US stocks fall from grace with ETF investors

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

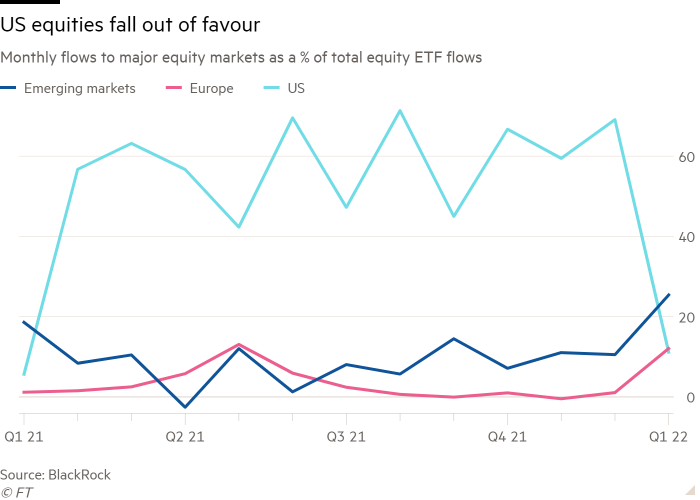

The US stock market fell dramatically out of favour with exchange traded fund investors in January, mirroring a similar fall from grace for US fixed income markets.

In 2021, US equity funds accounted for 55 per cent of the $1.07tn that flowed into equity ETFs, a figure that rose to 69 per cent in December.

Yet in January this plummeted to just 11.2 per cent of the net $66.2bn that was pumped into the asset class. Emerging market and European equity funds took unusually large shares of 25.4 per cent and 12.1 per cent respectively, with the bulk of the balance going to broad developed market ETFs.

In dollar terms, just $7.4bn was put to work in US equity ETFs in January, compared to $87bn in December and a monthly average of $48bn during 2021 as a whole.

For emerging markets, January’s net inflow of $16.8bn was an all-time record, with China, at the fore, accounting for $11.7bn of this. While the bulk of this money came from within China itself — where the ETF industry is still in its early stages — western investors poured in a net $4.1bn, despite a less than perfect economic and political backdrop.

“We are seeing a tilt away from the US towards Europe and EM,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region.

He attributed this largely to the sectoral dynamics currently unfolding, with emerging markets and Europe having a higher proportion of “value” stocks than the US, a boon now that value has finally come back into vogue at the expense of “growth” stocks.

Global flows into ETFs focused on technology stocks — the US trump card and typically a highly popular sector — dwindled to just $400mn, while energy and utilities ETFs attracted a net $4.4bn.

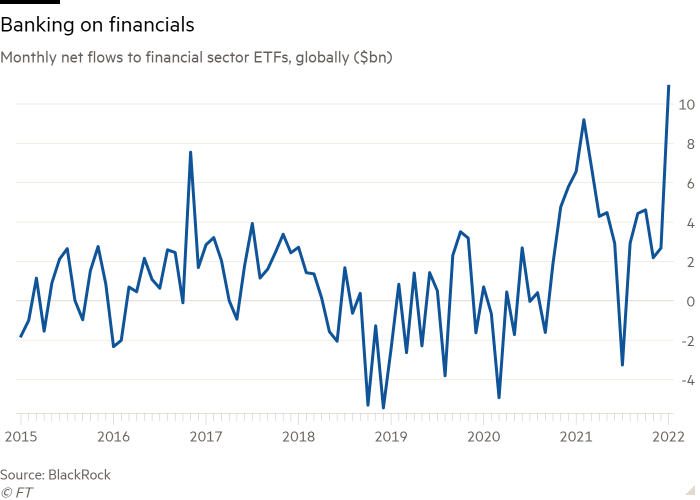

The standout winner, though, was another sector laden with value stocks, financials, which gathered a record $10.9bn.

“We are seeing increasing demand for financials. They look good in the context of higher rates and a potentially steeper yield curve from here,” Chedid said.

Peter Sleep, senior portfolio manager at 7 Investment Management, believed a lot of the recent flow dynamics were simply a reflection of the fact that often “money chases performance”, and, after many years of outperformance, the US stock market has slipped this year, with the S&P 500 falling 5.3 per cent in January, undershooting previously “unloved” bourses such as the UK and global emerging markets.

He also suspected there might be a seasonal factor in play, with value stocks often starting off the year well, only for their putative recovery to peter out soon after.

Nevertheless, Sleep believed that financial stocks, particularly banks, might have turned a corner after years of weak performance since the global financial crisis.

“Any money they made, rather than going to shareholders, went to fines or to rebuild capital,” he said, as regulators fined many banks for their roles in the GFC and substantially increased the capital buffers they needed to set aside to back their lending.

Now this process had run its course, banks were in a position to “buy back shares, pay dividends and reward, rather than punish, their shareholders,” Sleep argued.

While rising interest rates are generally viewed as positive for banks, in that they allow lenders to widen the spread between borrowing and deposit rates, Sleep believed this mechanism had weakened, with many banks packaging up and selling their mortgage books, rendering them less sensitive to rate rises.

At this stage, Chedid argued the switch in investors’ focus was a “tilt”, not a “rotation”, given that there had not been a sell-off in tech or growth ETFs, just a diminution in inflows. He believed, however, there was more to come in terms of the tilt to value thanks to a wave of “economic restarting” as the worst of the pandemic recedes. “This trend has legs,” he said.

Comments