The great uncoupling: one supply chain for China, one for everywhere else

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is part of a series on the New Cold War

Earlier this year, four dozen lawyers, accountants and bankers from all over Latin America piled into a conference room in an office tower on Miami Waterfront. They listened spellbound as Nicholas Chen, an energetic lawyer who had come all the way from Taiwan, told them about an exodus of manufacturing from China that could make them rich.

“The tsunami waters are flowing outward now,” Mr Chen said to the assembled audience.

Pointing to the US trade war with China, he said many companies were having second thoughts about maintaining operations in the Asian country. “Huge numbers of China-located companies are shifting their purchase orders, manufacturing capacities and operations out of China,” he claimed. “This can become your El Dorado!” — a reference to the mythical gold treasure that drove generations of explorers to Latin America.

Mr Chen knows how to make a good pitch. Starting in the early 1990s, the Chinese American lawyer helped hundreds of companies from Taiwan, a hub of manufacturing for electronics and other industries, to set up shop in Suzhou — a city just outside Shanghai in Jiangsu province.

The influx made Suzhou one of the largest clusters of Taiwanese manufacturing in China, with more than 11,000 companies and cumulative investment of more than $30bn as of 2018. The companies included flat panel maker AU Optronics, telecoms gear maker Sercomm and at least 10 Apple suppliers. They were part of a force that transformed China into an export machine supplying the whole world — until now.

Those same supply chains are now at the centre of a tug-of-war that has huge implications for the future of the global economy and for geopolitics.

Driven by President Donald Trump’s push to “decouple” the US economy from China and the disruptions caused by the coronavirus pandemic, many manufacturers are being forced to rethink their presence in China.

Untangling supply chains that have built up over a generation is a complex and difficult task and the multinational companies which sell into the Chinese market will stay and even expand. But if companies that once used the mainland to make goods for export do decide to depart in significant numbers, it will represent a major reversal of five decades of economic integration between the US and China.

At a time when tensions between Washington and Beijing are increasingly beginning to resemble a new cold war, products ranging from computer servers to the Apple iPhone could end up having two separate supply chains — one for the Chinese market and one for much of the rest of the world.

New Cold War

In a series of articles this week, the FT explores how the US-China rivalry is beginning to resemble a new cold war, with the technology world splitting into two blocs and countries being asked to choose sides.

Monday: Trump, Xi and the escalating US-China confrontation

Wednesday: The battle for tech supremacy

Thursday: How America turned hawkish on China

“In the past, there would be one massive plant in China for the whole world. But that globalisation is gone,” says CY Huang, a Taiwanese investment banker and adviser on a number of deals which have contributed to disentangling global supply chains from China. “It will be more costly, and it will be less efficient. But it is the way that politics is pushing us.”

Foxconn, the $178bn Taiwanese company which makes the iPhone and just about every other tech gadget and which has a workforce of close to 1m in China, says it expects manufacturing to fragment into a China supply chain and several others for the rest of the world.

“The past model, where [manufacturing] is concentrated in just a few countries like a world factory will no longer exist,” Young Liu, Foxconn chairman, said at a conference in June. “What we think is more likely in the future are regional production networks.”

Costs matter

There is plenty of evidence that many companies are cooling on China. According to surveys conducted by the American Chamber of Commerce in China over the past two years, about 40 per cent of US companies in China have moved manufacturing facilities out of the country already or are considering doing so.

In the chamber’s latest annual survey, published last month, only 28 per cent of member companies said their investment in China would increase this year — down from 48 per cent in 2019, around 60 per cent in the two preceding years, and 81 per cent in 2016.

To industry executives and experts following supply chains, none of this comes as a surprise. “The first dynamic at work here is cost control, and it has been a factor for 12-15 years,” says Ben Simpfendorfer, founder and chief executive of consultancy Silk Road Associates.

