Dealers expect discerning audience at Tefaf in tightening market for Old Masters

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Old Master dealers are bringing their most prestigious works to the 36th edition of Tefaf in Maastricht next week, reflecting how the Dutch fine art fair remains the pre-eminent place to gauge the state of the market. But perennial warnings about a tight supply of masterpieces and curious dynamics within the market show that not everything is smooth.

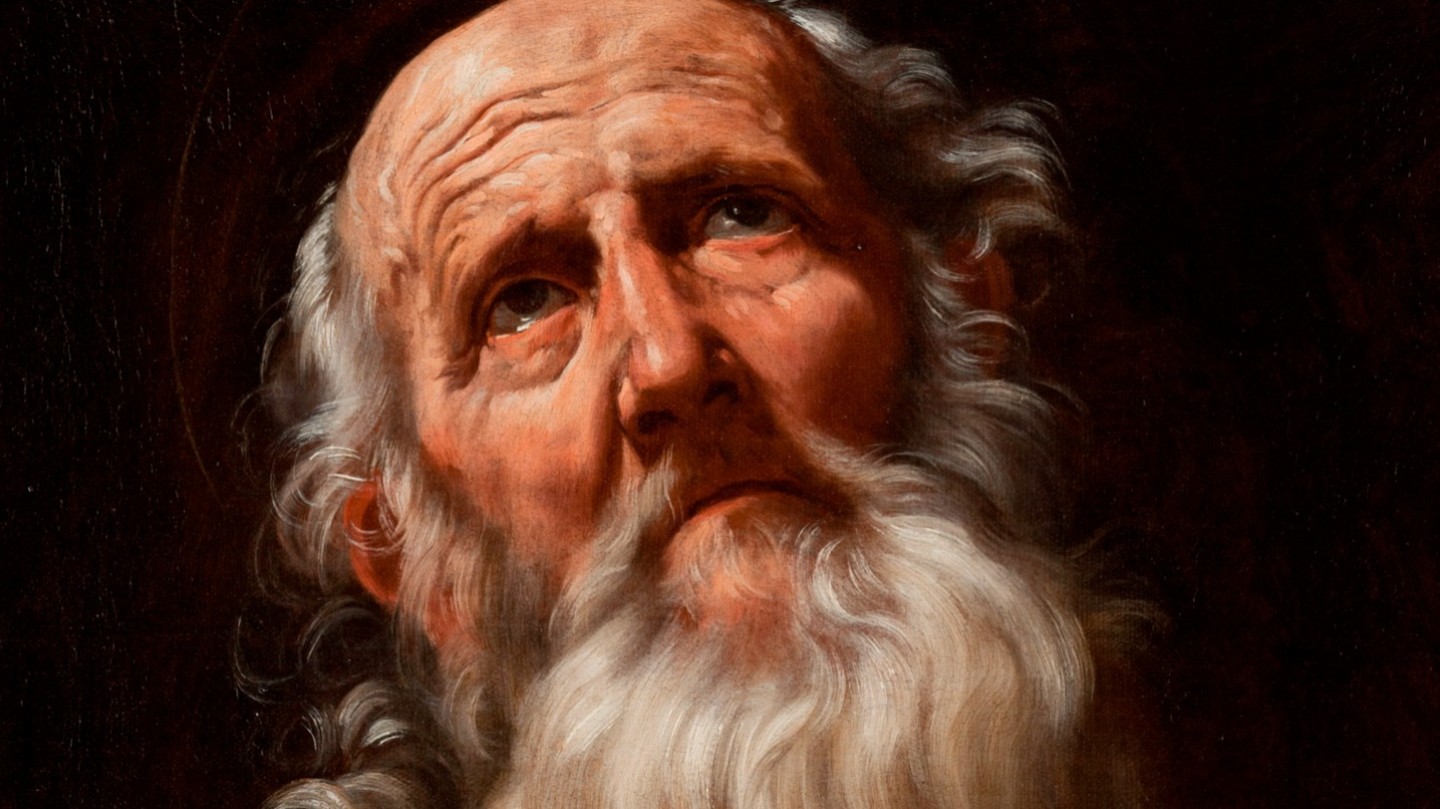

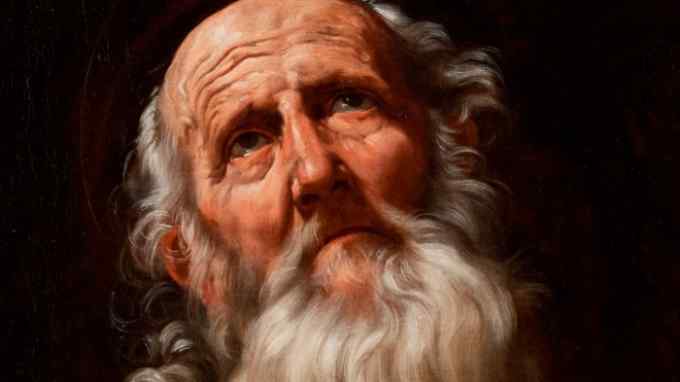

Galerie Canesso of Paris is showing Guido Reni’s “Saint Jerome” (c1610, €1.3mn), a rediscovery described by gallery founder Maurizio Canesso as “a new addition to the oeuvre of this great Bolognese master”. Canesso adds: “We’re presenting it at Tefaf because that’s where this kind of picture meets the expectations of a highly demanding audience — both museums and private collectors — who are seeking such a work which is very rare on the market.”

