How banks are planning to bring staff back to the office

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Before the first wave of staff returned to Credit Suisse’s Paradeplatz head office this month, the bank offered free antibody tests so employees would have a “greater degree of certainty” about whether they had already had Covid-19.

While Credit Suisse is considering expanding the programme globally, Goldman Sachs and UBS have both decided against it for now, mindful that results can be ambiguous and that people who test positive could be more careless about infection control.

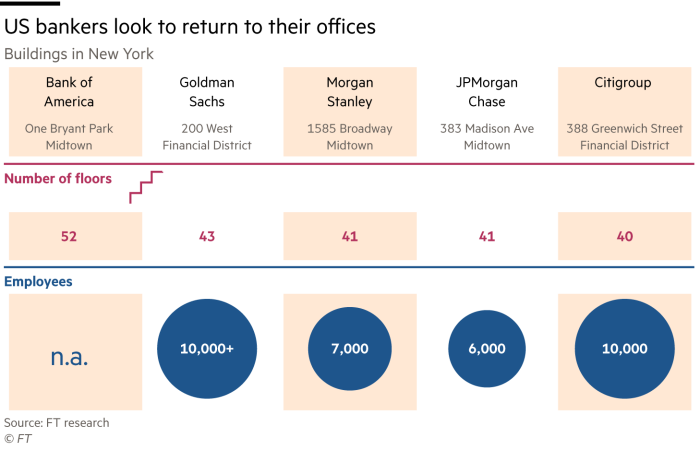

Other big banks such as JPMorgan Chase, Morgan Stanley, Bank of America and Citigroup have yet to make up their minds.

Credit Suisse is perhaps in a more convenient position to offer tests — deputy chairman Severin Schwan is chief executive of Roche, which makes one of only three tests deemed reliable. But this widely diverging approach to antibody testing is just one example of the different ways banks are tackling the mammoth task of bringing staff back into offices from London to New York, Frankfurt and Paris.

In a series of interviews with the Financial Times, executives described different strategies on everything from how to move staff to and from the office, to supplying personal protective equipment, managing how employees move around in the office and rotating teams.

How lifts can be used safely has emerged as a particularly vexing problem inside the building, while few managers expect employees to feel confident enough to restart daily commutes before a vaccine is found.

“This is going to cause a seismic shift in how all office-based organisations approach the workplace,” said Charlie Netherton, head of client advisory services for the UK and Ireland at Marsh. “No one was prepared for such a rapid shock and transition to the future.”

Banks also have very different perspectives on the long-term implications for working life after lockdown ends. A senior executive at a major European lender spoke enthusiastically about saving $100m or more a year on travel and entertainment expenses, which have plunged almost 90 per cent during the crisis to between $3m and $5m a month from $25m.

He said international travel for internal meetings could all but disappear, now that people have adapted to video calls.

Wall Street bankers are less optimistic about expenses cuts, because savings could be offset by new expenses such as paying employee home working costs, supplying PPE and higher property costs if staff have to work a metre or more apart.

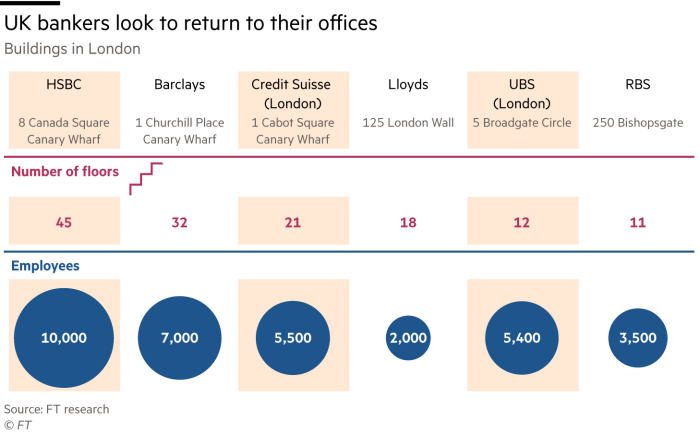

In London, many banks kicked off the first phase of their plans on June 15, when the government allowed “non-essential” businesses to reopen. HSBC, which is almost back to normal in Hong Kong and Shanghai, has told UK staff it will start repopulating its 45-floor Canary Wharf tower from July 1.

