Fuel transfer from South to North Korea sheds light on sanctions evasion

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A Russian tanker chartered by a South Korean company has been spotted conducting a fuel transfer to a Chinese vessel bound for North Korea, a rare sighting that illuminates the murky world of the east Asian oil trade.

A joint investigation by the Financial Times and the Royal United Services Institute think-tank tracked a shipment of marine oil from South Korea’s south-east coast into North Korea’s exclusive economic zone under a deal brokered by a mysterious Chinese shipping agent.

The shipment’s progress, documented by satellite images and transponder data, illustrates the difficulty of enforcing strict international sanctions on countries such as North Korea.

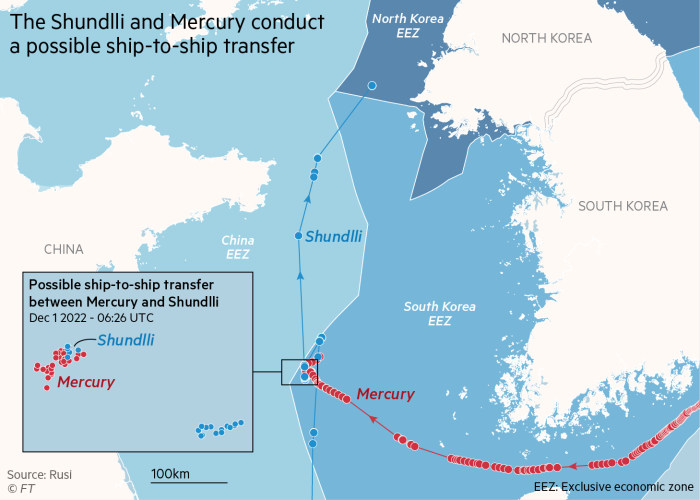

The cargo left the South Korean port of Gunsan on November 20 on a Russian-owned tanker called the Mercury, chartered by a South Korean company. On November 25, it entered the Yellow Sea between China and the Korean peninsula, and on December 1, it anchored for several hours alongside a Chinese-owned vessel called the Shundlli.

Data from the Mercury’s automatic tracking system recorded a change in the vertical distance between the surface of the water and the vessel’s lowest point, known as a draught change, after it encountered the Shundlli. This suggests cargo was unloaded during the meeting, an operation later confirmed by the South Korean company that chartered the Mercury.

Four days later, the Shundlli, which is Togo-flagged, entered North Korea’s exclusive economic zone, where it anchored at a location near the port of Nampo that RUSI said is known to be used for illicit oil deliveries.

Satellite images captured by US Earth observation company Planet Labs and seen by the FT show the Shundlli side-by-side with another vessel in the North Korean EEZ. Experts at RUSI said this was highly likely to have been a ship-to-ship transfer to a North Korean vessel. The Shundlli does not broadcast its draught, but its location data showed it was in the North Korean EEZ for several days. The vessel it met was not broadcasting any data at all.

While ship-to-ship transfers have legitimate functions, they are sometimes used to conceal cargo provenance and shipping routes.

North Korea is subject to sanctions agreed in 2017 by the UN Security Council that cap oil transfers to the country at 500,000 barrels a year, far below its energy needs. All such transfers must be reported to a UN sanctions committee, but only a small fraction are in practice.

The Mercury is owned by Niko, a company located in the far-eastern Russian city of Vladivostok, which said its vessels were chartered by other companies and that it had no control over, or visibility into, what they did under contract.

“In simple terms, our vessel is rented out,” said Andrei Velikorodnyi, a Niko director. “It loaded the cargo in South Korea and according to the charterer’s instructions, it is supposed to be bunkering South Korean and Chinese fishing vessels in the Yellow Sea,” he added, referring to the process of refuelling ships at sea.

Velikorodnyi shared with the FT a contract showing the Mercury had been chartered by a South Korean company called Eastern Pec. Eastern Pec confirmed it had chartered the Mercury and conducted a ship-to-ship transfer with the Shundlli as part of a deal agreed with a “Chinese agent” based in South Korea to supply fuel to Chinese fishing vessels.

Eastern Pec said it was the first time it had worked with the Chinese shipping agent, whom it declined to name, citing South Korean data protection laws.

