China coal futures post record weekly increase

Simply sign up to the Chinese business & finance myFT Digest -- delivered directly to your inbox.

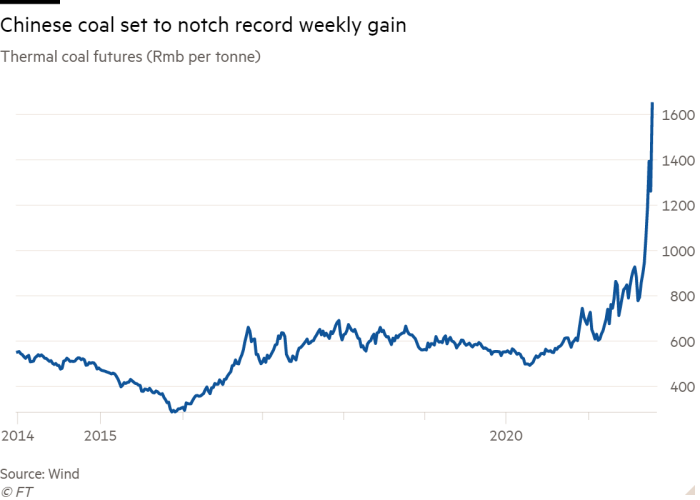

Chinese coal futures delivered their biggest weekly rise on record, driven by a worsening energy crisis that threatens to pile further pressure on the country’s property developers as they grapple with looming debt payments.

Thermal coal futures traded on the Zhengzhou Commodity Exchange rose 8 per cent on Friday to Rmb1,692 ($263) a tonne, taking them 34 per cent higher over the past five sessions and marking the largest weekly gain since they began trading in Zhengzhou in 2013. China’s coal futures have closed every trading day this week at a record.

The rally comes amid a mounting energy crisis in China, where coal-fired power accounts for about 70 per cent of electricity generation. A drive to close coal mines and power plants over environmental and safety considerations, along with local governments’ efforts to reduce power usage to meet strict emissions targets, have combined to produce power shortages and blackouts across the country.

Coal prices have continued to rise even as imports of the fuel surged and local authorities ordered mines this week to increase output, while deadly floods in the critical coal-producing Shanxi province severely disrupted attempts to boost supply.

Analysts said that the relentless rise of coal prices threatened to spill over into China’s other looming economic crisis: a liquidity crunch in the real estate sector in the wake of a missed payment by Evergrande, the world’s most indebted property developer.

Beijing has instituted power rationing that privileges residential consumption over industrial use to minimise disruption for Chinese citizens. Limited power resources for manufacturers are likely to raise the costs of construction materials including steel, glass and aluminium, which would further squeeze margins for already struggling property developers.

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

According to Michelle Lam, senior China economist at Société Générale, rising coal prices will “sharply” increase the costs faced by Chinese developers in the months ahead. “If developers want to complete construction, they’ll face higher material costs, and that will increase challenges in terms of profitability in the short term.”

Chinese industrial costs are already rising, with factory gate prices jumping 10.7 per cent last month, the fastest pace since 1995. The country’s producer price index, which includes the costs of raw materials sold to businesses, has climbed this year on rallying commodity prices.

Larry Hu, chief China economist at Macquarie Capital, noted that while higher oil prices had pushed the price index up earlier this year, it was now responding to rising coal prices. The portion of the index that captures producer prices for coal was up 75 per cent year on year in September.

The combined impact of the energy crunch and real estate debt crisis is expected to have dragged on China’s third-quarter economic growth, which will be released on Monday. Analysts at Goldman Sachs have forecast that output did not grow from the previous quarter and expressed “considerable uncertainty” about the fourth-quarter outlook.

Comments