The market for collectibles can be volatile but rewarding

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

What are the best stores of value that you can carry with you? Gold coins, perhaps?

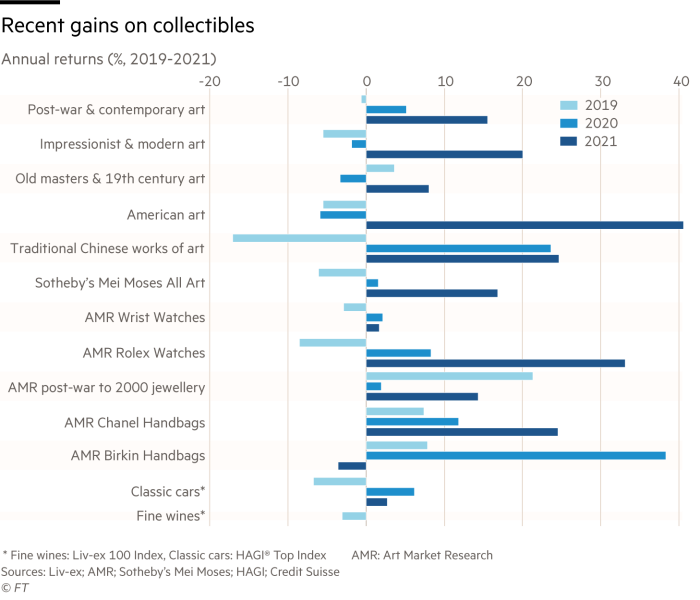

They were the top choice for many centuries. But not now. These days, it is a Rolex watch or a Chanel designer handbag. Researchers at Credit Suisse have calculated that the value of rare Rolexes sold at auction soared by 33 per cent in 2021, while Chanel bags’ sale prices were up 24.5 per cent, powered by examples designed by Karl Lagerfeld.

However, the markets for collectibles can be capricious. In 2020, it was the Hermès Birkin bag that came top, rising in value by more than 30 per cent. In 2019, it was modern jewellery dating between 1945 and 2000 that rose by more than 20 per cent.

You could be forgiven for thinking that it is all a matter of luck. But it is not entirely. The Credit Suisse report entitled Collectibles among heightened uncertainty and inflation, classifies these goodies under three levels of volatility: high, medium and low. Looking at the past three years together, the high-volatility group includes post-war and contemporary art, British paintings and Chinese art, alongside financial assets such as gold, commodities, global stocks and private equity.

Under medium volatility, we find Old Masters, Impressionists, classic cars and wine, as well as bonds and hedge funds. The Birkin bag is here, as well. Finally, look at low-volatility assets and you’ll find watches and jewellery, plus those Chanel handbags.

What of the future, though, as asset prices tumble, interest rates rise, and inflation bites? Credit Suisse predicts that, after a good start to 2022, collectibles are likely to see slower gains than last year.

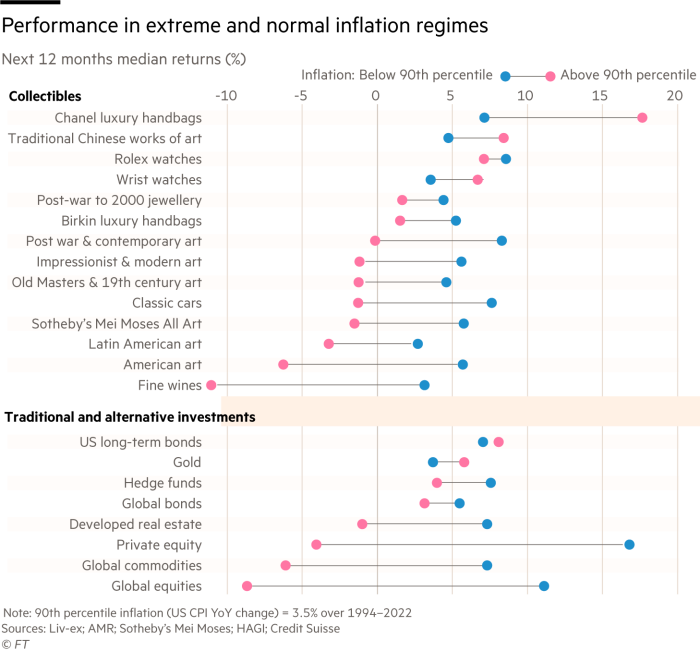

No surprise there, perhaps. What’s more interesting is the researchers’ take on how these physical assets perform in times of extreme inflation, defined as periods when US consumer prices are rising by 3.5 per cent a year or more, which happened only 10 per cent of the time from 1994 to 2022 — the years under review.

The best inflation protection is offered by Chanel handbags, wristwatches (Rolexes, especially) and traditional Chinese works of art, says Credit Suisse. Meanwhile, the assets most vulnerable to periods of high inflation are fine wines and American and Latin American art.

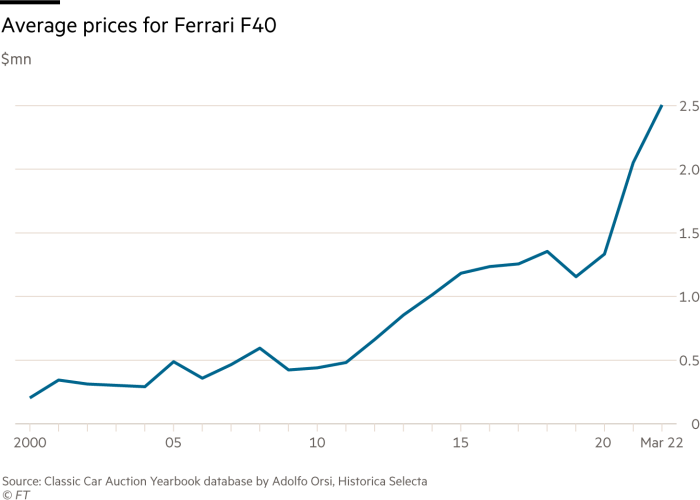

But, before you put your cash in any of this, bear in mind that it is easier to draw charts of upwardly rising Rolex prices than to make a profit from collectibles. These are not plentiful commodities — they are unique or rare items that are often hard to compare or value. Even two vintage watches from the same model range and year may differ in history and condition.

Gold is gold, of course. But gold jewellery’s value will also depend on quality, age and design. Go into diamonds, and the subjective influences multiply. Demand from collectors can be very unpredictable, too, especially in times of financial stress.

On top of that, owning collectibles involves far more cost than holding financial assets: storage and insurance, for example, as well the transaction costs of buying and selling your treasures at auction.

That all said, there is an excitement about collectibles that financial assets never bring. The pleasures of hanging even a very minor Impressionist painting on your wall, of driving a Ferrari F40, or carrying around a perfect Chanel bag are — for some people — simply priceless.

Just don’t expect to turn this stuff easily into cash in a crisis. If you are in need of some insurance, the only collectible that can offer it is a case or two of fine wine. In extremis, you may not be able to find a buyer, but you will at least be able to drown your sorrows in style.

Stefan Wagstyl is the editor of FT Wealth and FT Money. Follow Stefan on Twitter @stefanwagstyl

This article is part of FT Wealth, a section providing in-depth coverage of philanthropy, entrepreneurs, family offices, as well as alternative and impact investment

Comments