Tullow Oil: the end of an era for exploration and production

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Those who built the oil industry had to be good at two things: finding the black stuff and getting it out of the ground.

BP, Shell and ExxonMobil are a few of the integrated oil majors that pioneered and dominate the industry today. As well as doing the production, they refine, transport, sell and trade oil, natural gas and their products.

Climate change and the need to decarbonise is changing that. Oil majors are investing in renewables and diversifying from fossil fuels.

But the transition is proving painful for smaller groups that specialise in finding and developing new resources — known as exploration and production companies. London-listed Tullow Oil, Capricorn and Harbour Energy are some of the E&Ps having a particularly tough time.

Tullow’s story — from £15bn market darling to £550mn small-cap stock — illustrates the changes the sector has undergone. An update this week highlighted its focus on repairing holes in its overleveraged balance sheet rather than digging new ones in the ground for oil.

Exploration success used to be feted by the market because it gave canny companies access to cheap oil and gas that they could either develop or sell on to the majors at vast profits.

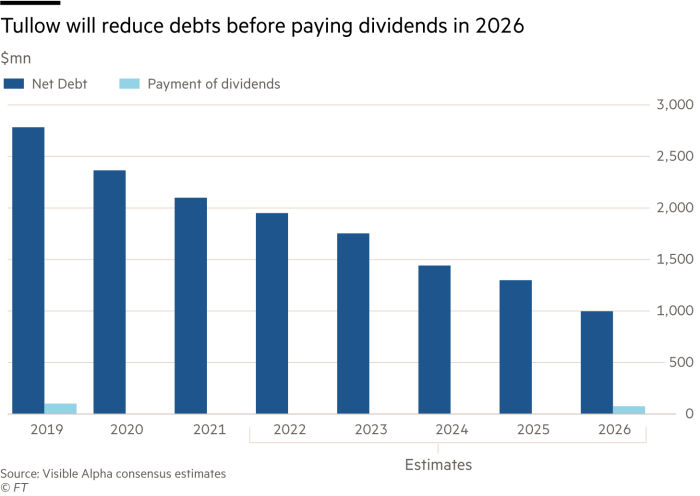

Tullow made knockout discoveries in the 2000s in Ghana and Uganda. But then things turned sour after a number of unsuccessful attempts. That left Tullow struggling to pay back a huge debt load — $1.9bn net of cash last year — with little to bet on the exploration roulette.

Net zero put the final nail in Tullow’s exploration-led strategy. As the International Energy Agency noted, a 1.5C trajectory requires no new investment in oil and gas. And even those who believe the world will transition more slowly have been unwilling to fund long-term bets, amid fears that discovered barrels will stay underground.

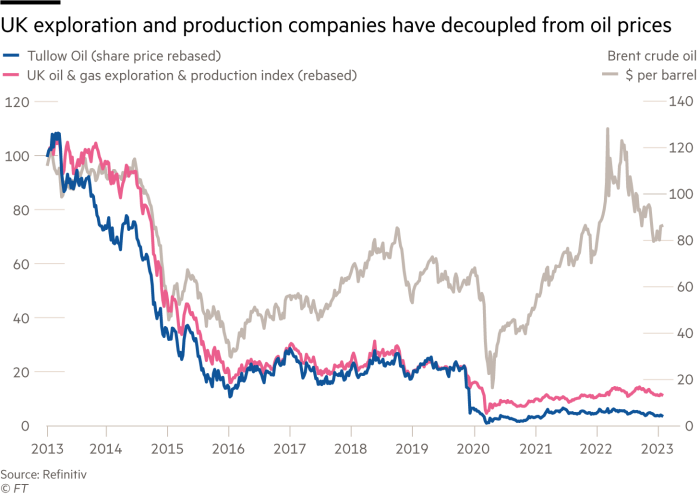

Share prices for Tullow and other E&Ps have grown less sensitive to rising oil prices over the past decade. Relatively small oil and gas finds simply attract very little attention from the market.

As a result, oil and gas majors have concentrated their exploration capital expenditure on really big new plays — such as TotalEnergies’ and Shell’s finds in offshore Namibia — and rerouting most of their gushing cash flows to shareholders as dividends and buybacks. European oil majors will return 11 per cent of their worth to shareholders in cash this year, thinks Goldman Sachs.

Instead of exploration, Tullow will focus on getting as much cash out of its working wells as efficiently as possible. Hopes of further big finds have been abandoned. Tullow forecasts its exploration capex at just $30mn in 2023 or less than a tenth of its total investment this year.

Once debts have been reduced Tullow hopes to start returning cash to shareholders too. Growth will come not from new wells, but by becoming better at managing legacy assets — a useful skill in a sector which the world needs to wind down.

US CDs/T-bills take the shine off cash

No US personal investment strategy has transformed quite in the way certificates of deposit (CDs) and short-dated Treasury bonds have in recent months.

For the past decade, CDs — which banks offer to savers with a fixed return for a defined period — have not been a big part of private portfolios because they paid such low rates. But aggressive rate rises by the Federal Reserve mean US banks are having to fight harder for savers’ cash.

At Citigroup, customers can get a 4.15 per cent annual percentage yield (APY) on a 12-month CD. Marcus, Goldman Sachs’s consumer banking business, offers CDs with a 4.4 per cent APY. This compares to the start of 2022 when average national CD rates were less than 0.5 per cent.

Even JPMorgan — one of the biggest beneficiaries of the surge in new deposits during the pandemic — has launched a three-month certificate of deposit that offers a 4 per cent APY.

The biggest US bank by assets warned this month that it might be forced to pay more for deposits this year. Its outlook for $73bn in net interest income in 2023 — what it makes from loans less what it pays on deposits — was still higher than the $67bn recorded for 2022.

Private investors have also crowded into auctions for newly issued short-dated Treasuries, called T-bills. In each of the Treasury department’s four-week T-bill auctions since November, individuals consistently snapped up more than 2 per cent of the notes. That compares with about 0.7 per cent at the start of 2022.

All of this may offer little consolation when both inflation and 30-year mortgage rates are running above 6 per cent. But with stocks still subject to earnings shocks and bond prices expected to remain under pressure from further Fed rate rises, investors need to be patient. A CD with a 4 per cent return is a sensible, safe place to park your cash while you ponder whether the US equities bear market is really over.

Lex Populi is an FT Money column from Lex, the FT’s daily commentary service on global capital. Lex Populi aims to offer fresh insights to seasoned private investors while demystifying financial analysis for newcomers. Lexfeedback@ft.com

Lex is the FT’s incisive daily column on companies, sectors and asset classes for premium subscribers. Expert writers in London, New York, San Francisco and Seoul offer concise, witty commentary on capital trends and important businesses. Click to see more

Comments