Barclays’ cull of 21 ETNs puts structure on shaky ground in US

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

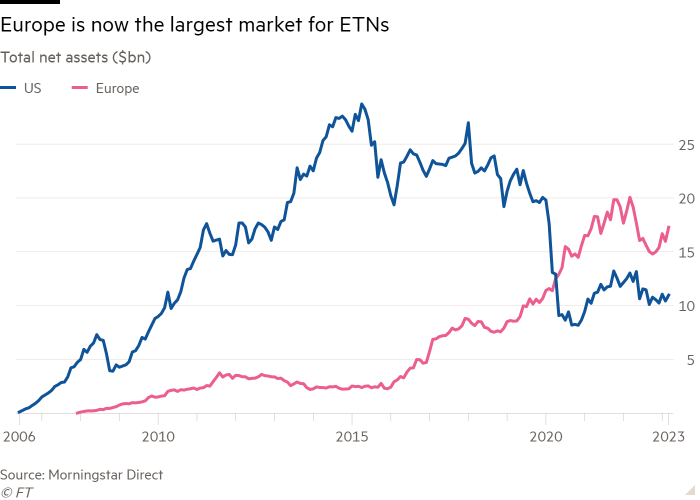

Barclays’ decision to axe almost half of its exchange traded note range appears to be eroding support for the structure in the US, but analysis reveals ETNs are showing resilience in Europe.

ETNs — born and bred in the US — are unsecured debt obligations issued by a sponsor, typically a bank, which promise to deliver the returns of an underlying investment exposure in return for a fee.

They are often lumped into the booming $10tn exchange traded fund sector. Although not technically ETFs, they both come under the umbrella of exchange traded products.

ETNs have endured a rocky few years in the US, though, often driven by their esoteric, high-risk exposures.

In 2018 Credit Suisse’s short volatility XIV ETN was killed off after collapsing 90 per cent in one day. Two years later the Swiss bank, then the largest ETN sponsor, delisted and suspended nine leveraged and inverse ETNs.

In March 2020, WisdomTree had to close its three times leveraged oil products after their value was wiped out by Covid-induced market volatility.

Last year Barclays, then the industry number two, had to suspend creation of new units across most of its ETN range for several months after inadvertently exceeding the $20.8bn of structured note issuance (including ETNs) it had regulatory approval for by $15.2bn.

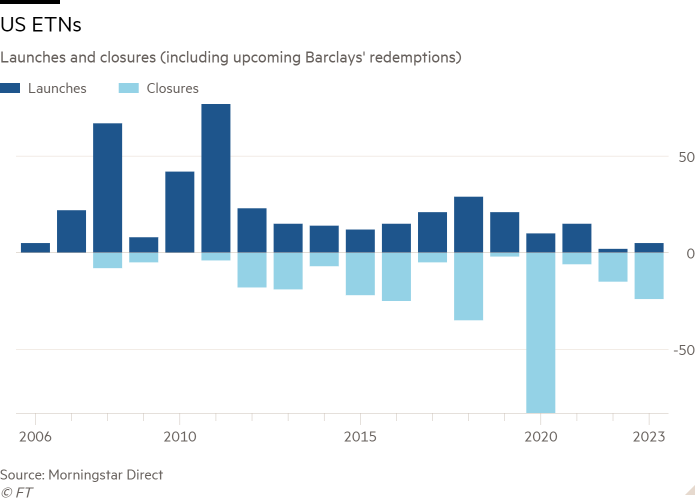

Now Barclays has unveiled plans to close 21 of its 50 New York-listed iPath ETNs, offering exposure to commodities from copper to coffee, in June.

The affected ETNs accounted for $517mn of the $1.7bn held in the iPath range at the end of March, according to Morningstar Direct data.

Shilpa Akella, head of equities structuring for the Americas at Barclays, said the UK bank was “focused on a core set of products and services that match client interest and demand”, and remained “firmly committed to building a leading position in global equity exchange traded products”.

Akella added that the ETNs due to be axed “represent a very small amount of notional in our overall portfolio and of our revenue”. She did not rule out the possibility of Barclays launching new ETNs if the demand was there.

The closures will cut the number of US-listed ETNs to 125, according to Morningstar, a far cry from the peak of 221 in 2019, even as ETFs have grown at a ferocious pace.

US assets under management have also tumbled, from a peak of $27bn in January 2018 to just $11bn at the end of March. Alarmingly, Morningstar data point to net inflows of $32.3bn since 2006, suggesting more than $20bn of value destruction due to the underlying exposures.

The situation in Europe is somewhat healthier, though. Admittedly the number of ETNs has fallen even more sharply from a peak of 270 in 2019 to just 94, after 233 products were scrapped in 2020.

However, assets have held steadier, at $17.3bn, not far below the zenith of $20.1bn in March 2022. As a result, Europe has been the larger market since mid-2020. Europeans have also been more successful with their investments, with cumulative $8.7bn of net inflows meaning they have, on average, doubled their money.

The differing outcomes may largely be down to regulation. In the US, ETNs are dominated by commodity and leveraged and inverse exposures, although the world’s largest note, the $2.6bn JPMorgan Alerian MLP ETN, invests in master limited partnerships.

Europe also has a lot of leveraged and inverse ETNs, but the structure appears to have found a niche in being able to offer exposure to an array of cryptocurrencies, led by bitcoin and ether. Such structures are barred by the Securities and Exchange Commission in the US.

Analysts are, though, downbeat on ETNs’ prospects of a comeback.

Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, said they “they have a place” in that they “can provide some exposures that may not be available in an ETF”, such as to a single commodity, although spread betting is often a viable alternative.

However, on the downside “there is an additional layer of risk, over and above the exposure that you are getting”, in the form of counterparty risk with the issuing bank.

“They service a market need, but most investors should not really be looking at them,” Lamont said. “They offer fringe exposures. They have always been a bit Wild West. Are they dead? No. Are they the future? Probably not.”

Nate Geraci, president of The ETF Store, said ETNs had some potential benefits over ETFs in the US, such as “better tax efficiency, tighter benchmark tracking and the ability to traffic in areas that are difficult for investors to access”.

Nevertheless, he questioned whether the average investor really needed exposure to triple-leveraged prominent technology stocks such as Apple, or triple-leveraged inverse gold mining stocks. “Issuers can say these products are geared towards more sophisticated investors, but they often end up in the hands of unwitting retail investors,” he added.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

Moreover, Geraci said “it seems that investors continually play second fiddle to the whims of issuing banks”, which can redeem ETNs at will.

“From a broader industry perspective, I worry that ETNs are giving the entire ETF industry a bad name,” Geraci added. “Whenever ETNs are in the headlines, it’s typically for negative reasons.

“I’m a strong proponent of providing investors greater access to financial markets, but the combination of banks’ poor track record of supporting these products, the potential credit risk and the outlandish exposure has me in the camp that ETNs should be put out of their misery.”

Comments