Rising green bond issuance erodes premiums

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When a unique selling point starts to become a ubiquitous selling point, prices are going to suffer. Green bonds are no exception: as ever more companies and governments have issued them, investors have become less willing to pay the premium these assets used to command.

This is partly because investors looking for debt linked to sustainable projects have become more sophisticated. Like the rest of the public, they have wised up to bogus environmental claims, or so-called greenwashing. There has also been a rush of debt to market in recent years, which has diluted prices and raised borrowing costs.

But, while the “greenium” — which amounts to lower borrowing costs for issuers of environmental, social and governance (ESG) bonds, and higher costs for their investors — may no longer be the right framework to assess pricing in green bond markets, it is not dead quite yet.

And the benefits afforded to companies and governments issuing green debt are far from gone.

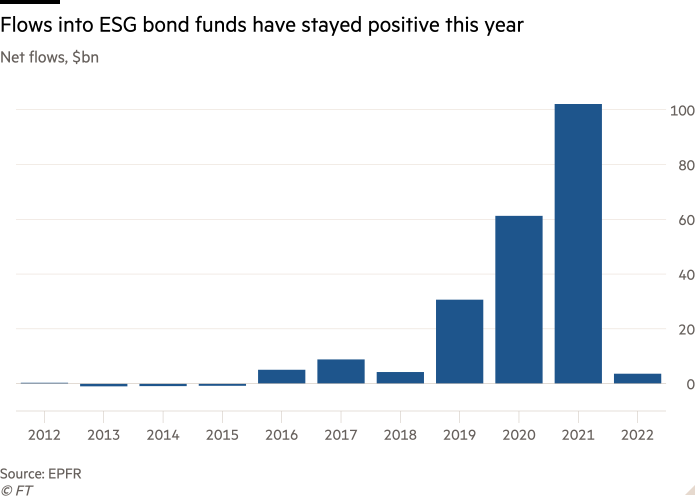

Issuance of green, social, sustainable and sustainability-linked (GSSS) bonds as a percentage of total global bond issuance rose from roughly 2 per cent at the start of 2018 to a peak of over 12 per cent at the end of 2021, according to research by rating agency Moody’s. Prices continued to rise as that flood of debt hit the market because demand from investors exploded. Figures from data provider EPFR show that flows into ESG and socially responsible investing bond funds rose from a net of $4.2bn in 2018 to $102bn in 2021.

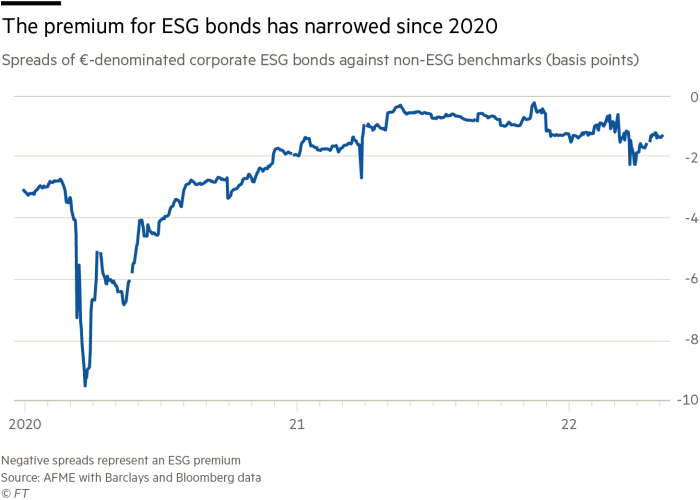

But much has been made of the narrowing gap between what investors are willing to pay for green bonds versus more traditional bonds. In Europe, the most developed green bond market, this greenium has shrunk from over 9 basis points in 2020 to between 1 and 2 basis points today, according to a report from the Association for Financial Markets in Europe.

The shrinking advantage for green bond issuers has long been touted as a potential existential threat to the market. Without lower borrowing costs, will issuers continue to come? And will investors’ appetite persist, as green bonds become more common and the crush of demand that buoyed their prices abates?

