SnapAV: follow the ETF

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Sometimes a snappy paragraph or two can help to elucidate on a crucial market move but, sometimes, a chart tells you all you really need to know:

With the Russian stock market suspended by its central bank, the VanEck Russia ETF, which is traded on the CBOE and has around $1.3bn of assets, is almost the next best thing we have to see how traders are weighing the effect of Western sanctions on the Eurasian nation.

And the answer — down 27.5 per cent today in morning trading — says it all.

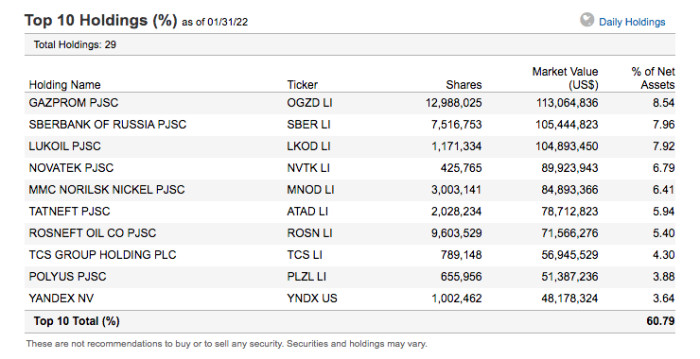

For those who want to know, here’s how its portfolio looked as of the end of last month:

With the ADRs (shares deposited in a foreign bank, and then made available to trade on a foreign exchange in the local currency) of its 2nd largest position, Sberbank, down 70 per cent in the UK this Tuesday, a haircut of a third just might be the best it’s going to get for a while for those who decided to bottom fish Russian stocks over the past few weeks.

Click here to visit the ETF Hub

Comments