Fed rate rise — now comes the hard part

Simply sign up to the US interest rates myFT Digest -- delivered directly to your inbox.

A momentous era in monetary history is finally over: the Federal Reserve has voted to raise interest rates for the first time since 2006. But actually implementing the decision may not be quite so straightforward.

The legacy of the US central bank’s efforts to combat the 2008-09 crisis is a financial system soaked with the Fed’s money, which has in the process neutralised its traditional interest rate tools and necessitated a radical new approach.

The Fed’s New York branch will on Thursday begin to push and pull on its new monetary levers in an attempt to get its main interest rate up by roughly a quarter of a percentage point.* While analysts mostly expect it to go smoothly, the experimental nature of this monetary tightening cycle means it could be a bumpy ride.

“Now comes the hard part,” Credit Suisse analysts Zoltan Pozsar and James Sweeney said in a note on Wednesday. “The financial system has completely changed since the last hiking cycle.”

First, some background. When economists talk about the Fed’s official borrowing rate, they refer to the Fed funds rate, which since late 2008 has been confined to a corridor between zero and 0.25 per cent.

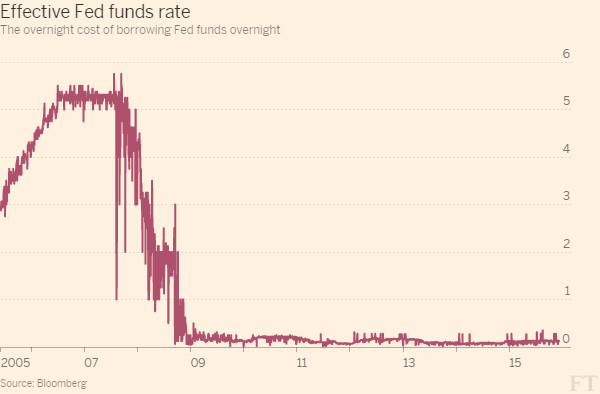

Here is a chart that shows the overnight Fed funds rate over the past decade. There were some loopy moves around the financial crisis, but generally the central bank has kept control of the rate.

The Fed funds rate sets a benchmark for the cost of credit that ripples through markets and guides borrowing costs for everyone in the US (and much further afield). But the Fed’s crisis-fighting has stymied the old-fashioned way of lifting interest rates.

Historically, the Fed has set interest rates by controlling how much money there is sloshing around in the Fed funds market. If it wanted to lift rates the Fed sucked funds out of the system by selling some of the Treasuries it had in storage, and charging the banks’ accounts at the Fed. When it lowered interest rates it pushed money into the market by buying Treasuries and debiting money to banks.

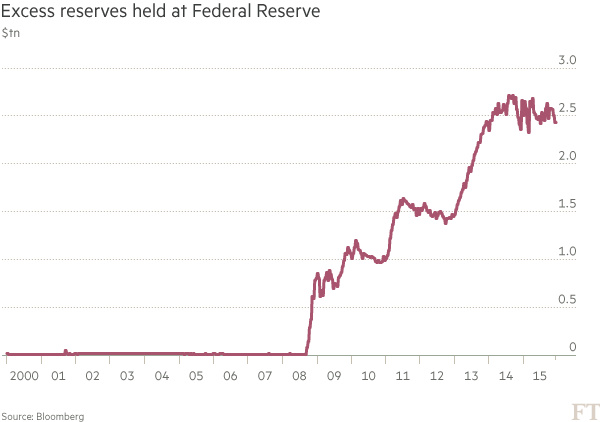

Yet quantitative easing by the Fed entailed buying massive amounts of bonds from banks and crediting their accounts at the Fed with new money — so the financial system is now awash with surplus Fed funds.

Here’s a chart that shows how the excess reserves have exploded in recent years. That little dimple in 2001 is when the Fed pumped extra money into the system following the 9/11 terrorist attacks.

The US central bank has maintained the effective Fed funds rate as its primary interest rate target, but has introduced some new tools to keep it within its new interest rate corridor. The first will act as a ceiling — or in reality a magnet — pulling the Fed funds rate upwards, while the second will in theory serve as a floor.

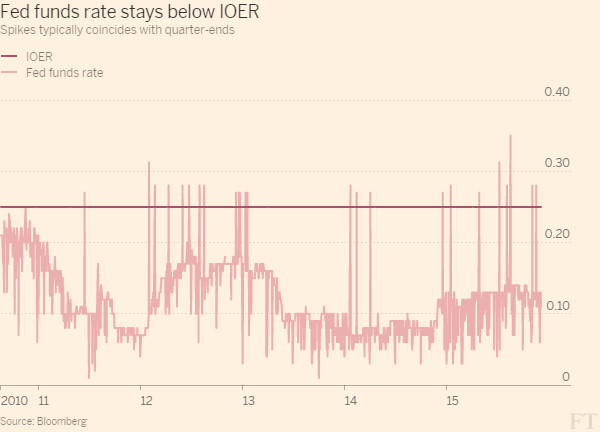

The first is called “interest on excess reserves”, or IOER. This lets the Fed pay interest on money held at the central bank. On Wednesday policymakers voted to lift the IOER rate from 0.25 per cent to 0.5 per cent.

