Streaming now: eurocrisis, the sequel

Simply sign up to the Eurozone economy myFT Digest -- delivered directly to your inbox.

Edward Price is a former British economic official and current teacher of political economy at New York University’s Center for Global Affairs.

All too often sequels suck, something the euro-area is about to find out.

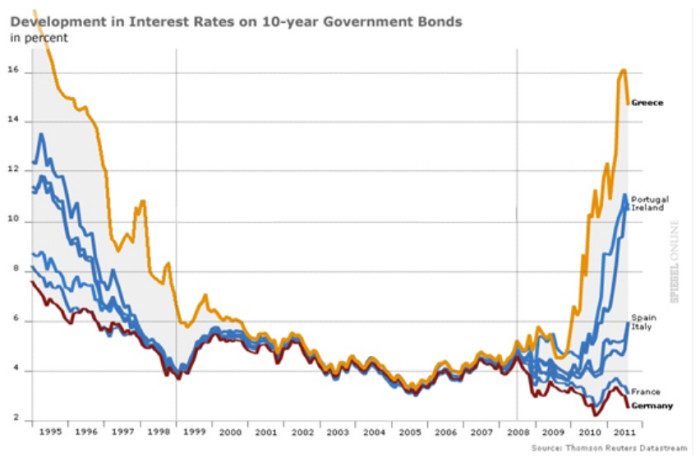

During the euro-area crisis ten years ago, one chart reigned supreme. You remember. The messy one. Sovereign spreads in the euro area.

Oof. When investors realised that lending to Greece was way riskier than lending to Germany, they freaked out. Borrowing costs for European governments diverged. The euro tottered.

Now, there’s a different reason sovereign spreads will widen. The ECB is set to tighten monetary conditions. Witness Christine Lagarde’s promise to tackle inflation in “a determined and sustained manner”. The ECB giveth and the ECB taketh away.

Just like last time, there are three ways to address the problem that will follow: higher borrowing costs in the European periphery and the threat therein that the euro itself will implode.

The first is structural: shrink. Kick weak euro-area countries out of the single currency. Of course, nobody wanted that the first time around, as it would have killed the euro. Even so, most commentators thought some expulsions, starting with Grexit, were likely (although yours truly thought otherwise #winning).

The second way to erase sovereign spreads is also structural: soothe. Germany could have placed its full fiscal capacity at the disposal of weaker economies like Greece. This would have palliated markets, and those calmer markets would then have lent to Berlin via Athens. But Germany was like . . . nee. This export money is ours, made and earned in Germany.

And then there’s the third option: sing. This is what Europe eventually did the last time. Super Mario saved the day with his power ballad “whatever it takes”. And his smash hit has been number one in the euro area ever since. The cantor-like ECB kept sovereign spreads tight.

However, this third solution relied on easy money, meaning it was temporary. Whenever the dead hand of the international macro-machine eventually ruled out a low global R-star, “whatever it takes” would rapidly become “whatever, it’s fake.”

And that’s what’s happening now. Peripheral risk premia in the euro area are back, and the ECB is still set on removing its broad monetary support. Facing record euro-area consumer inflation, at 8.1%, the ECB will raise interest rates by 25 basis points next month. Lord help us. Writing on Friday in the FT, Lorenzo Bini Smaghi said the ECB “needs to tighten monetary policy in order to rein in unexpectedly high inflation and at the same time prevent fragmentation of financial markets across the eurozone.”

Smaghi is wise. Prices are out of control and the cheap money needs to stop. And yet fragmentation — the break-up of euro markets/the euro — would be terrifying. For now, it seems the ECB has cauterised the wound with its emergency anti-fragmentation instrument. But all told, singing is no longer an option. Only shrinking or soothing remain.

What, then, should the euro do? Shrink itself by breaking up or soothe its lenders with fiscal policy?

It all comes down to what the euro really is. Exoterically, the European single currency is an upside risk. It is a safe, sound, real currency enabling peace and commerce in Europe. That lobbies for soothing markets with a new pan-European fiscal approach.

Esoterically, however, the euro is a downside risk. It is a potentially unsafe, unsound, and unnatural experiment. Rather than long-term prosperity, the euro might have enabled little more than unsustainable debt burps in the Palazzo delle Finanze. That suggests shrinking, and a smaller fiscal club. Or just ending it altogether.

And so, a question: whither the euro? If it looks like the single currency will implode, the ECB Berlin may step in to save the single currency. Welcome to a massive United States of Europe. This mega-pint of a sovereign will sell but one form of debt. Alternatively, if it looks like the euro may implode, Brussels Berlin may kick some other capitals out. Welcome to either a smol United States of Europe, or none. Either way, you can’t escape “the euro”. You just have to choose which “euro” you think you’re looking at. One currency to rule them all? Or one currency to fool them all?

Germany, we know you’re busy manufacturing some totally sweet tanks at the moment, but you’re up.

Comments