Stock markets weaken as US dollar bounce continues

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

Global stocks slid on Monday after their best week since November, while the US dollar regained lost ground as the global coronavirus pandemic worsened.

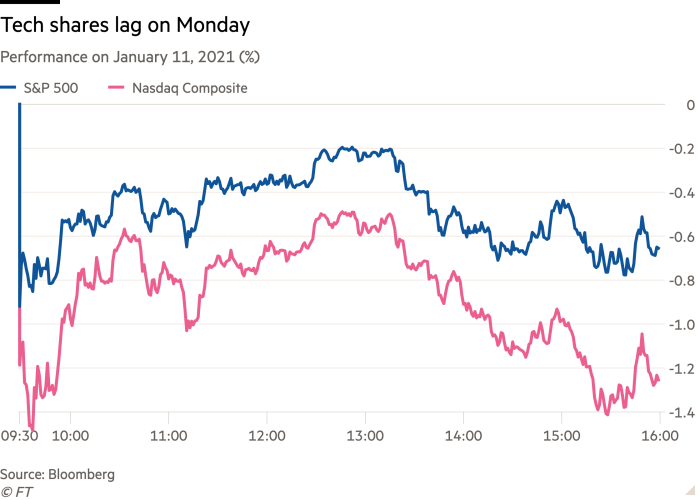

Wall Street’s benchmark S&P 500 index slid 0.7 per cent, while the tech-heavy Nasdaq Composite declined 1.3 per cent.

Treasuries also weakened, with the yield on the 10-year note rising for the fifth consecutive day to 1.14 per cent, the highest level since March 2020.

The declines in the US were led by stocks sensitive to interest rates, including utilities and real estate groups, as well as technology companies that had moved over the weekend to ban or suspend US president Donald Trump from their platforms.

Twitter shares fell 6.4 per cent while Facebook declined 4 per cent.

European indices snapped last week’s winning streak to post losses across the board as the deteriorating health crisis drew investors’ attention. The region’s benchmark Stoxx 600 index closed down 0.7 per cent, London’s FTSE 100 shed 1.1 per cent and Frankfurt’s Xetra Dax lost 0.8 per cent.

“The first quarter of the year will be worse than expected because of [renewed European] lockdowns everywhere,” said Jean-François Robin, head of global markets research at Natixis. “We were expecting a bit [of a] better start to the year.”

The FTSE All World index was 0.8 per cent lower, its worst day in three weeks.

Monday’s losses came after a strong start to 2021 for global equities when the prospect of further fiscal stimulus in the US has added to optimism about Covid-19 vaccines and hopes of a rebound in the global economy.

But Richard Saperstein, chief investment officer at Treasury Partners, said that “if we start seeing further surges in hospitalisations and Covid-related deaths, I am concerned that market enthusiasm will turn in the short term”.

“In the near term, there’s a very real and present danger that the US could double dip in the first quarter,” he added. “We saw the first signs of that with the jobs report last week.”

Salman Baig, multi-asset investment manager at Unigestion, pointed out that equity valuations remained elevated, with a large degree of optimism already priced in. “Earnings season is going to kick off in the next few weeks; depending on the tone set by some of these firms, that could be challenging, given where valuations are,” he said.

The dollar, as measured against a basket of peers, was up 0.5 per cent, taking it 0.6 per cent higher for the year. The US currency has been lifted along with Treasury yields on a bet that Democratic control of Congress will mean more stimulus for the US economy.

The dollar lost about 7 per cent last year after interest rate cuts by the Federal Reserve reduced the appeal of dollar assets and encouraged investors to bet on riskier currencies, such as China’s renminbi. Some analysts expect the rebound to be shortlived, with inflation expectations rising while interest rates are set to remain low for the foreseeable future.

Lee Hardman, a currency analyst at MUFG, said rising US yields were “triggering a temporary shake out of elevated short US dollar positions”, which had increased significantly over the past month.

The euro, which has rallied strongly in recent months, slipped 0.5 per cent against the dollar on Monday to $1.2153, while Britain’s pound fell 0.4 per cent to $1.3518.

In Asia, China’s CSI 300 index slipped 1 per cent as banks and exchanges moved to adhere to the US president’s executive order banning investment in companies with alleged links to China’s military.

Comments