Investors pile into market rally as economic slowdown risk ebbs

Simply sign up to the US equities myFT Digest -- delivered directly to your inbox.

Investors’ fears of an economic slowdown are rapidly ebbing, fuelling a rally which is boosting the riskiest asset classes in particular as the “fear of missing out” that dominated stock markets before last year’s sell-off returns in force.

The S&P 500 US share index is up 8 per cent since the start of the year and the Nasdaq Composite, which is weighted towards America’s tech giants, has rallied 16 per cent. They were down by a fifth and a third respectively last year.

Friday’s blockbuster US jobs report helped bolster investors’ confidence about the strength of the American economy, despite the risk that it could prod the US Federal Reserve to keep monetary policy tighter for longer as it attempts to subdue still-high inflation. Markets closed up on the week despite dipping after the jobs report was published.

“Markets are pricing in the end of the inflation problem and . . . very heavily discounting the risk of a tail event,” said Nitin Saksena, head of US equity derivatives research at Bank of America, referring to unlikely but high impact events that are difficult to model.

“The risk of a severe recession, a policy mistake, or a second wave of inflation is becoming an afterthought,” he said.

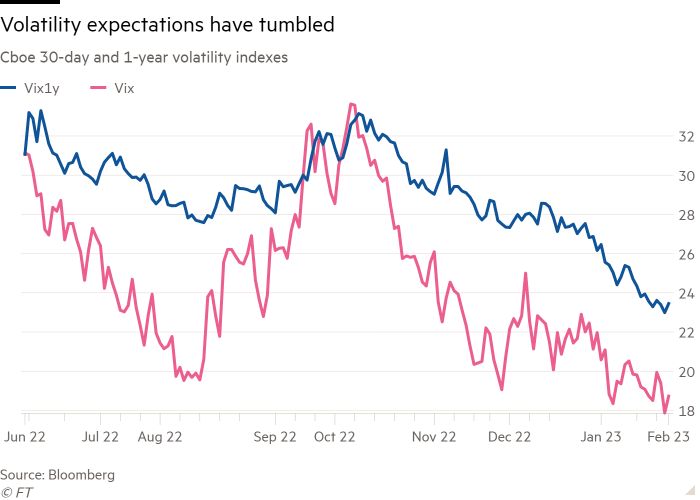

Cboe’s Vix index, which tracks investor expectations of volatility over the next month and is often referred to as Wall Street’s “fear gauge”, has plunged since the start of the year. It has been below its long-term average of 20 for two consecutive weeks, the longest stretch of low volatility since the beginning of last year.

The one-year Vix, which tracks expectations of stock market swings over the next year, this week touched its lowest level since the onset of the coronavirus pandemic.

“This tells you there’s some really strong reassessment of the future, not just the next month,” said Saksena.

Assets that were among the most beaten-up in last year’s sell-off are now the best performers. Bitcoin has jumped over 40 per cent, while Cathy Wood’s ARK Innovation fund — which is dominated by high-growth tech stocks — is up 46 per cent.

Analysts and investors at large banks and asset managers such as Morgan Stanley, UBS and BlackRock have repeatedly argued that markets have been too optimistic, but stocks have so far largely shrugged off weak fourth quarter corporate results. This is despite the fact the S&P 500 is on track to report its first year on year earnings decline since the height of the pandemic.

They have also ignored the Fed’s insistence that it will hold interest rates at an elevated level for a long time rather than quickly pivot to cuts.

The sudden improvement in the global economic outlook has bolstered the optimists’ argument. As recently as the start of this year, the IMF was warning that a third of the world faced a downturn; but this week it raised its forecasts and said the world was “well away from any [sign of] global recession”.

Investors are becoming increasingly confident that the Fed can subdue inflation without causing a major recession.

On several occasions last year, Fed chair Jay Powell helped to end similar market rallies by warning that the central bank did not want financial conditions to ease too soon. This week, however, he appeared relaxed about the recent gains, noting that “our focus is not on short-term moves” and declaring for the first time that “the disinflationary process has started”.

The extent of the rally has been exacerbated by factors ranging from timing to investor psychology.

For some hedge funds and quantitative investors, a drop in the Vix has a mechanical effect on risk calculations that leads them to increase leverage and add exposure to stocks. For many wealth managers, meanwhile, tax incentives created extra selling pressure in December and the chance to pick up bargains in the new year.

“If you had anything you were contemplating getting out of, December was the time to do it,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab. “Once those tax loss harvesting opportunities go away, people have money to spend and an opportunity to buy everything 20 per cent off.”

Once prices have started to rise, it becomes increasingly difficult for other investors to resist, even if their views on the economic outlook have not fundamentally changed.

Mike Lewis, head of US equity cash trading at Barclays, said: “There is a lot of cash on the sidelines after last year and that creates a conundrum [for investors] — people don’t want to miss a rally . . . you get a little bit of FOMO [fear of missing out].”

Lewis said the recent outperformance of assets like lossmaking tech stocks is “not what sustainable rallies are made of” but there were few obvious events on the horizon that could trigger a reversal.

Still, even some optimists believe the extent of the rally has become extreme.

Jonathan Golub, chief US market strategist at Credit Suisse, said there were “lots of reasons to build a positive narrative, and I think the bears are ignoring that there is a lot of good news” but “the market is behaving as if we’re on the other side of a recession that hasn’t even happened yet”.

Lewis suggested that economic data would be more important than Fed commentary in changing investors’ minds about the outlook for interest rates — but that could take several months.

“The thing that could create a risk hiccup is if we don’t start seeing some slack in the labour market [by the time] we approach the summer,” he said. “It could lead to a tough second half, but that’s a long way away.”

Comments