Treasuries soar as investors trim bets on half-point Federal Reserve rate rise

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

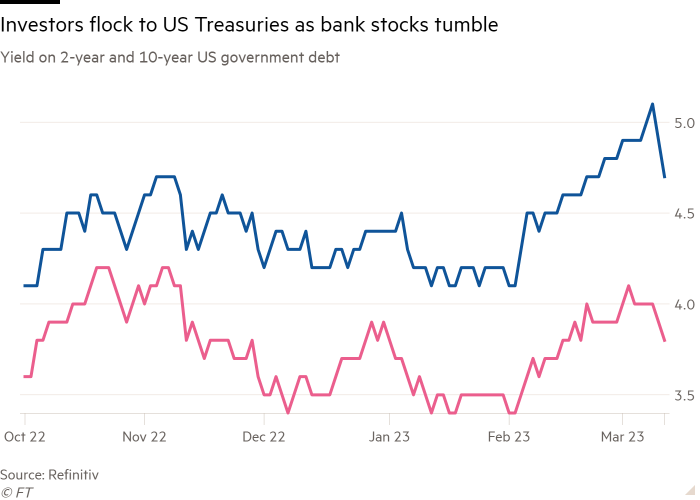

US Treasuries rallied and yields tumbled on Friday as investors sought safety amid a sell-off in bank stocks, and a mixed labour market report allayed fears the Federal Reserve would raise interest rates by half a percentage point at its meeting later this month.

Bond prices rose, sending yields on benchmark 10-year Treasury notes down 0.23 percentage points to 3.68 per cent — their lowest in almost a month and a sharp reversal from having traded above 4 per cent earlier in the week. The yield on the two-year note, which is more sensitive to interest rates, fell 0.32 percentage points to 4.58 per cent.

Kavi Gupta, co-head of rates trading at Bank of America, said some momentum-focused investors were likely to have covered short positions in bonds built on the expectation of a more hawkish stance by the Fed.

“The level of uncertainty is very high at the moment,” he added.

Stocks on Wall Street declined for a second day in volatile trading, dragged down by broad losses for banks’ shares following fears that the failure of tech-focused Silicon Valley Bank, which was put into receivership on Friday, could be a sign of broader woes in the sector.

The S&P closed down 1.5 per cent, taking its losses for the week to 4.5 per cent, the worst week in almost six months. The tech-heavy Nasdaq Composite ceded 1.8 per cent on the day and 4.7 per cent lower for the week — the poorest week since early November.

Adam Turnquist, chief technical strategist for LPL Financial, described the stock market mood as “sell now, ask questions later”.

Investors were left weighing the merits of the banking drama against signals from a closely watched monthly US employment report, which showed the economy added 311,000 new jobs in February, far above market expectations of 225,000.

However, wage growth slowed to 0.2 per cent from January, while a separate survey reported a larger than forecast rise in the unemployment rate to 3.6 per cent.

Combined, the data could ease pressure on the Fed to use bigger interest rate rises to curb inflation. CME Group’s FedWatch tool implied investors were pricing in a 64 per cent likelihood of a quarter-point rise at the Fed’s March 21-22 meeting. On Thursday there had been a 68 per cent probability of a half-point move.

“The mixed message from the February jobs report makes the upcoming Fed meeting a close call, but we are sticking with a [quarter-point] hike for now,” said Michael Feroli, analyst at JPMorgan.

The dollar index, which measures the greenback against a basket of six peer currencies, fell 0.7 per cent.

European markets were also lower. The region-wide Stoxx 600 closed down 1.4 per cent, hit by falls in bank stocks such as Deutsche Bank and Société Générale. The Stoxx bank index lost 3.8 per cent. London’s bank-heavy FTSE 100 ended down 1.7 per cent.

In Asia, Hong Kong’s Hang Seng index was down 3 per cent, China’s CSI 300 shed 1.3 per cent, South Korea’s Kospi declined 1 per cent and Japan’s Topix lost 1.9 per cent.

“An earthquake in Silicon Valley led to aftershock on Wall Street and the tremors could still be felt in London on Friday morning,” said Russ Mould, investment director at AJ Bell, a UK investment platform. “Lots of banks hold large portfolios of bonds and rising interest rates make these less valuable — the SVB situation is a reminder that many institutions are sitting on large, unrealised losses on their fixed-income holdings.”

Yields on European sovereign debt fell, with those on 10-year German Bunds falling 0.04 percentage points to 2.46 per cent.

The yield on 10-year UK government bonds fell 0.02 percentage points to 3.62 per cent after UK gross domestic product came in stronger than expected, with year-over-year growth flat, compared with expectations of a 0.2 per cent fall.

Brent crude rose 1.2 per cent to $82.52 a barrel.

Additional reporting by Kana Inagaki in Tokyo, Kaye Wiggins in Hong Kong and Philip Stafford in London

Comments