New York dealer Nicholas Hall says that Tefaf is the best showcase for a triptych depicting the adoration of the Magi (c1525-30, price undisclosed) by Pieter Coecke van Aelst, a leading exponent of the Antwerp Mannerist school, because of the calibre of collector who attends. “The underdrawing establishes that the master himself was directly involved in the production of this beautifully preserved panel,” Hall says.

The market for Old Masters — broadly covering the period from 1300 to 1800 — is seemingly in good health, buoyed by the avalanche of acclaim for the blockbuster Vermeer exhibition at the Rijksmuseum in Amsterdam. Dedicated January sales in New York delivered mixed results, but there were some healthy headline lots, including Bronzino’s “Portrait of a young man with a quill and a sheet of paper” (c1527), which fetched $10.7mn with fees at Sotheby’s. At Christie’s, dual portraits of a mother and daughter by Goya set an auction record for the Spanish painter, selling for $16.4mn with fees.

There are red flags however. Writing in Apollo magazine, commentator Jane Morris says that experts periodically predict the “long, slow demise of the category”. Indeed, sector specialists say there is less “noise” today around Old Masters, which is perceived as a niche market. European Old Masters represented only 4 per cent of fine-art auction sales in 2021, according to the 2022 Art Basel/UBS Art Market report. Auction sales did rise by 65 per cent to $464mn, but that was driven by a few expensive lots and came off a 15-year low.

Morris adds that “it is more accurate to say that the Old Masters market has remained the same while everything else around it has grown”, highlighting how the Old Master figures are often overshadowed by soaring postwar and contemporary results. Sotheby’s and Christie’s made £33mn and £13mn respectively in their evening Old Master sales last December in London; for comparison, a single lot in Christie’s 21st-century evening sale in New York last November, Jean-Michel Basquiat’s “Sugar Ray Robinson” (1982), sold for $32.7mn with fees.

Andrea Ciaroni of Milan-based Altomani & Sons argues that the Old Masters market is a world apart from the contemporary art sector. “The former is not simply a niche market but a market of true connoisseurs and passionate buyers who appreciate the beauty and mastery of the art on display. In contrast, the contemporary art market is often driven by fashion, trends, and the desire to make investments.”

Altomani & Sons is showing at Tefaf pieces it hopes will “astound art enthusiasts”, says Ciaroni, referring to a pair of works depicting Saint Jerome. “Both paintings are signed and dated, with one by Antonio Campi, who was Caravaggio’s first master during his time in Milan. The other is by Abraham Janssen, a prominent Flemish artist who adopted Caravaggio’s innovative use of light.” Prices are undisclosed.

Old Master dealers invariably highlight an enduring dilemma, however: the dearth of good material available. Ciaroni says that “it is indeed true that the availability of masterpieces in the art market is in a continuous state of rarefaction. This is due to the fact that over time many of these great works find their way into museums, thus leaving the market.”

Hall says there is undeniably a diminished supply of works by the most famous artists, though he adds that five paintings attributed to Botticelli have come to market in the past two years. (“Madonna of the Magnificat”, from the collection of the late Microsoft billionaire Paul Allen, sold for $48.5mn with fees at Christie’s New York in November.)

London dealer Charles Beddington says many great paintings still see the light every year. However, he stresses a curious attitude among collectors: “The lower the price range, the less demand there is.” At Tefaf he is offering “A View of Westminster Bridge” by Canaletto, which shows the Lord Mayor’s procession on the Thames on May 25 1750. “This is one of the most significant views of London in the 18th century ever likely to surface on the market,” he says. Yet it is only priced at €3.2mn.

There are silver linings nonetheless. “There is little demand for lower-price-range works at the moment,” says Carlo Milano of Callisto Fine Arts, London, “but don’t forget that there could be gems hiding there. Buy the good painting by the petits maîtres [less well-known masters], rather than a bad painting by a famous name.”

If dealers want to tap into the “lower end”, they need to market their product thoughtfully at major events such as Tefaf, argues Hall. “The key is to put works at a range of prices alongside each other and to show that even the art on the lower end of the spectrum is authentic, well preserved and of real aesthetic and historic merit,” he says.

So are there reasons to be cheerful about the Old Masters market? Davide Trevisani of Maurizio Nobile Fine Art gallery in Paris, another Tefaf participant, says a new generation of young art collectors is turning to Old Masters. “These include 30- to 35-year-old entrepreneurs from [tech] start-ups. There is a very interesting niche of new potential clients with spending power of up to €80,000 to €100,000 per purchase,” he says.

Milano also thinks new clients with eclectic taste may be the market cheerleaders in the future. “I think it is not time yet to pull the ready-made obituary for the Old Masters from the drawer.”

March 11-19, tefaf.com

Comments