Digital tools drive art market’s move into the cloud

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In March, when a token representing a digital collage by the artist Beeple sold for $69.3m at auction, the art world took notice.

It was the latest sale of a non-fungible token: a line of code locked into the blockchain — an unalterable computer register — as a record, or a certificate of authenticity, of an intangible asset. As such, NFTs can enable the buying and selling of digital artworks and could, according to some, revolutionise the market, although others have criticised NFTs as a get-rich-quick scheme.

The interest in NFTs — which can record digital creations ranging from images to video clips and music — reflects a broader shift towards online art viewing and sales since coronavirus lockdowns were imposed.

“When the pandemic hit, that was a catalyst for the excitement in NFTs really starting to take off,” says Ryoma Ito, head of marketing at MakersPlace, an online NFT art marketplace. “As more people got into crypto[currencies], it led to more people going into NFTs . . . more creators and more collectors.”

This shift appears to have been driven by a younger generation of collector to whom notions of original versus reproduction may be less relevant than they once were. A breakdown of bidders for Beeple’s “The First 5000 Days” collage in the recent Christie’s sale shows 91 per cent were new to the auction house, while 58 per cent were millennials.

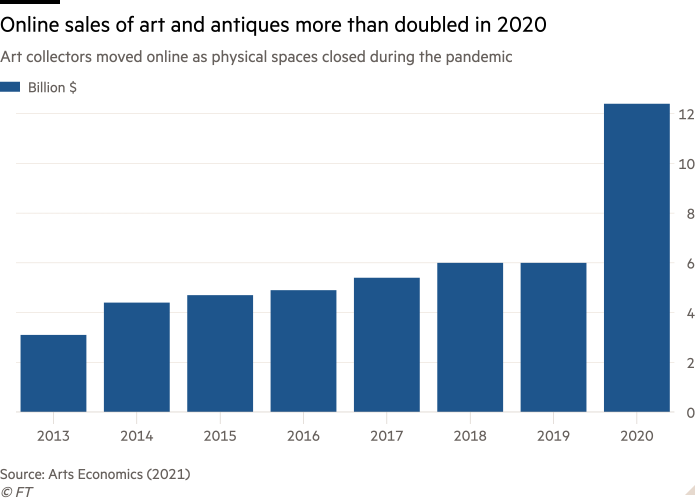

“The First 5000 Days” auction followed a period in which online art sales doubled in value in just a year. The Art Basel and UBS Global Art Market Report published in March found that global online art sales reached $12.4bn in 2020 representing 25 per cent of total art sales, up from 9 per cent in 2019.

Report author Clare McAndrew says that, after widely-anticipated growth in online art sales failed to materialise for years, the lack of opportunity to buy in-person prompted collectors to embrace online channels.

“Although people were buying randomly for high prices online, the ceiling went right up on what people would spend,” says McAndrew. “Collectors didn’t have opportunities to visit exhibitions and the content that was being produced online was really improving.”

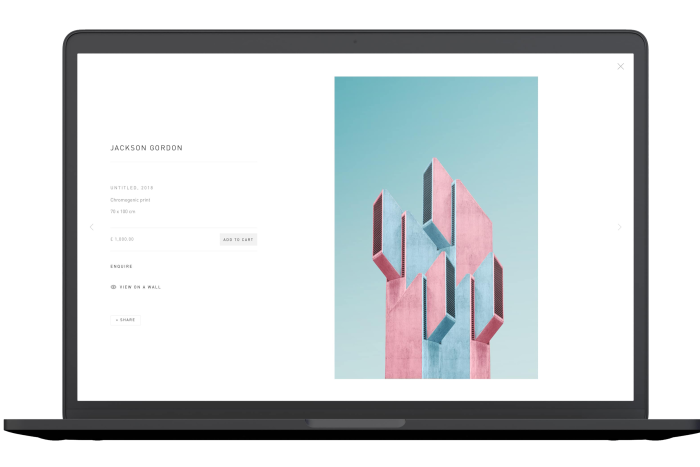

Similarly, the jump in quality of cloud-powered online gallery presentations was shown by the growth in online viewing rooms (OVRs) — immersive internet viewing experiences in which an artist’s creative process can be documented alongside works offered for sale.

While the Art Basel/UBS report found internet auctions were the most popular method for purchasing art online in 2020, OVRs came a close second.

As galleries around the world were forced to close physical spaces, those that invested in online sales channels prior to the pandemic had a head start.

David Zwirner became the first international gallery to open an OVR in 2017 and, since the pandemic, it has launched two new OVR channels: Studio, accessible to all and dedicated to selling works by the gallery’s roster of artists, including Stan Douglas and Thomas Ruff; and Exceptional Works, an invitation-only platform selling works on the secondary market by artists such as Josef Albers and Sherrie Levine.

Online art has not only broadened access to sales but has encouraged a new generation of buyers to join the market, says Zwirner.

“What the online space has taught [us] is that there’s a world of collectors, many of them young millennials, who are following what we’re doing but are not necessarily people who attend art fairs or show up in galleries,” he says. “There’s a lot of people that really love the online space.”

Joe Elliott, chief commercial officer of Artlogic, a London-based gallery management software and website company, sees a future in which physical gallery spaces coexist with OVRs.

“As we start to move into a hybrid world, and also a world where we realise that people are not going to jump on a plane and go back to fairs, they [galleries] need the digital tools to cater to those people who can’t make it,” Elliott says.

Galleries are “realising that digital tools act as a much more accessible means for the entire world to come and see the content of the fair, as opposed to just those who can physically visit it”, he adds.

Artlogic says that the number of its clients wanting to use OVRs has grown from one in 40 before the pandemic to one in three today.

Next month, David Zwirner is launching Program, live-streamed virtual walk-throughs of galleries in New York, London, Paris and Hong Kong, featuring works by 40 artists including Yayoi Kusama, Thomas Ruff and Kerry James Marshall.

Since the Beeple sale, MakersPlace has partnered with global contemporary art galleries to offer NFT works by artists such as Urs Fischer while, in March, HOFA Gallery in London launched “Pink Flower” by Zhuang Hong Yi as its inaugural NFT art offering.

More stories from this report

Repair, replicate and correct: how cloud automation is changing IT

Big Tech races to clean up act as cloud energy use grows

Office, home or hybrid? Business must embrace the evolution of work

Pandemic provides the push for Latin America to embrace the cloud

Cloud becomes new front line between China and the west

Academics edge closer to dream of research on cloud platforms

Most gallerists surveyed by McAndrew said increasing their online presence was a priority for the year ahead, but the return of physical art fairs such as Frieze London in October and Paris Photo in November cannot come soon enough for those reliant on face-to-face relationships.

For all the new clients attracted by online viewing, more than two-thirds of sales still come from clients already known to galleries.

“This is the problem with online,” says McAndrew. “Fairs are good for starting off new relationships. You can make one sale online, but it’s difficult to start a long-term [client] relationship online. You need that physical element as well.”

Comments