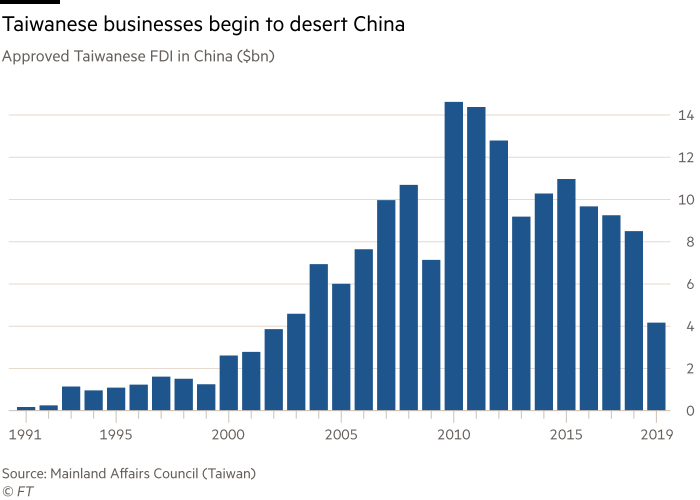

Taiwanese companies, among the earliest and largest investors in China, began to adjust their manufacturing set-up as early as 15 years ago when labour started becoming scarce in the coastal regions where most foreign investment is concentrated. Footwear, accessories, toy and furniture manufacturers began moving to countries in south-east Asia such as Vietnam and Cambodia more than a decade ago.

Western companies have also come to fear that making equipment in China might put data security and privacy at risk. As Washington stepped up its scrutiny of Chinese telecom gear makers ZTE and Huawei, began to indict Chinese hackers and started discussing if even computer hardware might be compromised, contract manufacturers of servers such as Taiwan-based Quanta Computer started moving some production back home and some to the US or Mexico. This process was already happening prior to the US-China trade war. “If you supply Google or Facebook, you need to show that it’s a non-China product,” says Mr Simpfendorfer.

Taiwan has been one of the biggest beneficiaries of America’s growing wariness about doing business in China. The Taiwanese government, long concerned about the country’s economic overdependence on China, has grabbed the opportunity and has offered subsidies for Taiwanese companies that bring some operations back home. Under that initiative, Taipei has registered more than NT$1.12tn ($39bn) in investment commitments over the past two years. Manufacturers of telecom networking gear, servers and integrated circuits have been among the largest projects committed.

As the US-China trade war heated up, consumer electronics companies also started to rethink their China operations. Over the past few years, Taiwanese companies have been selling manufacturing assets in China to Chinese competitors at an increasing pace. Those deals include the recent acquisition of a China-based plant of smartphone case maker Casetek by Chinese company Lens for NT$43.3bn, the sale of two China plants of Taiwan iPhone supplier Wistron to China’s Luxshare, and the transfer of China assets of Apple earphone maker Merry to Luxshare.

“Luxshare has become a mini-Foxconn. A lot of this activity is happening because of the reshuffling of the supply chain,” says Mr Huang. “These companies are all suppliers of Apple, and Apple is now separating its supply chain for China and non-China.”

Mr Huang believes even Foxconn might at some point have to sell its massive China-based assembly plants. “In the future, Apple wants to delegate supplying of the China market to Chinese suppliers. The other markets in the world can be handled by Taiwanese suppliers,” he says.

While all these factors were already under consideration, executives and analysts say the pandemic has made them much more acute.

“When China ordered factories to keep closed after Lunar New Year to contain the spread of the virus, that was the moment of truth for so many companies,” says a consultant who works with manufacturers in Greater China. “For a while, everyone was focused on getting through the crisis, but now that the economy is running again in China, these companies are busy rebuilding supply chains,” he says. “The number one priority is to find and qualify alternative suppliers you can fall back on to if something like this happens again.”

The pandemic has brought medical supplies into the group of industries traditionally sensitive to national security concerns such as defence, telecoms and technology. From the US to Japan to Europe to Australia, governments are pondering how to bring production of crucial items such as personal protective equipment and pharmaceuticals back home.

That pressure is already forcing a shift in manufacturing orders. Wistron Medical Technology, a subsidiary of the Taiwanese contract electronics manufacturer, says it so far handles 70 per cent of its production out of its factory in the Chinese city of Chongqing and only the remaining 30 per cent out of Taiwan. “But for our largest order, which is from the US government, we have already been notified that the next batch can no longer come out of China,” says Brian Chuang, vice-president. “That shift will push China-based production under 50 per cent in our overall manufacturing balance.”

‘Twenty-year process’

Not everywhere can adjustments be made this easily.

Anne Petterd, a partner at Baker & McKenzie in Sydney, who focuses on supply chain issues, says some companies are holding back from making big decisions before the US election. “Companies still think that the same would be happening under a Biden administration,” she says. “But if there were a change in government, they might have a bit more certainty and predictability.”

Some companies are waiting to see if they will be awarded exemptions from US trade tariffs before they make long-term decisions about production in China.

