Pension specialists edge ahead with fiduciary rule

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

America’s gargantuan retirement industry is set for an overhaul. More than 76m workers make regular investments from their wages to employer-sponsored defined contribution (DC) plans.

This massive investment market arose with little forethought. The most common type of DC plan, known as the 401(k), is named after what was at first a little-noticed clause in a 1978 US tax law. The measure allowed workers to invest for retirement without being taxed on the money until they drew down the funds. It took a couple of years for the clause to inspire the popular retirement plans.

They have become commonplace, with thousands of financial professionals advising these DC retirement plans on their design and investments. Yet the industry now faces one of its biggest regulatory challenges since the 401(k) was created.

In the past, the sector was overseen by a patchwork of rules. In April, though, the Department of Labor issued its “fiduciary rule” requiring financial professionals to put their clients’ interests before their own when selling retirement products.

The regulation will cause more headaches for broker-dealers — who are currently required only to ensure their retirement advice is “suitable” for the client — than for registered independent advisers (RIAs), who are already held to a “best interests” standard.

Plan advisers are suddenly in the spotlight. Comedian John Oliver even devoted a segment of his TV show in June to plan advisers and retirement plan advice.

Against this backdrop, the Financial Times publishes the FT Top 401, its second annual list of top DC retirement plan advisers in the US. The FT 401 listing provides a snapshot of the very best professionals who specialise in advising DC plans offered by corporate, non-profit and government employers.

Advisers do not have to comply fully with the revised fiduciary rule until January 2018. But the industry had already started to change before this regulation was finalised. Intensified scrutiny and additional responsibility seem to be whittling away the numbers of advisers for whom dealing with DC retirement plans is a sideline, as more plan advising is concentrated in the hands of specialist advisers such as those in the FT 401.

Advisers in the latest FT 401 listing had on average 74 per cent of total client assets in the DC plans they advised, up from 71 per cent last year. And for 14 per cent of the constituents of the FT 401, DC plans represent their only business.

That focus has resulted in an even more elite group of advisers in this year’s FT 401 when compared with last year’s. The “average” professional in the FT 401 advises 72 DC plans with $950m in assets. This is up from an average of 52 plans with $770m in assets last year.

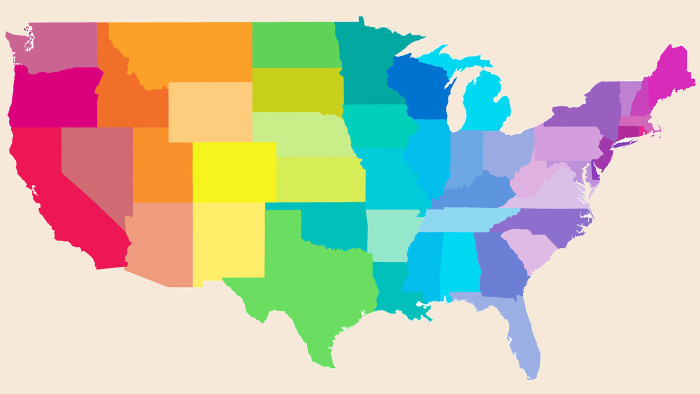

The advisers highlighted hail from 41 states and Washington, DC. The FT 401 table is listed state by state — and unsurprisingly the states with higher populations and higher concentrations of wealth have more advisers on the list. California leads the way with 46 advisers, followed by New York (33) and Texas (27).

Because of the complicated nature of advising plans, the advisers often work in teams. Like last year, 81 per cent of the FT 401 were either members or leaders of teams. For years the business has been gravitating away from sole practitioners. And teams of associates are gradually growing to handle more plans and more complicated services. The average number of professionals dealing with employer clients in particular teams rose from six to seven over the past year.

The fiduciary rule will accelerate other shifts already under way in the business, many of which are highlighted in this report. Several plan advisers take the safest interpretation of delivering their clients’ “best interests” as saving costs, and will be advising plans to switch to cheaper, index-tracking investment funds. FT 401 advisers already reduced their clients’ investments in actively managed US equity funds from an average of 28 per cent of plan assets at the end of 2014 to 25 per cent a year later.

The elite professionals

A-Z of the FT’s top advisers state by state

The FT 401 have boosted their clients’ investments in index-tracking US equity funds from 8 per cent to 9 per cent over the same period.

With the fiduciary rule only heightening worry about lawsuits from DC plan participants, employers who sponsor DC plans are often more interested in outsourcing plans’ risk to their advisers. This is a responsibility that top plan advisers are increasingly willing to take on. The portion of FT 401 advisers willing to take full responsibility for DC plan investments (known as “fiduciary outsourcing”) rose from 44 per cent last year to 54 per cent this year.

Such a service distinguishes the FT 401 advisers from generalists and appears to be attracting market interest. The fiduciary rule should benefit the specialist plan advisers who are experienced in providing an array of services to DC plans, including plan design, investment monitoring, one-onone employee meetings and participant performance benchmarking.

A recent survey from asset manager Fidelity found that 23 per cent of employers with DC plans are looking to switch their plan advisers for someone with greater expertise.

Better prepared organisations appear to be gaining ground, which can be seen in the make-up of the FT 401 membership. More than one quarter of the FT 401’s names turned over this year.

Dozens of high-quality advisers just missed the list, edged out by peers with slightly better profiles. The company with the most advisers on the list is brokerage heavyweight Merrill Lynch, which has 90 advisers this year, up from 60 in 2015’s list. Merrills, like some of the other big brokerages, expanded its team of DC plan specialists and invested in training and resourcing them.

Size is not the deciding factor, however. Employers also frequently seek counsel from smaller, independent registered investment advisers. Such firms account for 30 per cent of the latest FT 401 list, led by the six advisers from Captrust, an RIA with a focus on DC plans.

Nearly 95 per cent of FT 401 advisers have advanced industry designations, such as the Certified Financial Planner, which require additional courses of study. That is up from 92 per cent last year, an acknowledgment that plan advising requires specialised knowledge and often involves plan-specific credentials such as the Accredited Investment Fiduciary.

Advisers and plan sponsors continue to grapple with Americans’ reluctance to save for retirement. FT 401 advisers report that 75 per cent of their client organisations match a portion of the contributions made by employees — a powerful incentive to participate, even among new workers who may be 40 years away from retirement.

In addition, 41 per cent of the DC plans advised by the FT 401 automatically enrol new employees — putting the onus of workers to opt themselves out of pension plans and relying on inertia to ensure they do not. Around a quarter of client plans automatically increase the portion of payroll that workers contribute to the DC plans each year. Both automated procedures are slightly more widespread in the FT 401 than last year. These features are becoming seen as best practice to help grow workers’ retirement nest eggs.

Comments