In theory, this should drag the effective Fed funds rate up to this level, as banks should not be willing to lend to other financial institutions at a rate lower than what the central bank pays. But only actual banks have access to the IOER, and there are many other lenders in the Fed funds market that in practice have dragged the effective rate well below where the IOER is set.

Here’s a chart that shows that in action.

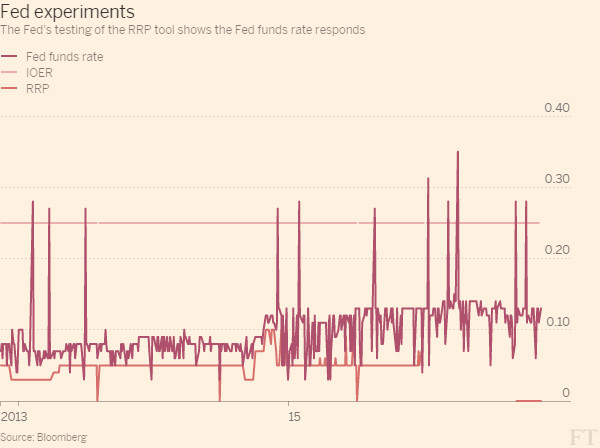

So the Fed has therefore since 2013 been testing out another, more powerful tool to help it manage the process of lifting rates. The overnight reverse repo programme, or Overnight RRP, is primarily aimed at money market funds, and is expected to do much of the heavy lifting when the Fed actually lifts rates.

In a typical RRP the Fed’s market desk sells a Treasury bond from its portfolio to a money-market fund and agrees to buy it back the next day at a certain price, a process known as “repo”, short for repurchase. In practice, the central bank’s balance sheet does not shrink, but this sets a benchmark for cash interest rates paid by the Fed itself. These RRP operations will happen every business day between 12.45pm and 1.15pm in New York.

Here is a chart that shows how the Fed has been testing the impact of the RRP on the effective funds rate. It has occasionally been lifted or lowered to see the impact on the Fed funds market.

The training wheels are now coming off. The Fed voted on Wednesday to increase the RRP rate from 0.05 per cent to 0.25 per cent. To ensure that the programme has enough torque to get the Fed funds rate above that level the central bank also crucially suspended an overall ceiling on the programme.

Each approved counterparty can take up to $30bn, but the Fed anticipates that $2tn of its Treasuries will be available for the programme. The Fed has already announced a total cap of $300bn on a coming batch of longer-term repos, which are separate from overnight repo.

Fed officials have been concerned about letting the RRP programme get too big, given that this could distort the money markets, but in the short term the absolute priority is clearly for the central bank to show that is has full control over the Fed funds rate.

As Megan Greene, chief economist at Manulife says, “If the Fed cannot effectively manage the Fed funds rate then its credibility will be severely undermined”. By in practice lifting size limits on the RRP, analysts expect it to manage this feat. While it may not be an instantaneous lift-off, Fed officials have been confident that the Fed funds rate will gravitate to within the new range.

Still, even if the Fed manages to get the effective Fed funds rate up to roughly the midpoint in its new corridor, the question remains whether the rest of the fixed income market will respond.

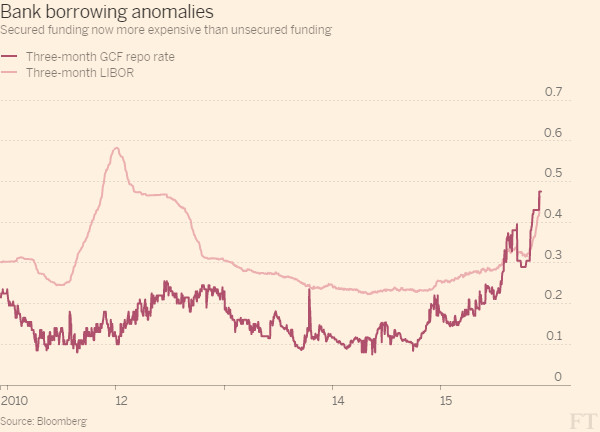

Typically, other important market rates would rise alongside the Fed funds, as banks and fund managers take advantage of any opportunities to “arbitrage” away anomalies. But regulations have severely curtailed the ability of banks to lubricate these arbitrage trades, leading to a series of anomalies in money markets.

For example, the GCF bank repo rate — essentially the cost for banks to borrow from each other when they proffer collateral like Treasuries — is now higher than Libor, the unsecured bank funding rate.

Some economists argue that the Fed should look for a new mechanism to set US interest rates, since the Fed funds market is so small and thinly traded nowadays. There used to be close to $350bn a day that changed hands before the crisis, but daily volumes are now roughly $50bn a day. Some are therefore urging a radical rethink.

Even Simon Potter, head of the New York Fed’s markets division — and thus the man who will have to implement the central bank’s decision — hinted that this may be needed.

“We should, of course, consider the traditional parts of an operating framework, for example, possible interest rate targets and the mechanisms used to achieve the target,” he said in a recent speech at the Bank of England. “But recent experience strongly suggests that we need to consider options beyond just a classic interest rate targeting regime that’s based on a scarcity of reserve balances.”

But for now, the focus is squarely on ensuring a smooth interest rate lift-off with its new experimental toolkit.

* This article has been amended to make clear the Fed’s New York branch will begin using its new monetary levers on Thursday

Comments