Hong Kong to overhaul Hang Seng to reflect Chinese listing boom

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Hong Kong is planning to double the number of stocks in its benchmark index, in a shake-up that will better reflect the growing dominance of Chinese listings in the city’s market.

Hang Seng Indexes will raise the number of stocks in its eponymous benchmark, tracked by about $28bn in exchange traded and local pension funds, from 52 to 80 by mid-2022. It will ultimately raise the total to 100, the company announced after markets closed in Hong Kong on Monday.

Analysts say the move will help the Hang Seng to better reflect mainland Chinese companies, particularly highly valued technology groups that have flocked to raise funds in the Asian financial hub in recent years.

“This is the largest-ever reform of the Hang Seng index,” said Dickie Wong, head of research at Hong Kong-based Kingston Securities. “Expect more and more Chinese companies to be included and more and more Hong Kong companies to be excluded,” he added.

The 50-year-old index provider also said on Monday that it would cap stocks’ individual weightings at 8 per cent, down from 10 per cent at present, with the same limit applied to all members — including New York-listed Alibaba and JD.com, whose weightings are currently capped at 5 per cent due to having sold shares in Hong Kong only as a secondary venue.

It had already announced three new component members from mainland China on Friday, including Alibaba Health Information Technology, a healthcare spin-off of the Chinese ecommerce group.

More than 80 per cent of respondents surveyed during a consultation had backed the expansion of the gauge, Hang Seng Indexes said. It also gained support for capping maximum weightings at 8 per cent and retaining at least some Hong Kong companies in the gauge.

Analysts said the biggest losers from the shake-up would include Hong Kong-focused financial groups and local property developers run by the city’s tycoons, whose longstanding sway over the benchmark has persisted despite their shrinking share of overall market capitalisation.

Hang Seng Indexes last year moved to tweak the index by allowing companies such as Alibaba, whose primary trading venue is New York, to be included but at lower weightings than others including Tencent, whose primary listing in Hong Kong allows it to enjoy a weighting of up to 10 per cent.

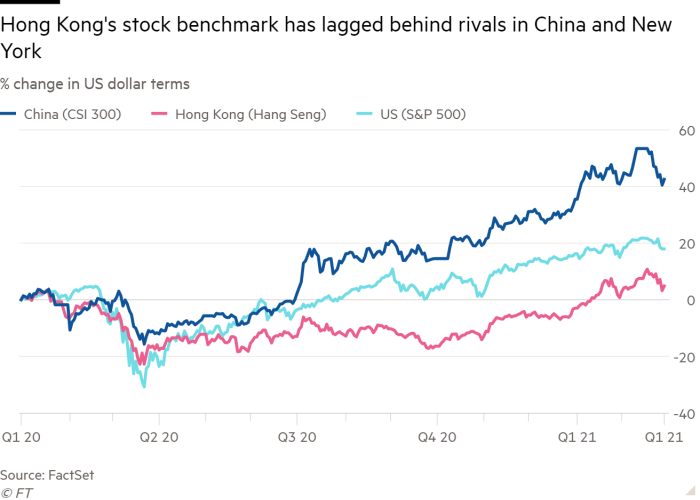

The gauge’s heavier weighting of old-economy stocks has held back the Hang Seng relative to its peers in other financial centres, particularly New York, where tech stocks dominate the benchmark S&P 500 index.

While the new regime will maintain a minimum of 20 Hong Kong companies in the Hang Seng, that leaves plenty of room for higher-valued Chinese stocks to expand as the total is gradually raised to 100.

“The Hang Seng has underperformed other major markets that have more constituents with higher valuations,” said Bruce Pang, head of research at China Renaissance, an investment bank.

“Expect the [revised] Hang Seng to be more representative of the market and gain more favour with investors,” he added.

Comments