofA also noted that, since 2017, mutual funds had gone from having an equal weight position in the US companies with top decile exposure to China to being more than 10 percentage points underweight.

ETFs, being overwhelmingly passive, do not have the scope to follow suit, even though these stocks trade at near-record 25 per cent premium to their peers, according to BofA.

Rahul Sen Sharma, managing partner of Indxx, an index provider, said “only time will tell,” whether active managers’ decision to underweight US stocks heavily exposed to China pays off.

“We will have to see how the returns stack up over the long term. Passive investment usually wins out over active,” he said.

Lamont agreed, saying “next week something might change and these active managers will be caught off guard.

“Sometimes [active management] pays off and sometimes it doesn’t. Maybe it will pay off this time but most active managers don’t make enough calls right over time.”

Click here to visit the ETF Hub

Comments