Foreign investors tiptoe into frontier markets in search of returns

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors have begun wading more deeply into frontier markets such as Uzbekistan and Tanzania as they chase higher returns and seek assets that do not move in tandem with those in larger developing nations.

The European Investment Bank issued its first-ever frontier local currency note in the Georgian lari on Monday, responding to a surge in demand for high-yielding but riskier debt in previously untapped countries.

Craig McLeod, head of emerging markets at electronic bond trading venue MarketAxess, said that relatively low returns on many fixed-income assets were pushing investors into less popular markets such as Kazakhstan, Serbia and Egypt. Some of these frontier markets provide investors with juicy bond yields to account for the higher risk of holding their debt.

“A couple of years ago I would talk to three of the largest asset managers about frontier markets. That’s expanded to nearly all of our clients this year,” said McLeod.

The currency-linked eurobonds issued by organisations in frontier markets provide average coupon payments of 9 per cent, according to Netherlands-based TCX, a fund that helps borrowers hedge the currency exposure on the debt they sell.

By comparison, the yield on a basket of local currency bonds sold by emerging market governments that most investors can access is less than 5 per cent, according to the JPMorgan GBI-EM global diversified index.

The Georgian deal follows shortly after the Dutch development bank FMO’s issuance of a $10m paper in the Kenyan shilling on Thursday last week.

“We have seen growing demand for and larger transactions in local currency offshore markets,” said Matthijs Pinxteren, director of treasury at The Hague-based FMO, noting that the Uzbek government’s recent $50m local currency offshore bond had strong demand.

“Supported by the low yielding . . . environment, this bond was heavily oversubscribed,” he said.

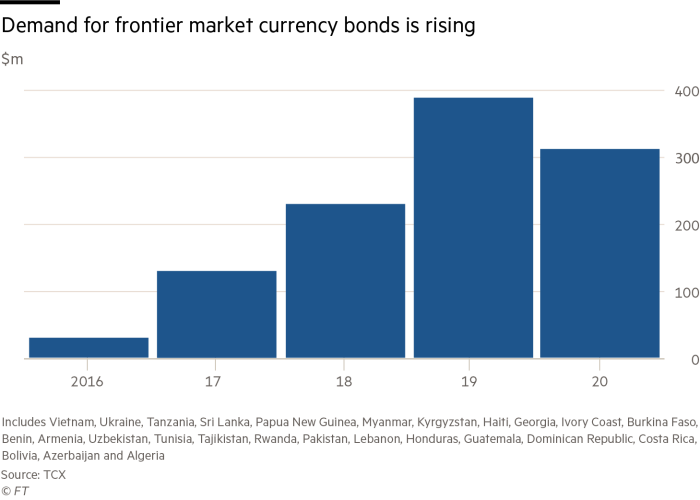

Since 2015, 270 frontier currency-linked bonds have been sold, raising almost $5bn, according to TCX. After participating in more than 100 issuances, TCX has recently launched a frontier market currency index to make these markets easier to access.

The index tracks the debt of agencies such as the European Bank for Reconstruction and Development and African Development Bank that is issued in local currency. These currency-linked eurobonds carry investment-grade credit ratings, trade on international markets and are settled in dollars and euros. This means investors who hold them are relatively insulated from credit risks and are instead betting on the local currency.

“To our own surprise we learned there are eager buyers out there for the market risk and return of Papua New Guinea, Uzbekistan, Tanzania, as long as the currency risk and return came with triple-A credit risk,” said Ruurd Brouwer, chief executive of TCX.

Gyula Toth, a portfolio manager at Macquarie Group, said he had exposure to frontier markets through bonds issued by supranational banks and denominated or linked to EM local currencies.

“[By] investing in these markets, we aim to reduce correlation to larger emerging market currencies and at the same time earn a yield which reflects the local macroeconomic background,” said Toth.

Unhedged — Markets, finance and strong opinion

Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here to get the newsletter sent straight to your inbox every weekday

Axel van Nederveen, treasurer of the European Bank for Reconstruction and Development, noted that while increasing local currency funding in frontier markets was a top priority, only about 15 per cent of the agency’s lending took place in local markets’ currencies.

While the market had grown over the past three years, rising yields in developed markets since the beginning of 2021 presented a risk, said Charles Robertson, chief economist at Renaissance Capital.

He added that appetite for these bonds would be highly dependent on how fast investors thought the US central bank would respond to rising inflation, as climbing yields in the US would dent the attractiveness of frontier markets.

The opportunities are still out there for now, according to Bank of America strategists, who listed shorting the dollar against the Kazakh tenge and the Ghanaian cedi among their favourite trades in April. Athanasios Vamvakidis, a currency strategist at the US bank, described the tenge as a diversification trade and cited attractive yields as the rationale for the cedi.

“[The 11 per cent potential return] make Ghana the most attractive . . . frontier carry trade,” he said in a note.

*This story has been amended to clarify that Serbia’s short-term local-currency government bonds currently trade at a yield of around 1.5 per cent.

Comments