For the first three months, it expects only 10-20 per cent capacity in order to maintain social distancing. Those working on the trading floor will be among the first to return.

“Philosophically, I think it is important to [return to office],” one HSBC executive said. “We are going to help the economy normalise, so we as an institution need to get back to normality as well.”

British lender Lloyds will retain a skeleton staff of less than 10 per cent in its two London offices until September, said a person briefed on its plans. It anticipates it will be easier to bring people back to its nine-storey Gresham Street office than its other London Wall building, which has twice as many floors.

Across Europe, UBS is bringing back traders, risk managers and bankers working on live deals first, but other staff will continue at home as long as possible.

In London, UBS is better placed than most to manage the problems of employees in lifts, having moved into a low-rise 12-storey building five years ago. Traders will be segregated into teams on the second and third floors. Staff will be able to order pre-wrapped food from the café and will be required to wear company-provided masks in communal areas.

Use of the stairs will be encouraged and the building’s 20-or-so lifts will be divided into those going up and down, with a maximum of four people, one in each corner. In some parts of UBS’s Zurich office the lifts are so small, only one person will be allowed in at a time.

Barclays is expected to have about 200 more staff returning to its 32-floor Canary Wharf tower over the next three weeks, after the building was “essentially mothballed” for the past three months, one person familiar with the plans told the FT.

Morgan Stanley — in a 12-storey building nearby — is also expecting to boost the 350-strong UK staff it has maintained through lockdown by another 200 by mid-July.

In New York, banks face more difficulties as they try to refill much taller office blocks. JPMorgan and Goldman began increasing numbers from Monday, though the former said departments beyond sales and trading would not begin returning to their New York offices until at least July 13, and even then occupancy would be below 20 per cent until Labor Day which falls on September 7 this year. Citigroup, BofA and Deutsche Bank will be bringing staff back later in the summer.

Most banks will supply masks to be worn in communal areas — in a note to New York staff on Monday, JPMorgan said face coverings must be “work appropriate”.

BofA has told staff it might employ lift operators — as the only people allowed to touch the buttons — to ensure social distancing is maintained and that elevators are efficiently allocated at its 52-storey, One Bryant Park headquarters.

The bank has decided against using stairs as an alternative, even for the traders working on floors three to six that will make up a high percentage of early returners, because it would be too hard to ensure staff did not pass in opposite directions.

However, JPMorgan expects its trading staff — located on the lower floors — to use the stairs in the 383 Madison Avenue HQ. Citigroup expects the same at its 40-storey, head office at 388 Greenwich Street.

Goldman is among those that will use a team-based rotation system, with deep cleaning in between. BofA and Citigroup are not planning to rotate at this stage and will instead have lists of people authorised to be in the building for the number of days they want to.

Most banks will supply masks to be worn in communal areas.

While they are confident they can keep staff a safe distance apart, managers are also worried about how people will commute.

BofA is paying for Lyft and Uber rides or reimbursing driving costs to discourage the use of public transport, a person familiar with that bank’s planning said. Credit Suisse expects a large number of its London staff to drive to work, because its Canary Wharf offices have enough parking for the numbers forecast in the early phases.

Goldman, which has increased its staffing levels since mid-June, has had a rise in the numbers of employees cycling and running to its new 10-floor Plumtree Court office in London. The bank is asking staff to book showers in advance so it can undertake “Covid standard” cleaning between every use.

Most companies have told staff that returning to the office will be purely voluntary and those who wish to continue working from home will be able to do so without suffering any disadvantage.

A survey of Lloyds employees seen by the FT found that two-thirds of staff want to work from home several days a week permanently because it brings “benefits such as a better work-life balance and a less hectic commute”.

Matt Sinnott, the bank’s people and property director, said in the future it will “likely mean that we need fewer buildings and different types of space” and that the bank will review its property strategy “over the coming months”.

One Swiss executive echoed this sentiment: “Working from home generates higher productivity and it’s better for diversity . . . We have been trying to encourage it in London for a few years, but there has always been a reluctance. People want to be seen in the office, but now we have finally shifted that philosophy.”

This article has been updated to remove a reference to Credit Suisse not paying parking costs for staff who drive in to its Canary Wharf office.

Letter in response to this article:

The new normal for American bank workers / From Michele Perez, Fort Lee, NJ, US

Comments