Emerging market investors focus firmly on central bank decisions

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors in emerging market assets always watch the pronouncements of the US Federal Reserve carefully. This week, the focus is particularly sharp.

No change in policy is expected from the Fed this Wednesday. But the potential for higher inflation as the US economy springs out of its coronavirus slump has tripped up the country’s government bond market, dragging emerging market bonds lower too.

Now, any sign that the Fed could even consider bringing forward its distant plans to raise interest rates could make a challenging year for emerging markets even tougher, and potentially bump EM central banks into raising rates too.

“This week is going to be huge,” said David Hauner, head of emerging markets strategy and economics at Bank of America. “The Fed’s meeting is one of the most important in a very long time.”

Central bankers in Brazil, Turkey and Russia also meet on Wednesday, Thursday and Friday respectively. Coronavirus-scarred economies mean they would prefer to keep their stimulus flowing, Hauner said. But any hawkish tilt from the Fed would probably fire up the dollar and hurt EM currencies, exacerbating the risk of accelerating inflation. “How much leeway they have depends on how strong the dollar is and on what happens in Washington,” he said.

“What will really matter for EMs is whether there is a signal [from the Fed] that the rise in yields has gotten ahead of itself,” said Jonathan Fortun, an economist at the Institute of International Finance.

“If such a signal is sent, it would help EM tremendously. If instead there is a message that rising yields are fine and justified by better US growth, then things get more tricky.”

US government bonds have weakened sharply this year, as better news on vaccinations and the promise of huge fiscal stimulus from the Biden administration have raised hopes of a quick US recovery. Bondholders fear that fast growth will lead to rising inflation, eating into the fixed income streams that bonds provide.

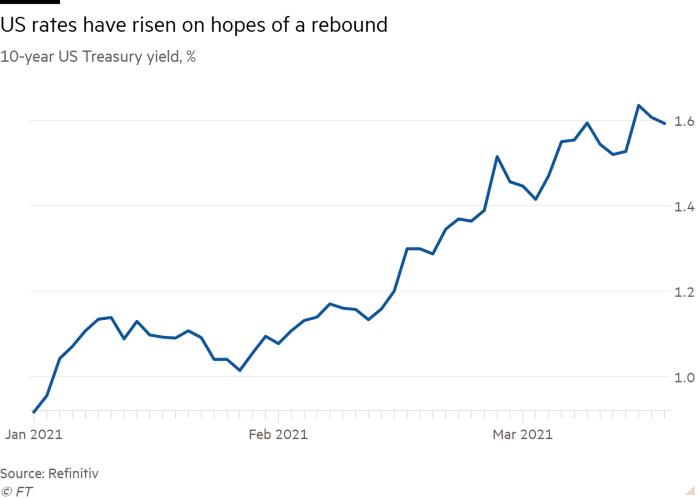

As bond prices have fallen in the sell-off, the yield on 10-year US Treasuries has risen from 0.9 per cent at the end of 2020 to 1.6 per cent this week, returning to levels last seen before the pandemic.

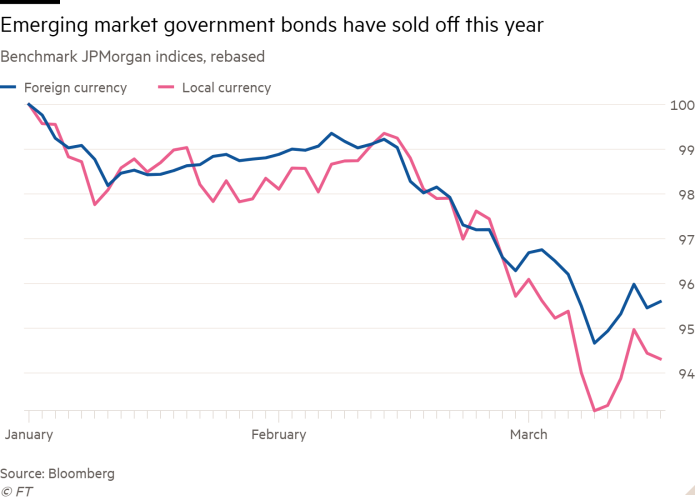

That eats into the appeal of higher-yielding EM assets, which are also seen as more risky. After the rise in US rates gained pace in February, investors began to dump EM assets too, with cross-border portfolio flows turning negative in the first week of March for the first time since October, according to the IIF.

The impact has been strongest in bond markets. The benchmark JPMorgan indices for local currency and foreign currency EM bonds have both fallen sharply over the past month, bringing losses this year to about 5 per cent.

All this puts pressure on emerging market central banks. Brazil, for example, has cut its policy interest rate aggressively in recent years. But with short-term rates now negative after inflation, the currency has come under pressure and long-term yields have risen as investors demand greater returns.

Analysts say Brazil’s central bank will have no choice but to raise rates at its Wednesday meeting, even though Covid-19 death rates remain alarmingly high. Markets are expecting a half-point rise from the current 2 per cent policy rate, with further rises expected to take the Selic rate to 4 per cent before the end of the year.

That threatens to add to the fiscal pressure on the government, as its spending during the pandemic has already taken public debt above 100 per cent of gross domestic product, according to the IIF, and higher interest rates will add to borrowing costs.

Similarly, Turkey’s central bank “has essentially no room for error”, says Phoenix Kalen, an emerging markets strategist at Société Générale, and will be forced to raise its policy rate by a full percentage point on Thursday to 18 per cent.

“We previously expected it to keep the rate unchanged but now we expect 100 basis points, given how unstable financial markets are and how vulnerable Turkey is,” she said.

Russia is not expected to raise its policy rate on Friday but it is forecast to adopt a more hawkish tone and prepare the ground for a rate rise as early as next month.

Some investors expect EM assets to withstand the pressure from rising US rates so long as other conditions remain supportive. Benjamin Melman, CIO at Edmond de Rothschild Asset Management, said global liquidity, pumped up with trillions of dollars from the Fed and other central banks during the pandemic, was more relevant than the US 10-year bond yield.

“There is no discussion about tapering [that liquidity],” he said, “so that will be a tailwind for EM assets.”

Hauner at BofA said that even if short-term volatility receded, there was little prospect of avoiding a rise in US interest rates beyond 2023 based on current projections. That put pressure on the likes of Brazil to bring their debt under control.

“As an emerging market, you definitely need to get your house in order by then,” he said. “This is the maximum time you have.”

Comments