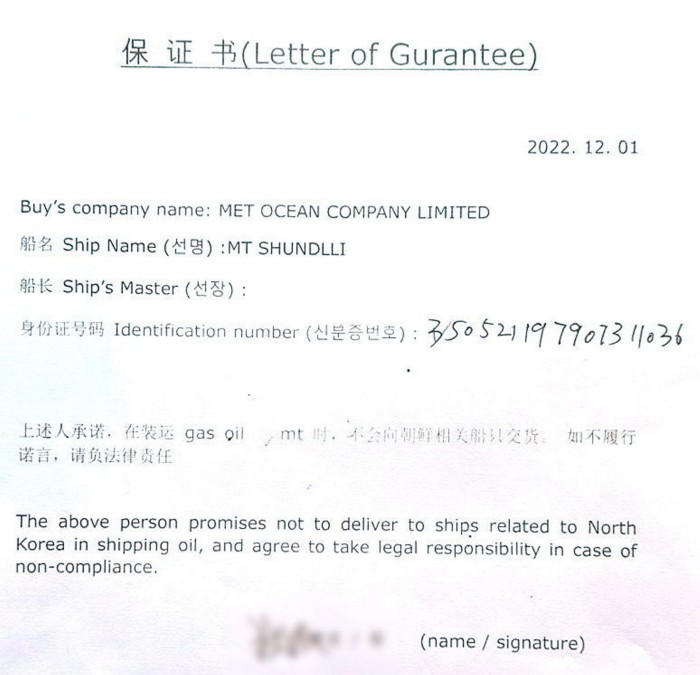

Eastern Pec added that the agent had denied the cargo was taken to North Korea’s EEZ but had not accounted for its whereabouts. The company said it had received a letter of guarantee from the Shundlli’s captain confirming the cargo “will never be transferred” to a North Korean-related entity.

According to a copy of the letter of guarantee provided to the FT by Niko, signed on the day of the transfer between the Mercury and Shundlli, Eastern Pec’s counterparty was a Shanghai-based company called Met Ocean Co Ltd.

In the letter, Met Ocean “promises not to deliver to ships related to North Korea in shipping oil, and agree[s] to take legal responsibility in case of non-compliance”.

“We will continuously abide [by] the law and all sanctions,” Eastern Pec said. “Despite our best efforts to avoid this situation, we are very sorry to have encountered [it]. We will co-operate faithfully should [an] investigation [be] conducted by [the] authorities.” Eastern Pec did not respond to a request for comment on the authenticity of the letter of guarantee.

A company called Met Ocean appears in the Panama Papers leak of millions of files from Mossack Fonseca, one of the largest offshore law firms. Met Ocean is listed as registered in the British Virgin Islands, with shareholders connected to addresses in Shanghai.

Met Ocean does not appear to have a website, but requests for comment from two associated email addresses did not receive a response. The FT also spoke by phone to a person listed online as a contact for the company, who confirmed his identity and involvement in the shipping industry but refused to discuss the contents of this story.

Joseph Byrne, a research fellow at RUSI, said the movements of the Shundlli closely resembled those of other ships previously shown to have been involved in illicit shipments of oil products to North Korea.

He added that all ship-to-ship transfers between North Korean and non-North Korean vessels were prohibited because of a blanket ban imposed by the UN. “It doesn’t matter if you are transferring oil or water, if you transfer any commodity to a North Korean flagged vessel, it’s a violation of UN Security Council resolutions,” said Byrne.

According to Chinese court records, under previous ownership, the Shundlli was involved in smuggling petroleum products into China between 2017 and 2019 as part of a scheme to evade import taxes.

The vessel is now owned by a Hong Kong-registered company called Hongkong Great Star Development, which did not respond to a request for comment submitted via a separate business in the city that acts as its company secretary.

“North Korean vessels or those engaged in sanctions-busting are regularly operated by complex front company networks that make their real beneficial owners hard to establish,” said Byrne, adding that illicit oil shipments to North Korea were more commonly supplied by vessels operating from Taiwanese ports.

Go Myong-hyun, senior fellow at the Asan Institute for Policy Studies in Seoul, said oil product transfers to North Korea from South Korea were “rare, but not unheard of”.

Hugh Griffiths, a former co-ordinator of the UN panel that monitors North Korea sanctions, said the South Korean foreign ministry endorsed a package of best practices for compliance in 2018, but “small companies without proper standards” continued to trade fuel.

Velikorodnyi, the Niko director, said he had been “pretty blown away” to hear from the FT about its tanker’s activities. Niko was still “working out what happened”, he said.

Additional reporting by Primrose Riordan in Hong Kong and Xueqiao Wang in Shanghai

Letter in response to this article:

Put Le Carré down, this FT report is more gripping / From Martin Swinley, Cantley, Norfolk, UK

Comments