Women-led hedge funds try to crack the boys’ club

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When she launched an event for female hedge fund managers seven years ago, Tracy Castle-Newman, a managing director at Morgan Stanley, struggled to find any.

“I ended up with about 10 people,” she said.

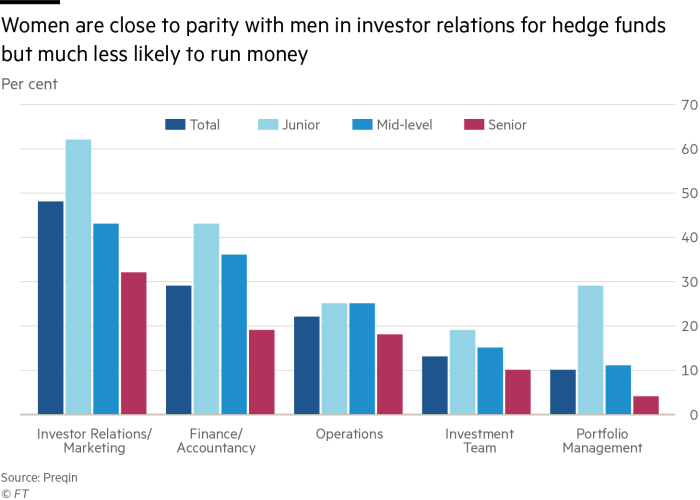

The ratio of women to men working in the industry is one of the most lopsided in all of finance. Last year, 19.3 per cent of hedge fund employees were women, up from 18.6 per cent in 2017, according to the data provider Preqin.

That conceals an even greater imbalance when it comes to people making investment decisions: 48 per cent of the funds’ investor relations teams are women but in portfolio management it is only 10 per cent.

And among those actually running funds, women are even rarer.

Jamie Zimmerman has been running her event-driven fund since 2000, though its current assets — about $169m, according to regulatory filings — are down from a peak of $3.4bn in 2014, according to Bloomberg. Leda Braga has overseen Systematica, which trades using computer algorithms and manages about $8.6bn, since the start of 2015, when she spun out from BlueCrest Capital. One of the more high-profile women in the industry, Samantha Greenberg, closed her fund, Margate Capital, earlier this year to join Citadel.

Yet finally there are signs of an infusion of women at the top. Six years after Morgan Stanley’s inaugural event, the number of female managers attending the bank’s Women’s Investment Roundtable had tripled.

For the first time ever, many of the highest-profile hedge fund launches this year are led by women.

They include: Impactive Capital, an activist investing fund run by Lauren Taylor Wolfe; Snowcat Capital, an alternative risk premia fund run by Rebecca Pacholder; Bayberry Capital, a long-short equities fund run by Angela Aldrich; and Martlet Asset Management, an alternative risk premia fund run by Jane Buchan.

The latest batch of new launches comes at a time when most portfolio managers are struggling to strike out on their own. The number of new hedge fund start-ups fell to their lowest level since 2000 last year, according to HFR.

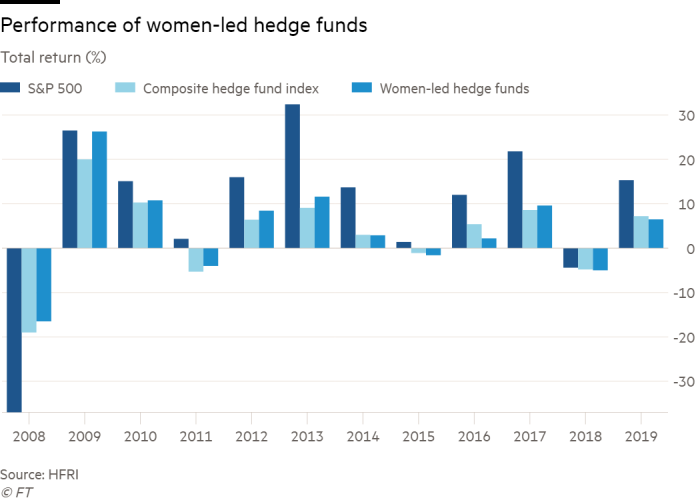

To get to launch, women have to overcome a higher hurdle than men even though they tend to perform better, according to a 2015 study by Northeastern University.

“I think all the evidence is really solid on the fact that, for women, you have to outperform by more to build the same kind of business,” said Ms Buchan, who was most recently the co-chief executive of Paamco Prisma, one of the largest fund of hedge funds in the world. “And the outperformance can be as much as 100 basis points . . . That’s saying that something’s wrong with the capital allocation process.”

“One of the problems is there are a lot of biases that people have in their head,” she added. “The issue is going to be, are [allocators] willing to do this or not? There’s a lot of talk, but not a lot of action.”

Ms Buchan has attracted $100m of assets for her fund. Ms Taylor Wolfe launched Impactive Capital alongside Christian Asmar with an anchor investment of $250m from the California State Teachers’ Retirement System. Ms Pacholder raised $100m and her former boss Leon Cooperman of Omega Advisors has said he would be a “substantial” investor*. All four funds are currently fundraising.

Yet the amount being raised by the female fund managers is still markedly lower than some of the recent headline launches led by men, who often start with more than $1bn in capital. In the largest hedge fund launch ever, Michael Gelband, the former head of fixed income at Millennium Management, started ExodusPoint with $8bn last year.

“I was starting to think of the natural networks that their male counterparts have,” said Ms Castle-Newman, the chief operating officer for institutional equities distribution at Morgan Stanley. “The men have these networks that are quite large. What generally happens is they feel more confident going out on their own because they have money backing them up right from the start because they have that network.”

While hedge funds have been notoriously uninviting places for women to work, the industry is yet to have its “me too” moment. The lack of women is attributed more towards the clubby male atmosphere and what some female fund managers say is an unconscious bias towards women in investing and a lack of women in leadership positions.

A lawsuit filed last year by an associate director of Point72, Steven Cohen’s hedge fund, alleging that female employees were subject to a hostile work environment and paid as little as a third of what the men receive, brought attention to the way some people allege women are treated in the industry.

Point72, whose president stepped down following the complaint, denied the allegations. The hedge fund won a court bid to have the case moved to private arbitration.

One female fund manager who asked not to be named said women once were not supportive enough of each other, because of a presumption that there was room for only one woman in a senior leadership role.

That, she said, has changed, and hedge funds and investors are now embracing the benefits of cognitive diversity.

Some hedge funds, such as Man Group and Baupost, have created internal initiatives to hire more women in their analyst and portfolio manager ranks, while groups such as Girls Who Invest are targeting university-age women to attract them to the asset management industry.

Visibility might help. Both Ms Aldrich and Ms Taylor Wolfe were speakers at the recent Sohn Investment Conference in New York, with the latter also making several television appearances to pitch her firm’s investment in Wyndham Hotels.

As one of the few women running an activist fund, Ms Taylor Wolfe, a former managing director and investing partner at the shareholder activist fund Blue Harbour, has a good chance of generating headlines with campaigns to improve company operations.

Ms Buchan, who has worked in the industry for several decades now and is well-known among funds and investors, said one motivation for striking out on her own was to help redress the gender imbalance.

“In my case, I think we have something valuable to add, we have good returns and an interesting perspective, but I also think that as for doing it on my own and not going under someone else’s shell, I wanted to prove that women can make it,” she said.

*An earlier version of this article wrongly stated that Ms Pacholder received $100m from Mr Cooperman

Comments