COP26: Carney’s $130tn climate pledge is too big to be credible

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

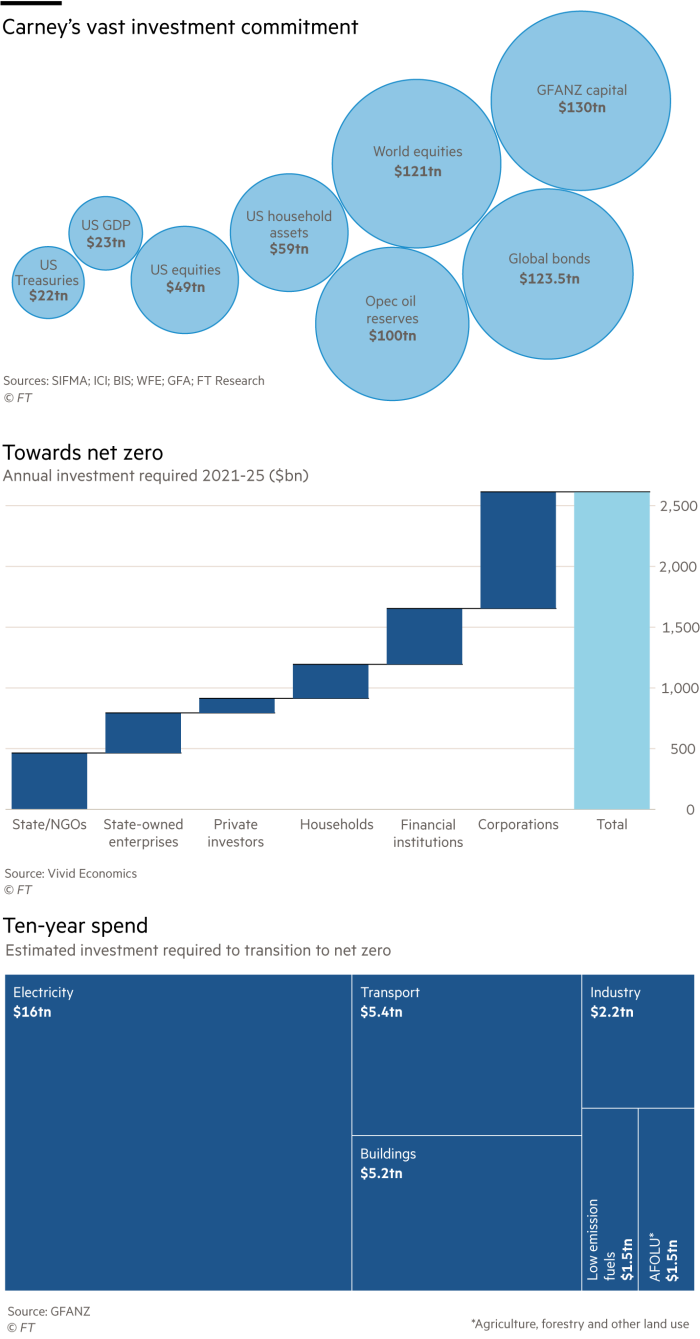

The bigger an estimated number, the lower its reliability. The over $130tn “of capital committed to net zero” by the Glasgow Financial Alliance for Net Zero proves the point. This group of banks, fund managers and insurers is led by Mark Carney, former governor of the Bank of England, and has admirable intentions. But its expansive use of statistics is unwise.

The COP26 summit in Glasgow has put pressure on business to produce eye-catching proofs of progress in the battle to halt global warming. A GFANZ press release came up with the goods, hailing “the deployment of this capital . . . through 24 major initiatives”.

Unfortunately, there are problems with that figure of $130tn. First, if it were an investment fund, as some observers wrongly assumed, it would be insanely large. The financial sector would be committing a sum six times larger than the annual gross domestic product of the US. The market capitalisation of the world’s stock markets is only about $120tn.

To be fair, if “punching up” text to grab public attention were a crime, many journalists would be doing time alongside PR professionals. GFANZ is happy to explain that $130tn is not ready funds, but total assets managed by member financial institutions. These have all committed to setting targets at five-yearly intervals. Those way markers are meant to take them to net zero in their operations and asset bases by 2050, starting in 2030.

However, $130tn may still be wrong even as an aggregate of member assets. Banks account for half of the total. And banks habitually count single assets several times through chains of lending. Economist JK Galbraith, in his book Money, saw through this multiple accounting. Asset managers, the other half of GFANZ’s membership, do something similar when they subcontract specialist fund management to one another.

“The implication of this number is that finance is greening the world,” said one sceptical banker. The reality is that carbon transition will require huge state intervention and investment. The risk for GFANZ is that having overpromised, private finance will now under deliver.

The Lex team is interested in hearing more from readers. Please tell us what you think of GFANZ’s $130tn commitment in the comments section below.

Letter in response to this article:

Consumer behaviour and carbon taxes matter too / From Rupak Ghose, Chief Operating Officer, Galytix London SW5, UK

Comments