Diamond industry buffs up its image for the young generation

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The diamond industry has long had to deal with predictions of doom. In the early 2000s, prices started to fluctuate as De Beers Group gave up its monopoly. Then scandals over conflict diamonds tarnished the gem’s sparkle among young, ethically minded consumers. At the same time, lab-grown diamonds began making strides in fine jewellery.

This pessimism deepened as the pandemic led to the closure of mines and the cancellation of auctions for preapproved buyers. In July 2020, De Beers revealed interim revenues to June 30 had plummeted 54 per cent year on year: from $2.6bn to $1.2bn.

But the industry is adapting to the new climate and is betting on a marketing push to revive its fortunes. Last autumn, the Natural Diamond Council, which comprises seven of the largest diamond producers, launched its first advertising campaign targeting the Asian and US markets.

The campaign boosted the industry’s marketing spend which, according to the latest Bain Global Diamond Report, represents 1-2 per cent of its revenue — behind the luxury goods sector’s spend, of 6-8 per cent.

In contrast to the “A Diamond is Forever” slogan coined for De Beers in 1947, the NDC tagline “For Moments Like No Other” reflects the shifting values of a new generation of consumers, for whom memorable experiences are an important buying criterion. “Research shows that when women talk about diamonds, they talk about the memories linked to them,” says David Kellie, NDC chief executive, adding that the council’s campaign targeted young women who buy for themselves.

Bernstein Research analyst Luca Solca believes this makes sense. “The idea of making diamonds more ‘casual’ and less restricted to love and marriage seems good in my view.”

French jewellery designer Valérie Messika, for example, built her business by marketing diamonds as “fun” — thus encouraging self-purchase.

In 2018, US retailer Tiffany & Co also sought to tap into a new generation of diamond buyers with a commercial featuring actress Elle Fanning dancing to a new version of “Moon River” — the song originally made famous by Audrey Hepburn in the film Breakfast at Tiffany’s.

However, none of this may be enough to appeal to young millennials and Generation-Z, who hold brands to account on ethical standards and sustainability. “Customer expectations are no longer simply related to a luxury piece’s beauty and quality,” says Céline Assimon, chief executive of De Beers Jewellers. In January, to company presented the high jewellery collection, Reflections of Nature — named after the sites where the diamonds were mined.

Advances in mining techniques have helped the diamond industry to promote this narrative of “nature’s wonders” — exemplified by large rough diamonds, such as the 1,758-carat Sewelô and the 549-carat Sethunya marketed by Louis Vuitton, with a view to involving prospective buyers in the cutting process.

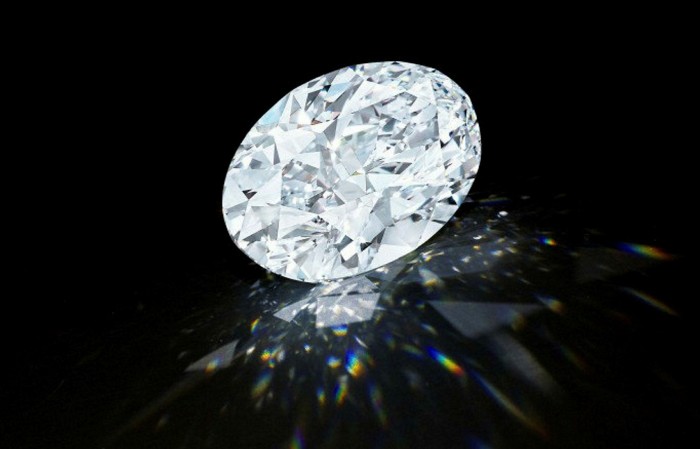

Apprehension over the investment value of diamonds was quietened in October when Sotheby’s offered a flawless 102-carat diamond with no reserve (pictured below). The stone fetched $15.7m. A few months earlier, Christie’s achieved a remarkable result with an unusually cut 100-carat stone that was sold to Moussaieff Jewellers of London for SFr5.6m ($6.1m).

Such stellar prices have a halo effect on smaller stones, but diamond sales still need the right macroeconomic environment in order to blossom.

Olya Linde, a Moscow-based consultant at Bain & Company, says the purchasing power of people in their late thirties and early forties has made them “warm up to diamonds” — and suggests this will be a big influence on Gen-Z consumers in the future.

To cater for the tighter budgets of people in their twenties and early thirties, jewellery houses are promoting smaller, more affordable engagement rings — Dior’s successful Mimirose, for example, at £670 (pictured below). De Beers is also targeting this market by inviting up-and-coming designers to create engagement rings set with 0.30 carat to 0.70 carat diamonds, at prices ranging from $3,000 to $4,000.

Investment in a digital presence — accelerated by the pandemic — drove up online sales 60-70 per cent, year-on-year in 2020, according to Bain. But when 90-95 per cent of consumers prefer buying diamonds in a store in person, as Bain found, brands can ill afford to ignore bricks and mortar. Amid the pandemic, Messika opened 10 new branches last year, four of which are in Asia. “Without flagship stores, Messika would have difficulties becoming known among consumers,” Messika says. The company’s first-quarter 2021 sales were 42 per cent up on 2019.

Retailers in the US and China reported similarly strong figures, achieving 5-10 per cent and 15-20 per cent rises respectively in the fourth quarter, compared with the same period in 2019, based on Bain research.

Diamond retail sales have also been helped by buoyant stock markets and because, says Linde, “consumers are unable to spend on experiences or travel and use those funds for items such as diamonds”.

Comments