Those questions may be put on hold for this year, at least, as recession fears have thrown a wrench into markets. With economic growth slowing globally — thanks to high inflation, high commodity prices and higher interest rates — issuers of bonds, both green and conventional, have pulled back.

“Sustainable bonds are bonds and they’re still subject to the same headwinds that we’re seeing in the broader market right now,” says Matthew Kuchtyak, a sustainable finance analyst at Moody’s.

Green bond issuance this year is expected to be roughly in line with 2021. That is a notable slowdown, given how quickly the market has been growing and the effect of that growth on pricing. Moody’s is forecasting that global issuance of GSSS bonds will be around $1tn this year, down from its initial forecast of $1.35tn.

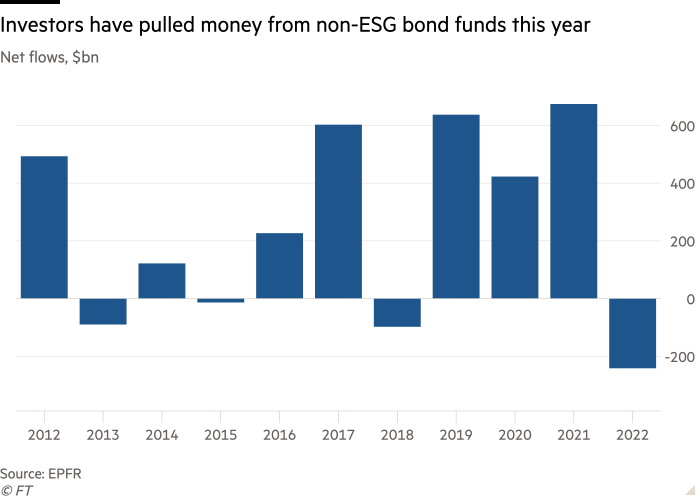

However, amid a broader dash out of bond funds this year, investors appear to be more willing to stick with the ESG variety. EPFR data show that ESG funds had a net $3.6bn of inflows between January and May (see chart above). That is slim, but far better than the $242bn in outflows for non-ESG bond funds.

Relatively stronger demand for a stable pool of assets could keep green bond prices from falling as much as prices in the wider bond market.

The trend in ESG fund flows reflects another benefit that accrues to green bond issuers: a deeper, more stable investor base with a longer-term outlook, says Stephen Liberatore, the lead portfolio manager for Nuveen’s fixed-income ESG funds.

And a new focus on greenwashing, along with closer regulatory scrutiny, may result in a more robust greenium for select issuers. Last year, the EU’s sustainable finance disclosure regulations came into force, requiring fund managers to detail the ESG risks in their portfolios. In the US, the Securities and Exchange Commission (SEC) financial regulator recently proposed similar rules to standardise climate-related disclosure for investors.

Crackdowns have already begun. In May, German police raided fund manager DWS and parent company Deutsche Bank as part of an investigation into greenwashing claims, while investment bank BNY Mellon settled with the SEC for $1.5mn over misleading ESG disclosures.

This less forgiving regulatory environment could reorient investor demand towards issuers that hew to stricter ESG standards. A Federal Reserve paper published last month found that “while green bond governance appears to matter for the greenium, the credibility of the underlying projects does not have a significant impact.” Rather, it said, the greenium is afforded to large, high-quality issuers like banks in the corporate sector and developed countries among sovereigns.

“What we’re not seeing is differentiation in terms of the greenium based on the quality of that [underlying] structure. And that’s what we would like to see and what we expect to see over time,” says Erin Bigley, head of fixed income responsible investing at fund manager AllianceBernstein. “We think, in future, you’ll see some distinguishing between the stronger and the weaker structures across issuers.”

With higher regulatory standards for what counts as “green”, the supply of suitable bonds may even shrink. That, coupled with a growing pool of sustainability-minded investors, could help keep the greenium in place for a long time yet.

Comments