Most importantly, many manufacturers may struggle to build new operations in countries other than China because they lack the country’s material and component suppliers and surrounding services.

“Some manufacturers have long done some final assembly in countries closer to the end market, for example in Mexico for the US market, but it takes time to proceed from ‘Level 10’ assembly to Level 5 or 6,” says the consultant, referring to a stage of production where key components are put together rather than just final assembly and testing.

Trade experts caution that the shift of global supply chains away from their sole reliance on China will take a long time. While China’s share of global exports markedly dropped in 2019 as a result of trade war-related adjustments, the country’s share of global exports hit a new historic high this year.

Mr Simpfendorfer says monthly trade data is not a good indicator of the longer-term shifts, especially because Covid-19 has distorted demand structure. For instance, the fact that hundreds of millions of people are working from home has created sudden new large demand for laptops and tablets — products for which the biggest capacity is in China.

“The supply chain shifts under way now are comparable to the shift of production by northeast Asian companies from Japan, South Korea and Taiwan into China in the 1990s,” he says. “It was a 20-year process then, and it will be a 20-year process now.”

Multiple networks

Governments are trying to take advantage of these historic shifts. “Some countries are starting to hand out incentives for companies to come home,” says Ku-hyun Jung, an economist and professor emeritus at Yonsei University in Seoul. He predicts that the scope for reshoring is limited, and that instead three large supply chain systems will form: the largest one in Asia, including China but reaching down to south-east Asia, and two smaller ones centred on the US and Germany.

Japan has offered its companies incentives to bring production home, and has a separate set of incentives for manufacturers that move production from China to south-east Asia. The EU has a review of its trade policy under way to look at how it could deal with supply chain restructuring.

Last month, the EU’s representative office in Taiwan organised its first ever conference on investing in Europe, as various countries especially in central and eastern Europe hope to become new manufacturing hubs.

The US, meanwhile, is kicking off a new economic dialogue with Taipei focused on rejigging global supply chains.

Mr Huang, the investment banker, last month launched an initiative called Re!Chain aimed at helping Taiwanese companies reinvent themselves amid the rapid change. He is bringing together enterprises including Fair Friend Group, the world’s third-largest machine tool maker, WPG, the world’s largest integrated circuit distributor, and Teco, Taiwan’s largest automation provider. Instead of offering cheap manufacturing services in China, he expects them to manage smart global supply chains with the help of automation, AI and blockchain.

“My assumption is that Taiwan should become the co-ordinating centre in the global supply chain,” he says.

Mr Chen, meanwhile, is going back to his roots. Now 63, he is planning to return to the China-based industrial parks which he helped fill up more than 30 years ago — to convince companies to build additional production facilities in new countries. “I will replicate those industrial clusters elsewhere,” he says.

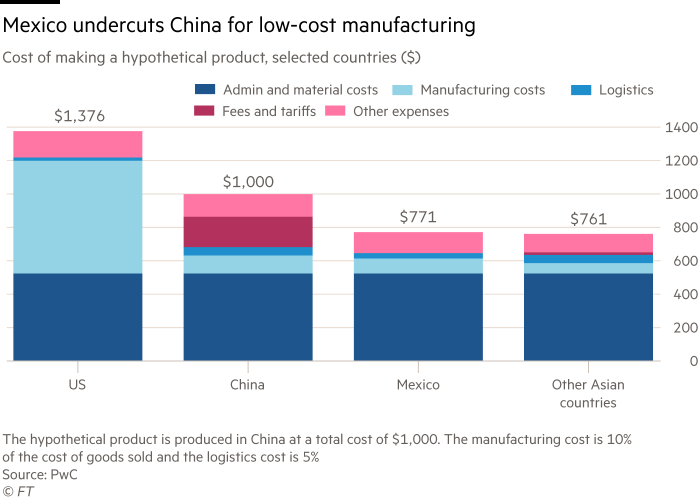

Mr Chen believes northern Mexico’s time has come. “It was still cheaper to manufacture in China 10 years ago than in maquiladoras,” he recalls, in a reference to Mexico’s export processing factories. According to him, industrial park managers from Nuevo Leon, a Mexican state bordering Texas, used to try to convince him to bring over companies from China, but could never match the cost structure that China offered.

“Now I’m telling them that you still can’t come up with that number, but you don’t have to, because they have had the trade war, cost increases and Covid, so their number changed. Do you still want to talk now?”

Letters in response to this article:

Comments