Better stock selection boosted ESG funds, research suggests

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Avoiding exposure to fossil fuel companies, which slumped earlier this year when oil prices crashed, cannot explain all of the outperformance of funds, invested according to environmental, social and governance principles, new research suggests.

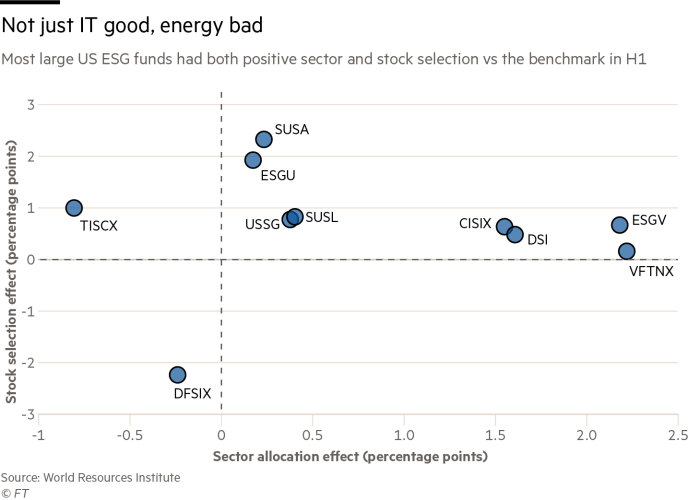

The World Resources Institute, a Washington DC-based sustainable development think-tank, found that nine of the 10 largest US mutual and exchange traded ESG funds, all of which are focused on large-cap US stocks, outperformed a benchmark, the Vanguard S&P 500 ETF (VOO), after fees, in the first half of 2020. On average they beat the benchmark by 2.1 percentage points.

These funds’ exposure to information technology, the best performing sector in H1, was on average 1.71 percentage points above that of the benchmark, while their exposure to energy, the worst performing sector, was typically 1.33 points less than for VOO.

However, using attribution analysis, which is used to determine the sources of excess returns, the researchers found that the differences in sector exposure accounted for just 0.77 percentage points of the funds’ outperformance.

Notably, nearly 0.65 percentage points of outperformance was gained by picking better performing stocks within each sector, the in-depth analysis showed.

The remaining 68 basis points of outperformance resulted from factors such as the “interaction effect” between positive sector and stock selection, and, potentially, the benefits of well-timed trading.

The positive stock-selection effects were highest in the financial, healthcare and industrial sectors.

The one large ESG fund that underperformed the benchmark, Dimensional Fund Advisors US Sustainability Core 1, had a larger exposure to smaller companies, the researchers found, which typically underperformed blue-chip stocks during the period.

“Surprisingly, the largest ESG funds are doing well on both fronts: asset allocation and stock selection,” said Lihuan Zhou, lead author of the analysis. “We thought [the stock-selection effect] was very intriguing.”

However Mr Zhou said the lack of clarity in the stock selection methodologies underlying the funds made it difficult to ascertain why the impact had been positive in the first six months of the year, and hence to glean any real insights as to whether it was repeatable.

“We didn’t find a very good answer, partly because the fund processes and indexes remain a black box,” he added.

The strongest performing large ESG fund in H1 for instance, was the iShares MSCI USA ESG Select ETF (SUSA), which is based on the MSCI USA Extended ESG Select Index.

The latter is modelled on portfolios calculated by MSCI ESG Research. Each company is given a rating from triple-A to triple-C based on its exposure to industry-specific ESG risks and its ability to manage those risks relative to its peers.

Mr Zhou said it was unclear exactly how the ESG ratings of index providers such as MSCI were arrived at, however.

“We can only find limited information on stock selection from public data,” he said. “Investors would benefit from greater transparency [and] published methodologies.”

Linda-Eling Lee, global head of ESG research at MSCI, countered that although the full granular data on each company was only available to clients and the companies themselves, the ESG ratings system was openly available for scrutiny.

“I think that we are pretty transparent about the entire process and well as about the methodological components,” she said. “I think what is true is [these models] are complex. I feel there is some confusion between complexity and transparency.” MSCI alone runs 1,000 ESG indices across equity and fixed income.

This complexity is heightened by the fact that rival index providers often have wildly divergent methodologies, meaning that one company can be given very different ESG ratings by different organisations.

ETF screener

Interested in finding out more? Our ETF Hub means in-depth data, news, analysis and other essential investment information is only one click away.

Setting that aside, there would appear to be three possible explanations for the strong stock selection exhibited by most of the funds.

One is that there could be some element of “ESGness,” or a high ESG rating, that does genuinely lead a company to outperform its sector peers.

Mr Zhou said there might be some tentative evidence for this. “The two funds that have the greatest [stock] selection effect, SUSA and ESGU [iShares ESG MSCI USA ETF], use what we call ESG optimisation for each sector,” he said. “They were overweight companies with greater ESG performance. It looks like they have had some success in that [although] it’s very hard to know.”

Ms Lee said MSCI’s research covering 1,600 stocks and stretching back over 13 years suggested that companies with a high ESG rating “tended to be more profitable, pay more in dividends, face fewer catastrophic losses in share price and be less volatile”, than lower-rated sector peers, supporting this hypothesis.

An alternative, or perhaps supplementary, factor might be momentum. Given the weight of money flowing into ESG strategies, these inflows might simply have bid up the prices of the stocks favoured by such strategies, at the expense of those equities unloved by the ESG fraternity.

However given the size of a market like the US, Ms Lee questioned whether the flows into ESG were large enough to drive a significant degree of momentum, although she believed further research was needed to get to the bottom of this.

If the momentum effect is meaningful, it may continue for some time if ESG investing remains in vogue, even if it does ultimately lead to skewed stock valuations.

The third alternative is simply pure randomness, particularly given the short-term nature of the analysis. Longer-term data will be needed to before simple pot luck can be discounted as a major factor.

This is the first time [we have analysed the data],” Mr Zhou said. “We would like to keep looking at this as the pandemic is unfolding. This is the biggest test that the ESG funds have encountered.

“ESG investing is the shining star. We haven’t seen any other investment strategies have such consistent outperformance.”

Click here to visit the ETF Hub

Comments